Vanar is one of those blockchain projects that doesn’t really fit the usual DeFi-heavy mold. It’s a Layer-1 chain, yes, but it wasn’t built just for trading tokens or farming yields. The whole idea from the start has been about real products — games, entertainment, AI-driven apps, and things normal users might actually touch.

If you remember Virtua (TVK), that’s where this all started. In late 2023, the team rebranded everything to Vanar Chain to match the bigger picture they were working toward. Along with that came the 1:1 swap from TVK to VANRY. Same value, different name, wider scope.

Their long-term goal is pretty straightforward: make Web3 usable for a lot more people, not just crypto natives. They often talk about onboarding the “next 3 billion users,” which sounds ambitious, but at least their tech choices line up with that idea.

How the Chain Is Built

At its core, Vanar is a public Layer-1 blockchain designed to be fast and cheap. Transactions settle quickly, and fees are almost negligible — we’re talking fractions of a cent. That matters a lot if you’re building games or consumer apps where users aren’t going to tolerate high gas fees or long wait times.

One thing that makes Vanar different is how deeply AI is baked into the system. This isn’t just an add-on or a buzzword layer. They’ve built components like Neutron, which compresses large data (even things like video files) into tiny, usable formats, and Kayon, which handles decentralized AI reasoning and real-time queries.

The interesting part is that this setup lets apps work with complex data directly on-chain, without leaning heavily on external oracles. That’s not something you see often in other L1s.

The interesting part is that this setup lets apps work with complex data directly on-chain, without leaning heavily on external oracles. That’s not something you see often in other L1s.

VANRY — The Token Side of Things

VANRY is the native token that keeps the network running. It’s used for transaction fees, staking, validator rewards, and eventually governance. On top of that, it’s meant to be used inside the ecosystem itself — in games, metaverse experiences, and AI-based services.

Supply-wise, the max cap is 2.4 billion VANRY. As of late 2025, around 1.96 billion was already circulating, with total supply sitting a bit above 2.1 billion depending on the source.

What’s unusual is the distribution. A large majority of tokens went toward validators, with smaller portions allocated to development and community initiatives. There were no tokens set aside specifically for the team, which suggests they’re betting on long-term ecosystem growth rather than quick upside.

For now, VANRY also exists as an ERC-20 token on Ethereum, which helps with liquidity and exchange listings during this stage.

The Ecosystem Isn’t Just Theory

Vanar isn’t just infrastructure on paper — it already has products running on it.

The biggest one is Virtua, a metaverse platform where users can explore environments, interact socially, and use blockchain-backed assets. It’s been around since before the rebrand and continues to be a central piece of the ecosystem.

Then there’s VGN (Vanar Games Network), which focuses on blockchain gaming. The goal here is to give developers scalable tools while letting players actually own in-game assets and economies. It’s very much aligned with Vanar’s focus on entertainment as the gateway to Web3 adoption.

Other Stuff They’re Building

Beyond games and virtual worlds, the team has been rolling out AI-powered tools aimed at both users and developers. One example is myNeutron, which runs on a subscription model and feeds back into the VANRY token economy.

They’re also working with brands and enterprises that want to experiment with Web3 without needing deep technical knowledge. Think loyalty programs, digital collectibles, and consumer-facing experiences that don’t scream “crypto” to the end user.

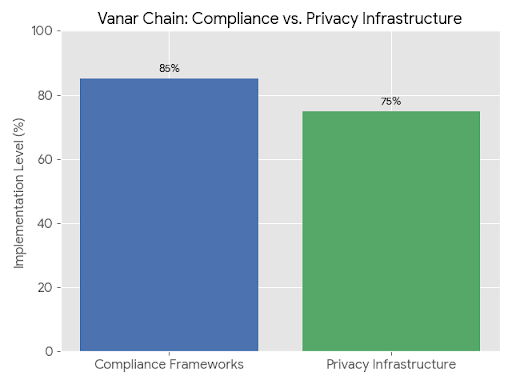

On top of that, Vanar has frameworks for real-world asset tokenization, with an eye toward compliance and institutional use rather than experimental DeFi.

Partnerships and Community

Vanar has been involved in programs like NVIDIA Inception, which supports startups working with advanced AI and computing tech. On the community side, they’ve used platforms like Galxe for rewards, campaigns, and user engagement.

The team itself comes from backgrounds in gaming, VR, AI, and brand tech, which explains why the project feels more consumer-focused than finance-first.

Adoption So Far

By late 2025 and early 2026, VANRY had a few thousand on-chain holders and was trading across roughly 15 to 16 exchanges. Price action has been volatile — not surprising for a relatively young project — with clear highs and lows along the way.

They’ve also run community-driven events, like in-game treasure hunts and collaborations with other projects, to keep activity flowing on-chain rather than just sitting idle.

What’s Coming Next

Looking ahead, the roadmap is centered around expanding AI tools, tying subscription revenue more tightly into the token economy, and continuing to onboard games and brands.

There’s also ongoing work around long-term security, including quantum-resistant encryption, which shows they’re thinking well beyond short market cycles.

Final Thoughts

Vanar isn’t trying to be everything at once. It’s not chasing DeFi dominance or hype narratives. Instead, it’s quietly building a Layer-1 designed for games, AI, entertainment, and everyday users — with infrastructure that’s fast, cheap, and flexible enough to support that vision.

Whether it succeeds or not will come down to execution and adoption, but its focus on real products and AI-native design definitely sets it apart from a lot of generic L1s out there