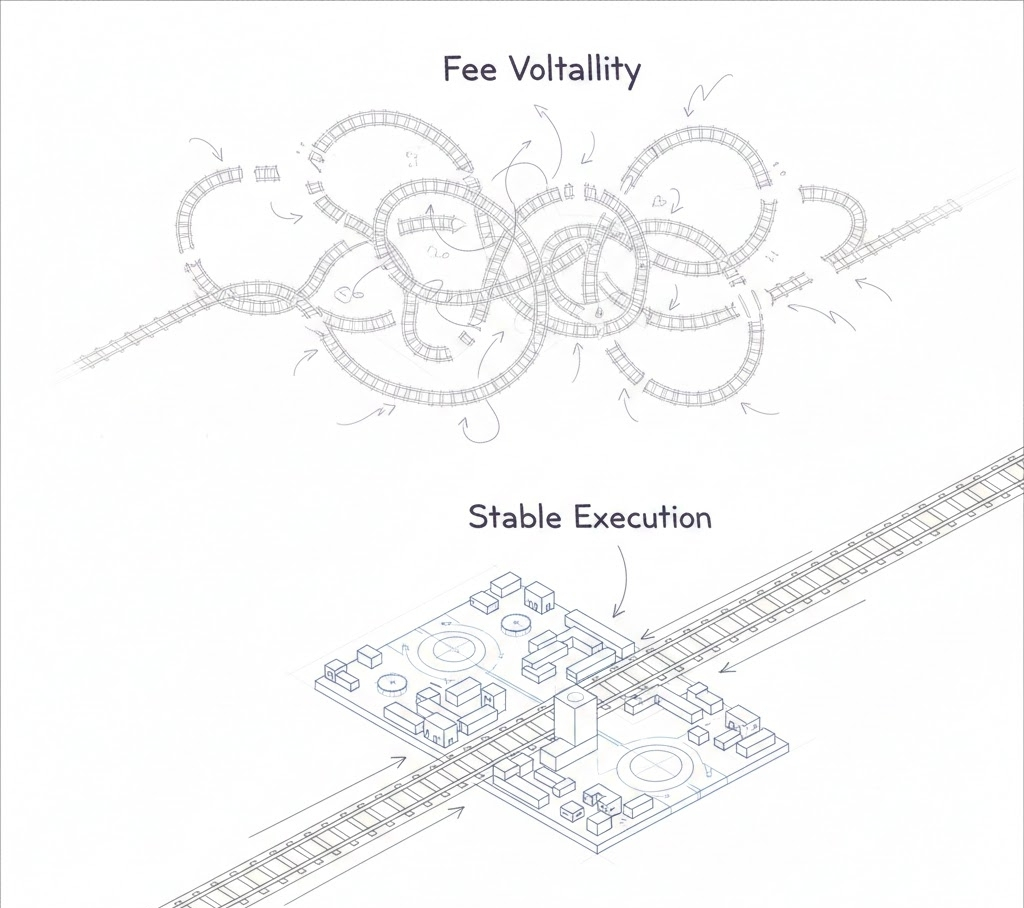

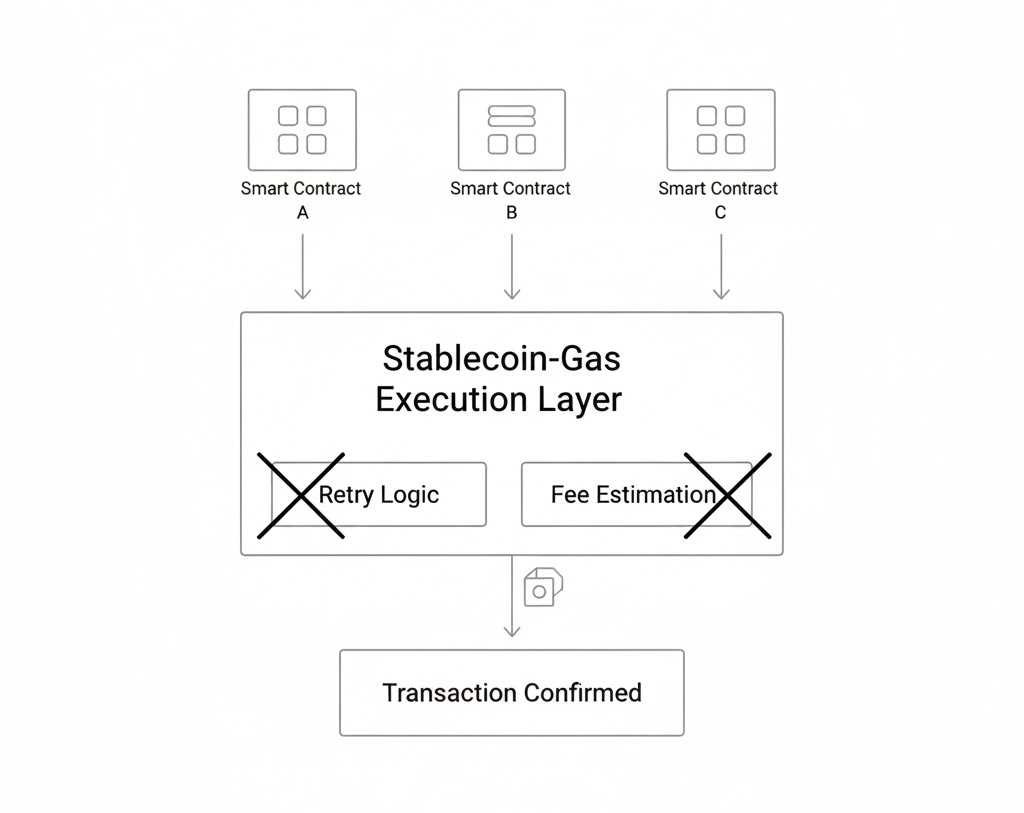

Most blockchain applications quietly assume instability. They retry transactions, overpay for urgency, and build fallback logic around fee spikes. @Plasma breaks this assumption at the execution layer. When gas is priced in stable terms, applications no longer need to anticipate congestion as a variable input. The software stops negotiating with the chain.

This shift matters because fee volatility doesn’t just affect users—it shapes architecture. On volatile chains, developers optimize around uncertainty: batching logic, delayed execution, defensive margins. Plasma’s stablecoin-denominated execution collapses that entire design space. Contracts can assume that tomorrow behaves like today, not statistically, but mechanically.

