When I look at Web3 today, especially through the lens of real finance rather than crypto-native culture, one uncomfortable truth keeps resurfacing: transactions were never the hardest problem. Identity was. Speed can be optimized. Fees can be lowered. Liquidity can be incentivized. But regulated systems do not run on raw throughput — they run on rules. Who is allowed to act, under which conditions, at which moment, and how that decision can later be proven without turning the entire system into a surveillance machine. This is where my interest in Dusk Network keeps deepening, because beneath the usual “privacy and compliance” discussion sits a much more fundamental design choice: identity as verifiable proof, not exposed data.

When I look at Web3 today, especially through the lens of real finance rather than crypto-native culture, one uncomfortable truth keeps resurfacing: transactions were never the hardest problem. Identity was. Speed can be optimized. Fees can be lowered. Liquidity can be incentivized. But regulated systems do not run on raw throughput — they run on rules. Who is allowed to act, under which conditions, at which moment, and how that decision can later be proven without turning the entire system into a surveillance machine. This is where my interest in Dusk Network keeps deepening, because beneath the usual “privacy and compliance” discussion sits a much more fundamental design choice: identity as verifiable proof, not exposed data.

Most blockchains still treat identity as an external problem. You connect a wallet, maybe sign a message, and everything else happens off-chain in databases that quietly grow more dangerous over time. Every KYC upload becomes another honeypot. Every repeated verification becomes another liability. In theory, transparency sounds empowering. In practice, real markets collapse under too much exposure. Companies cannot operate if every relationship is public. Traders cannot hedge if every move is broadcast. Regulators do not want chaos — they want controlled visibility. This is the tension Dusk seems willing to face directly instead of pretending it does not exist.

