Stablecoins have become the most important product in crypto, not because of speculation, but because they solve a real financial problem: moving dollars efficiently across a fragmented global system. Their growth has been quiet, structural, and consistent. What’s increasingly obvious is that the blockchain infrastructure supporting stablecoins today was never designed for the scale they are now reaching.

This widening gap between demand and infrastructure is where Plasma positions itself.

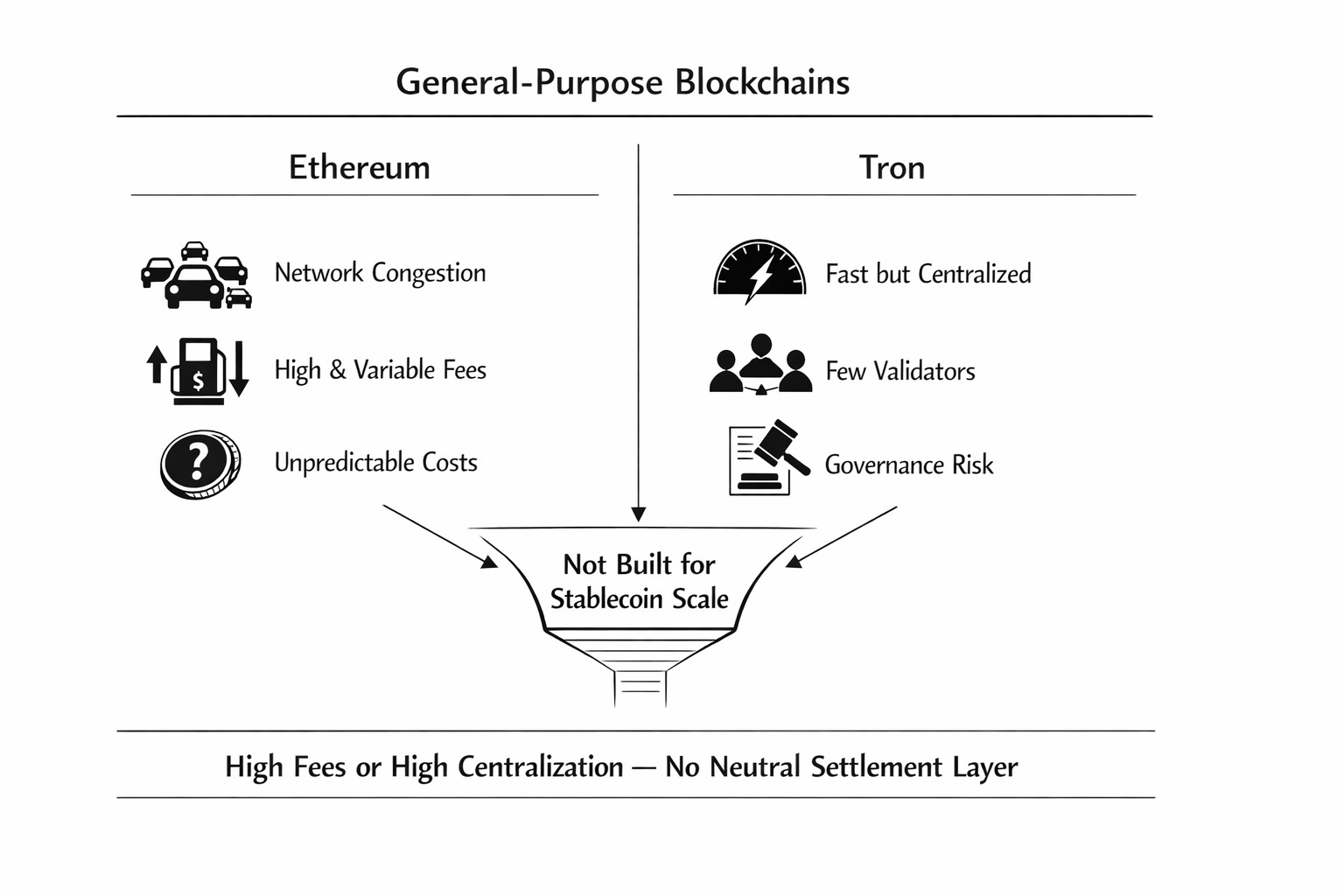

Most stablecoin activity today still runs on general-purpose blockchains like Ethereum and Tron. Both played an essential role in early adoption, but each reveals clear limitations once stablecoins are used as everyday financial instruments rather than speculative assets.

