The Most Misunderstood “Blue-Chip” in Crypto

Most people treat $BNB like just another exchange coin.

That’s a mistake.

BNB is not only a token…

It’s the fuel of the largest crypto ecosystem on Earth.

And in the next 2–4 years, BNB will either:

✅ become one of the strongest long-term holds

OR

⚠️ become one of the biggest regulatory battlegrounds in crypto.

Let’s break it down properly.

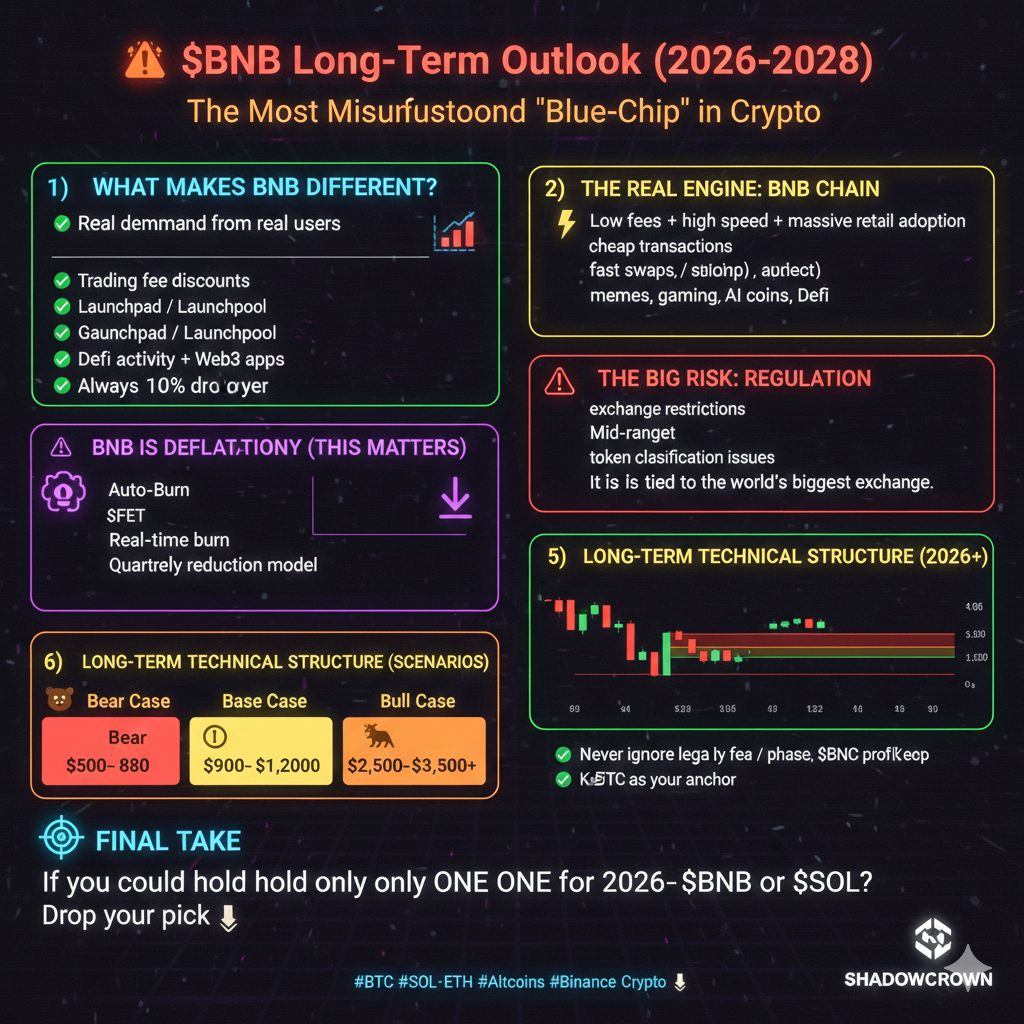

1) WHAT MAKES BNB DIFFERENT?

BNB is backed by something most coins don’t have:

🔥 Real demand from real users

BNB is used for:

Trading fee discounts on Binance

Launchpad / Launchpool staking rewards

Gas fees on BNB Chain (BSC)

DeFi activity + Web3 apps

Payments, NFT platforms, and ecosystem incentives

That means BNB has constant utility demand, even when the market is boring.

2) THE REAL ENGINE: BNB CHAIN

BNB Chain is one of the most used smart-contract networks.

The biggest advantage is simple:

⚡ Low fees + high speed + massive retail adoption

When retail returns in bull markets, they don’t care about ideology.

They care about:

cheap transactions

fast swaps

simple apps

memes, gaming, AI coins, DeFi

BNB Chain always becomes a major playground during altseason.

3) BNB IS DEFLATIONARY (THIS MATTERS)

BNB has multiple burn mechanisms:

Auto-Burn

Real-time burn from fees

Quarterly reduction model

So supply keeps shrinking.

That’s important because:

📉 Less supply + 📈 demand = long-term pressure upward

This is why BNB behaves like a “crypto stock buyback” model.

4) THE BIG RISK: REGULATION

This is the one factor that can’t be ignored.

BNB’s biggest strength is Binance.

BNB’s biggest risk is also Binance.

If regulators tighten hard again:

exchange restrictions

token classification issues

banking rails pressure

BNB can get hit faster than $BTC or $ETH.

So the BNB long-term story is:

🟢 strongest utility

🔴 highest political/regulatory sensitivity

5) LONG-TERM TECHNICAL STRUCTURE (2026+)

BNB has already proven one thing:

It survives cycles.

BNB did:

huge 2021 rally

deep 2022 crash

recovery + new highs later

This is what long-term winners do.

Key long-term zones (simple):

🟩 Strong support: $600–$800

🟨 Mid-range: $900–$1,200

🟥 Breakout zone: $1,300+

If BNB holds above $800–$900 for long periods, the next cycle can expand.

6) PRICE PREDICTION (SCENARIOS)

Let’s do this realistically, not moon-boy style.

🐻 Bear Case (bad macro / heavy regulation)

BNB could revisit:

$500–$800

🟡 Base Case (normal bull cycle, Binance stable)

BNB can reach:

$1,500–$2,200

🐂 Bull Case (full bull market + strong BNB Chain growth)

BNB could push:

$2,500–$3,500

7) THE SMART INVESTOR PLAN (BNB)

If you want to hold BNB long-term:

✅ Buy during deep fear / dips

✅ Stake when Launchpool is active

✅ Take profits in phases

✅ Never ignore legal headlines

✅ Keep BTC as your anchor

🧠 FINAL TAKE

BNB is one of the few coins that:

has real utility

has strong tokenomics

has a massive ecosystem

has survived multiple cycles

But it also carries one unique risk:

⚠️ It is tied to the world’s biggest exchange.

That makes BNB:

🔥 high potential

⚠️ high sensitivity

Question:

If you could hold only ONE for 2026–2028:

Drop your pick 👇

#BNB #BTC #ETH #crypto #altcoins #ShadowCrown