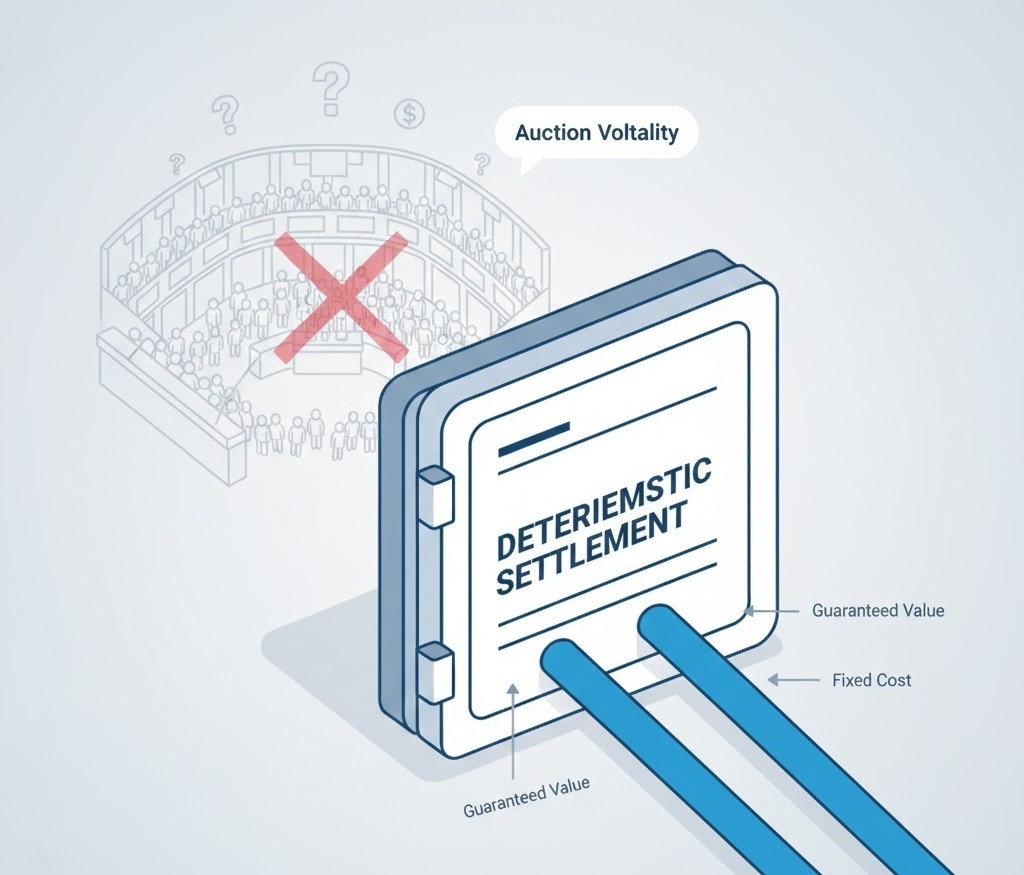

What’s interesting is how this reframes neutrality. By anchoring security to Bitcoin while keeping execution costs stable, @Plasma removes two common levers of influence: price reflexivity and discretionary prioritization. The network stops signaling when to act. It simply clears.

Over time, this could standardize how financial software reasons about blockspace. Not as an adversarial auction, but as a known-cost surface—closer to accounting infrastructure than speculative terrain. If that mental model sticks, Plasma’s real contribution won’t be throughput or composability, but the quiet normalization of predictability as a first-class property of blockchains.