Ethereum offers strong decentralization and mature developer tooling, but its fee market is inherently volatile. When blockspace demand rises, even simple transfers become expensive and unpredictable. This makes Ethereum poorly suited for high-frequency payments, remittances, or low-margin financial flows.

Tron, by contrast, optimized early for throughput and low costs, becoming the dominant rail for Tether transfers. However, that efficiency comes with tradeoffs. Validator concentration and opaque governance introduce centralization risks that become increasingly important as stablecoins begin to support trade finance, payroll, and cross-border settlement.

The result is a constrained system: one chain that is secure but expensive, and another that is fast but centralized. Neither was built specifically to serve stablecoins as a global monetary layer.

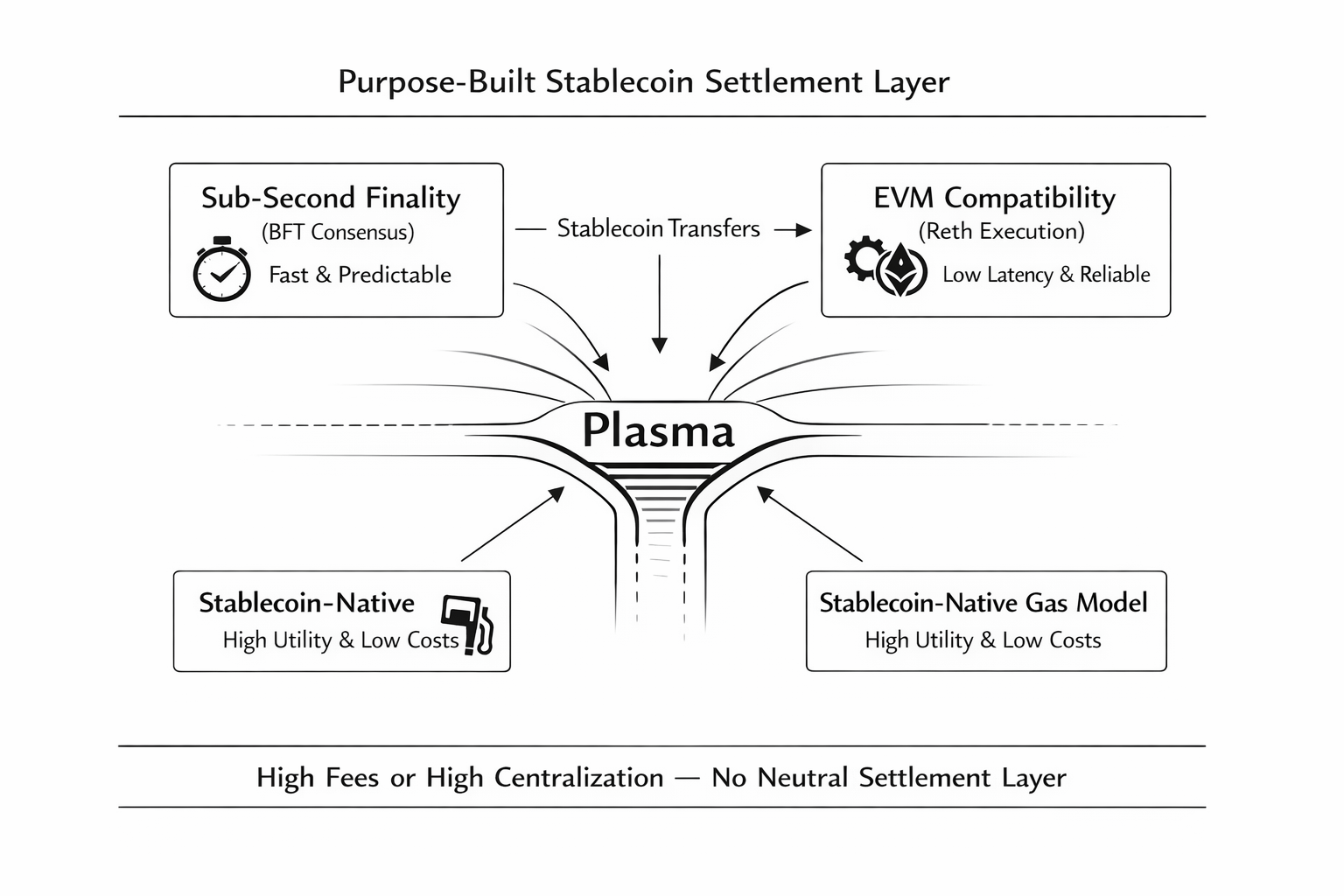

Plasma is based on a narrow but deliberate thesis: stablecoins are not just another application of blockchains, they are the primary workload. That assumption leads to a fundamentally different architectural approach.

Instead of optimizing for generalized smart-contract expressiveness or speculative activity, Plasma treats stablecoin settlement as the core system requirement. Predictable costs, low latency, and operational simplicity are prioritized over flexibility that is rarely needed in payment flows.

This distinction matters. Payment systems don’t succeed by being feature-rich. They succeed by being boringly reliable.

At the consensus layer, Plasma uses a leader-based Byzantine Fault Tolerant design inspired by Fast HotStuff. The objective is not theoretical throughput, but fast and consistent finality. Sub-second confirmations matter when transactions represent payroll, merchant settlement, or trade finance, not leveraged DeFi positions.

