solve a very specific problem, not just add another chain to the pile. It’s a Layer 1 blockchain that’s been around since around 2017–2018, and from the start it’s been focused on regulated finance, privacy, and institutions — things most blockchains either ignore or actively avoid.

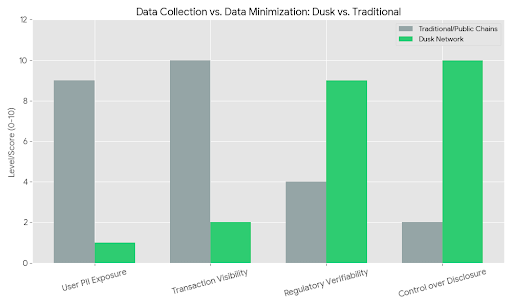

At a high level, Dusk is built for situations where privacy actually matters, but rules still apply. The idea is that transactions and balances can stay confidential, while regulators or authorized parties can still verify what they need to. That balance between privacy and compliance is really the core of what Dusk is trying to do.

Instead of being a general “do everything” chain, it’s more like infrastructure for banks, exchanges, custodians, and financial platforms that want to move real-world assets on-chain without breaking laws. Think tokenized stocks, bonds, funds, and settlement between institutions — not anonymous meme trading.

Instead of being a general “do everything” chain, it’s more like infrastructure for banks, exchanges, custodians, and financial platforms that want to move real-world assets on-chain without breaking laws. Think tokenized stocks, bonds, funds, and settlement between institutions — not anonymous meme trading.

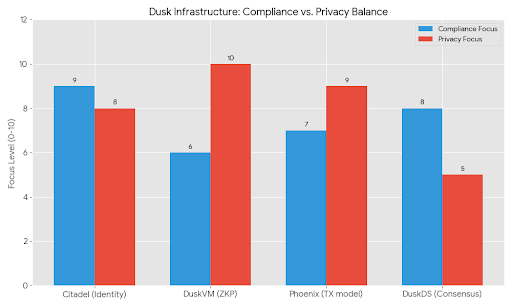

The way the chain is designed reflects that. Dusk splits things into different layers so everything isn’t mashed together. There’s the base layer (DuskDS) that handles consensus, settlement, and finality. It uses a proof-of-stake system with deterministic finality, which basically means transactions settle cleanly without weird edge cases.

On top of that, there’s DuskEVM, which is Ethereum-compatible. Developers can deploy Solidity contracts and use DUSK for gas, but with the option to plug into privacy tools when needed. Then there’s DuskVM, which is more focused on privacy-heavy smart contracts using WASM and zero-knowledge proofs. It’s not something casual users will touch directly, but it matters for confidential computation.

Privacy on Dusk isn’t just “everything is hidden, trust us.” It’s built using zero-knowledge proofs so transactions can be private but still provable. There’s also Citadel, which handles self-sovereign identity and selective disclosure — basically a way to prove who you are or what you’re allowed to do without dumping all your personal data on-chain. The transaction models (like Phoenix) mix public and private elements instead of forcing everything into one extreme.

Privacy on Dusk isn’t just “everything is hidden, trust us.” It’s built using zero-knowledge proofs so transactions can be private but still provable. There’s also Citadel, which handles self-sovereign identity and selective disclosure — basically a way to prove who you are or what you’re allowed to do without dumping all your personal data on-chain. The transaction models (like Phoenix) mix public and private elements instead of forcing everything into one extreme.

The DUSK token ties the whole system together. It’s used for gas, staking, and network services. Supply-wise, it’s capped at 1 billion, with 500 million originally issued and the rest emitted slowly over decades as staking rewards. That long emission schedule is clearly meant to support network security over the long term rather than front-loading everything.

Most of the token supply went to the sale, with smaller portions for the team, advisors, development, exchanges, and marketing. Nothing too exotic there, though the long-term staking angle is a big part of the design.

Development-wise, Dusk has been steadily moving forward rather than chasing hype cycles. The DayBreak public testnet opened things up more for developers and users, and recent Layer 1 upgrades have been focused on performance and getting the network ready for broader use. There’s also real-world traction — licensed platforms like NPEX are building tokenized securities marketplaces on Dusk, which lines up perfectly with its original goal.

On the infrastructure side, integrations like MiCA-compliant stablecoins and Chainlink support make it easier to plug Dusk into real financial workflows instead of keeping it isolated. The project is also involved in privacy-focused industry groups, which makes sense given how much of its identity revolves around compliant privacy.

In terms of use cases, Dusk really shines where most chains struggle. Tokenized securities, private but compliant DeFi, institutional payments, and settlement are its sweet spots. It’s not trying to replace Ethereum for retail users — it’s aiming to be the backend that regulated finance can actually use without cutting corners.

The team behind Dusk includes people with strong backgrounds in cryptography and finance, and that shows in how the project is structured. It feels like something built slowly and deliberately, not rushed out to catch trends.

Overall, Dusk isn’t flashy, and that’s kind of the point. It’s a privacy-first, compliance-aware blockchain designed for real financial use, not speculation. If tokenized real-world assets and regulated on-chain finance continue to grow, Dusk is clearly positioning itself to be part of that future.