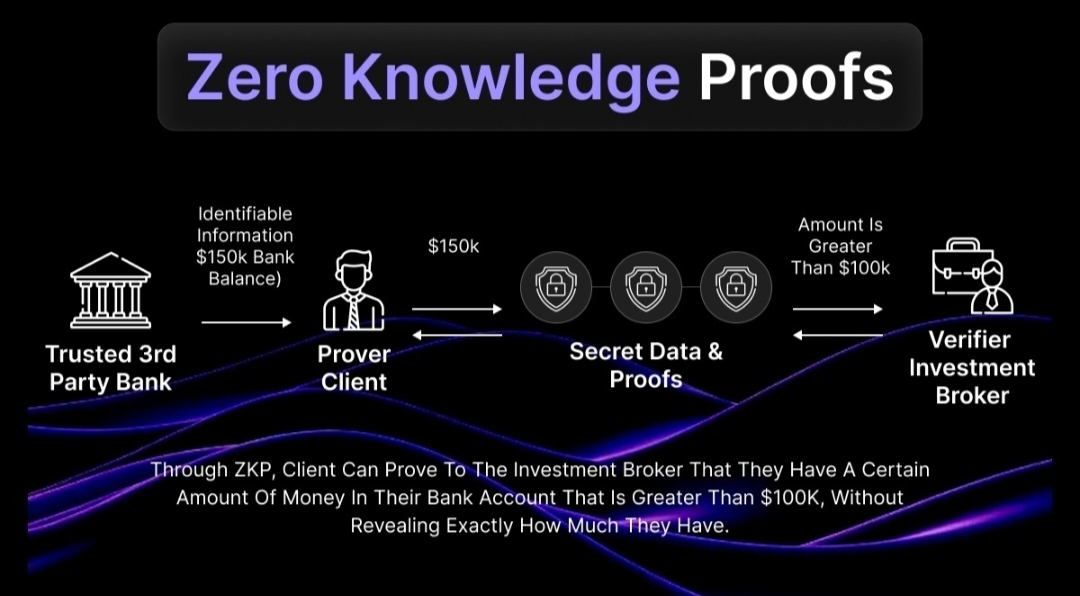

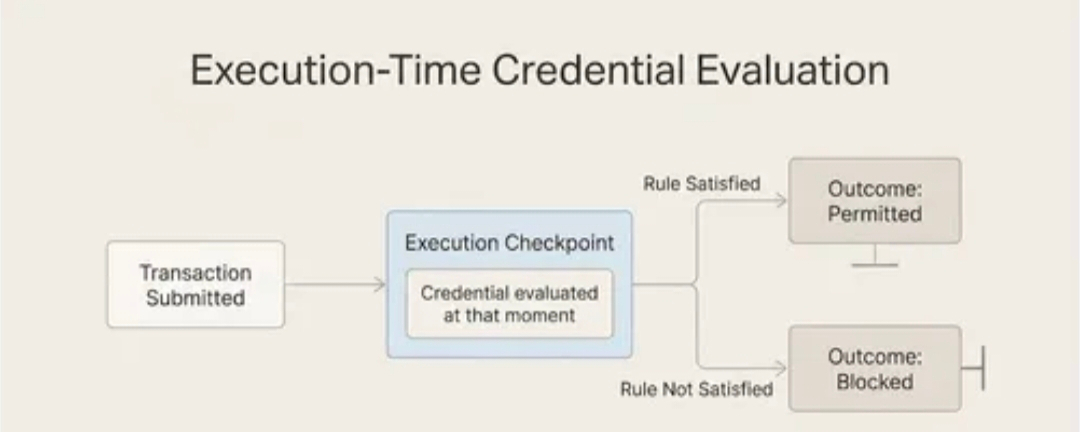

What makes Dusk interesting to me is that it does not frame identity as “who you are” but as “what you can prove.” That distinction sounds small, but it changes everything. Instead of repeatedly handing over documents, users hold credentials. Instead of uploading files, they generate proofs. The system does not ask for your identity; it asks whether you satisfy a condition. That condition might be jurisdiction, accreditation, compliance status, or eligibility for a specific action. You prove the answer without exposing everything else.

This is where Citadel, Dusk’s identity layer, stops feeling like a side feature and starts feeling like the spine of the system. The structure is deliberately simple: a user, a credential issuer, and a service provider. The issuer verifies something once. The user receives a credential. Later, the user proves possession of that credential using zero-knowledge proofs. The service provider verifies eligibility without ever touching raw personal data. From a risk perspective, this is not just cleaner — it is safer. Fewer databases. Less duplication. Less long-term exposure.

The more I think about it, the more Citadel feels aligned with how the real world is already moving. Europe’s direction toward verifiable credentials and digital identity wallets is not a crypto trend; it is a regulatory one. Governments and institutions are realizing that identity systems built on repeated disclosure do not scale. Proof-based identity does. Dusk is not inventing a new ideology here — it is adapting blockchain mechanics to the same direction regulators and enterprises are already taking.

Identity alone would not be enough if it lived in isolation, but Dusk’s transaction models give it context. Moonlight handles transparent, account-style flows where visibility is expected. Phoenix handles confidential, note-based execution where privacy is required. The important part is not that one is public and the other private — it is that applications can choose. Disclosure becomes intentional rather than absolute. This mirrors real finance far more closely than “everything public” or “everything hidden” ever could.

Early network behavior actually reinforces this view. Most activity still happens in the transparent lane. That is not a failure; it is a pattern. Institutions start with what is legible. They move slowly. They test. Only once trust and workflow stability exist do they adopt confidentiality by default. Privacy does not lead adoption — it follows it. Watching that transition over time will tell us far more than short-term volume spikes ever could.

Even the token design fits this infrastructure-first mindset. DUSK is not positioned as a speculative centerpiece. It exists to secure the network, coordinate staking, and pay for execution. In a system where much of the activity is intentionally opaque, economic enforcement matters more than social signaling. Incentives and penalties do the work that “crowd transparency” usually handles on public chains. That is a quieter model, but a more realistic one for regulated environments.

One thing I genuinely respect is how Dusk treats operational risk. When uncertainty appears, services pause. Mitigations are implemented. Communication is direct. This is not how hype-driven ecosystems behave — it is how financial infrastructure behaves. Containment first. Explanation second. Continuity always. These moments rarely make headlines, but they build long-term credibility where it actually matters.

When I zoom out, I do not see Dusk trying to win attention. I see it trying to win trust. It is attempting something structurally difficult: a public ledger where confidentiality, identity, and enforceable rules coexist without collapsing into surveillance or disorder. That path is slower. It is less exciting. It does not reward loud narratives. But it aligns with how real markets evolve.

The real success signal for Dusk will not be viral metrics or sudden volume explosions. It will be boring repetition. Credentials verified quietly. Assets settled predictably. Audits resolved without drama. When identity stops being a bottleneck, markets begin to move naturally. If Citadel succeeds as an adoption layer, Dusk stops being “a privacy blockchain” and starts becoming infrastructure that regulated systems can actually live on.

That kind of success rarely trends. But it lasts. And in a space obsessed with what is new, I find myself far more interested in what is quietly becoming necessary.