Execution is fully EVM-compatible and built on the Reth client in Rust. This preserves the maturity of Ethereum’s tooling and contract ecosystem while allowing Plasma to optimize execution and networking for payment-heavy workloads. Compatibility also reduces friction for wallets, exchanges, and financial platforms that already support Ethereum-based assets.

One of Plasma’s more distinctive design choices is its gas model. Instead of requiring users to hold a volatile native token to move stablecoins, Plasma allows transaction fees to be paid directly in stablecoins or other major assets. For basic transfers, fees can be fully subsidized. This removes a major UX and accounting barrier for non-crypto-native users and institutions.

From an infrastructure perspective, this aligns incentives correctly. Payment rails should abstract away internal mechanics. Users care about cost, speed, and reliability, not token complexity.

The $XPL token functions primarily as a security and coordination asset rather than a speculative instrument. Its main roles are validator staking, network security, and long-term incentive alignment. Inflation declines over time, with fee mechanisms designed to balance validator compensation and network sustainability.

Notably, Plasma does not depend on $XPL to extract fees from stablecoin usage. This separation is intentional. By decoupling payment costs from token volatility, Plasma preserves the economic properties that make stablecoins useful in the first place.

This approach closely mirrors traditional financial infrastructure, where settlement rails operate as neutral utilities rather than profit centers exposed to market swings.

Plasma’s governance model emphasizes operational stability over rapid experimentation. Validator participation, protocol upgrades, and economic changes are structured to minimize disruption to payment flows.

For settlement networks, governance risk often outweighs technical risk. Sudden rule changes, fee shocks, or validator instability can erode trust quickly. Plasma’s conservative governance reflects an understanding that financial infrastructure must evolve slowly and predictably.

