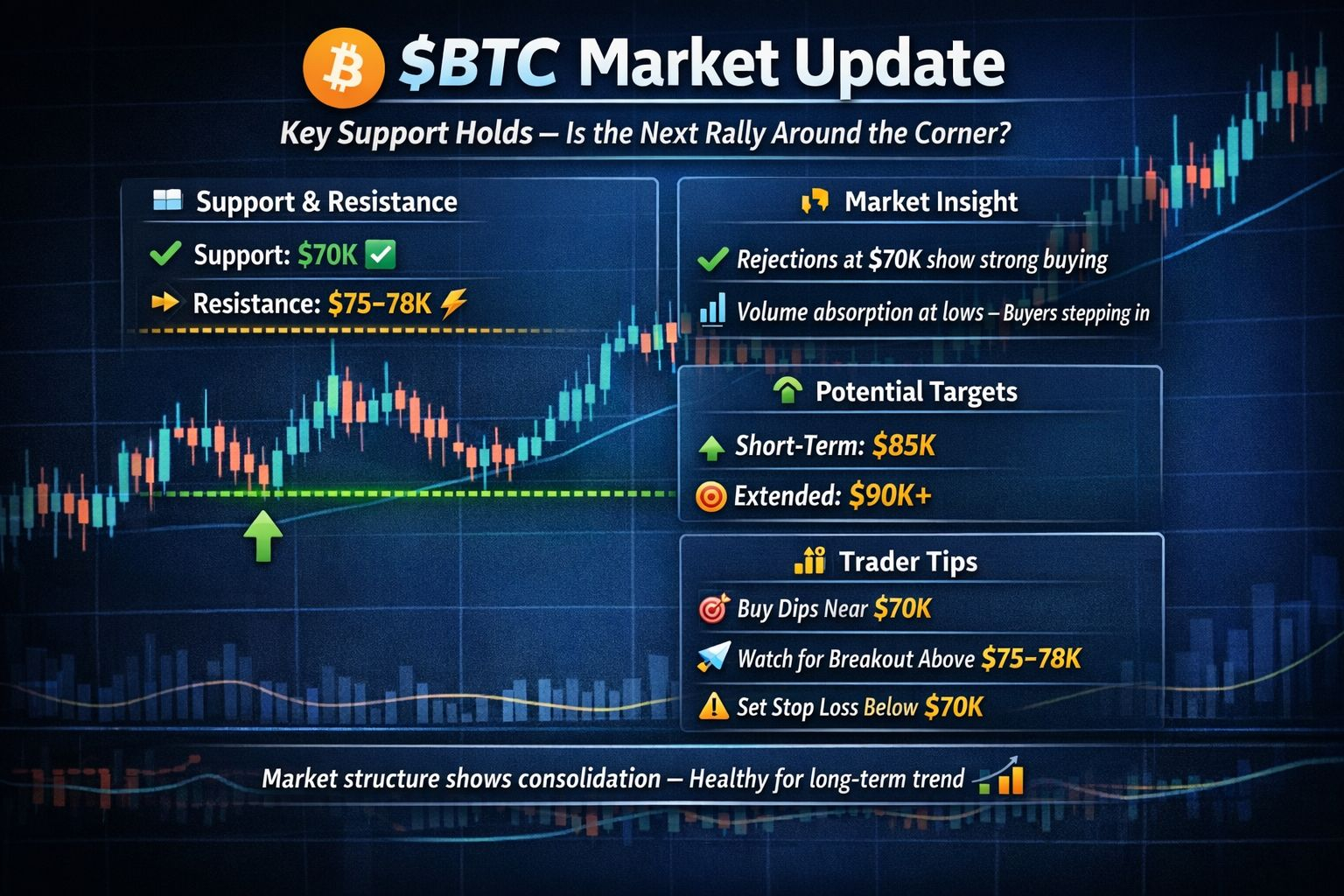

Bitcoin ($BTC ) has been on everyone’s radar this week as it navigates a critical support zone around $70,000. After a sharp surge to the $80–90K range, $BTC faced a natural pullback, driven mainly by institutional profit-taking. However, recent price action indicates buyers are stepping in aggressively at lower levels, preventing a deeper drop.

Market Analysis:

The $70K support has proven resilient, with multiple rejections showing strong demand from both retail and institutional players. Volume analysis confirms absorption at the lows – meaning sellers are being met with equal or greater buying pressure. This is a bullish signal for swing traders looking for entry points during dips.

On the upside, the $75–78K range serves as a key resistance zone. A sustained break above this level could trigger a momentum-driven rally toward $85K and beyond. Traders should watch for increased volume on any breakout, as it validates the move.

The macro structure of Bitcoin shows a classic consolidation after a strong upward trend, which is healthy for long-term sustainability. While some fear a drop to $65K, the market’s current absorption patterns suggest that scenario is less likely unless there’s a major external shock.

Trader Insights:

Support Levels: $70K is critical – hold above this and the bullish trend remains intact.

Resistance Zones: $75–78K must be broken for a potential rally continuation.

Volume Signals: Absorption at lows shows large buyers are accumulating.

Risk Management: Set stop losses slightly below $70K to protect capital if the support fails.

Conclusion:

Bitcoin’s current behavior highlights the importance of watching both price action and volume. The market is signaling strength at key levels, and traders who manage risk while entering during dips may be well-positioned for the next upward swing.

Trade here 👇🏻