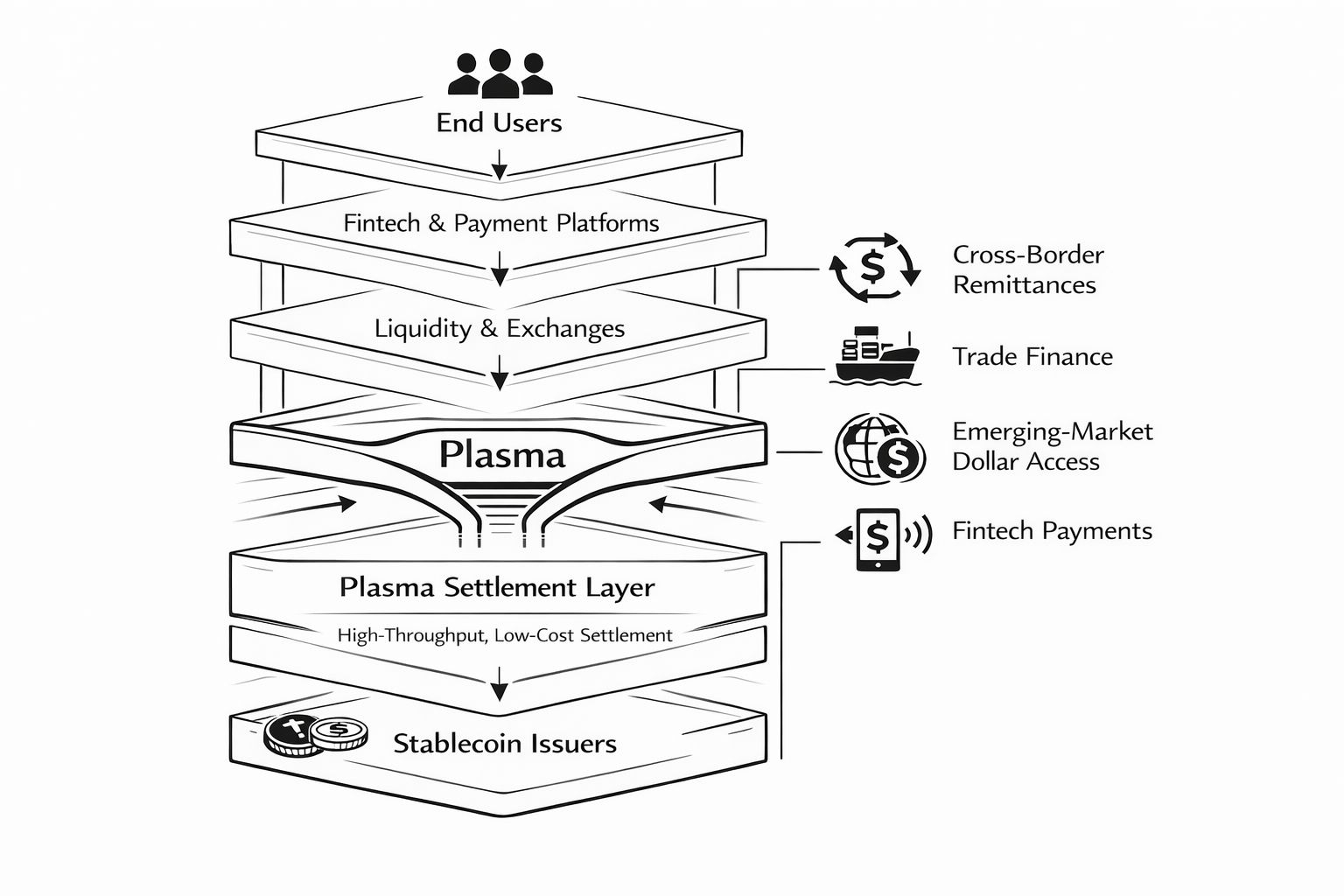

The architecture is best understood through the use cases Plasma targets: cross-border remittances where margins are thin and cost predictability matters; trade settlement and export finance that can reduce reliance on correspondent banking; emerging-market dollar access where users seek stability without local currency exposure; and fintech platforms that need a neutral backend for stablecoin accounts and payments.

In these contexts, Plasma behaves less like a crypto platform and more like invisible settlement infrastructure.

That narrow focus is also Plasma’s primary risk. By concentrating heavily on stablecoins, it sacrifices the narrative flexibility of general-purpose chains. If regulation, issuer behavior, or market structure shifts materially, Plasma must adapt without compromising its core thesis.

There is also execution risk. Payment infrastructure succeeds less on technology alone and more on integration. Issuers, wallets, on-ramps, and liquidity providers must adopt Plasma as a default rail, not merely an alternative.

Regulatory alignment will also be critical. As stablecoins become systemically important, settlement layers will face increasing scrutiny. Plasma’s long-term relevance depends on navigating this environment without sacrificing neutrality.

If stablecoins continue their move into mainstream finance, the need for purpose-built settlement infrastructure becomes unavoidable. History suggests that specialized systems eventually replace generalized ones at scale.

Plasma represents a bet on that transition. Not on whether stablecoins will grow — that is already happening — but on the idea that they will require infrastructure designed specifically for their constraints.

In that sense, Plasma is less a competitor to existing blockchains and more a successor to an architectural era that treated payments as a secondary use case. Whether it succeeds will depend on discipline, integration, and time.

As an infrastructure thesis, however, the direction is clear: stablecoins are becoming money, and money requires rails built for nothing else.