At small scale, almost any payment system can look composed. The first few thousand transfers clear, the dashboards stay green, and “it worked” gets mistaken for “it will hold.” Then volume arrives, reconciliation tightens, and you learn what the system truly guarantees when the pressure is constant.

The popular narrative around stablecoins is that the breakthrough already happened. Value can move globally, 24/7, without legacy intermediaries. The story is told in speed and distance, as if payments are a race and the only metric that matters is motion.

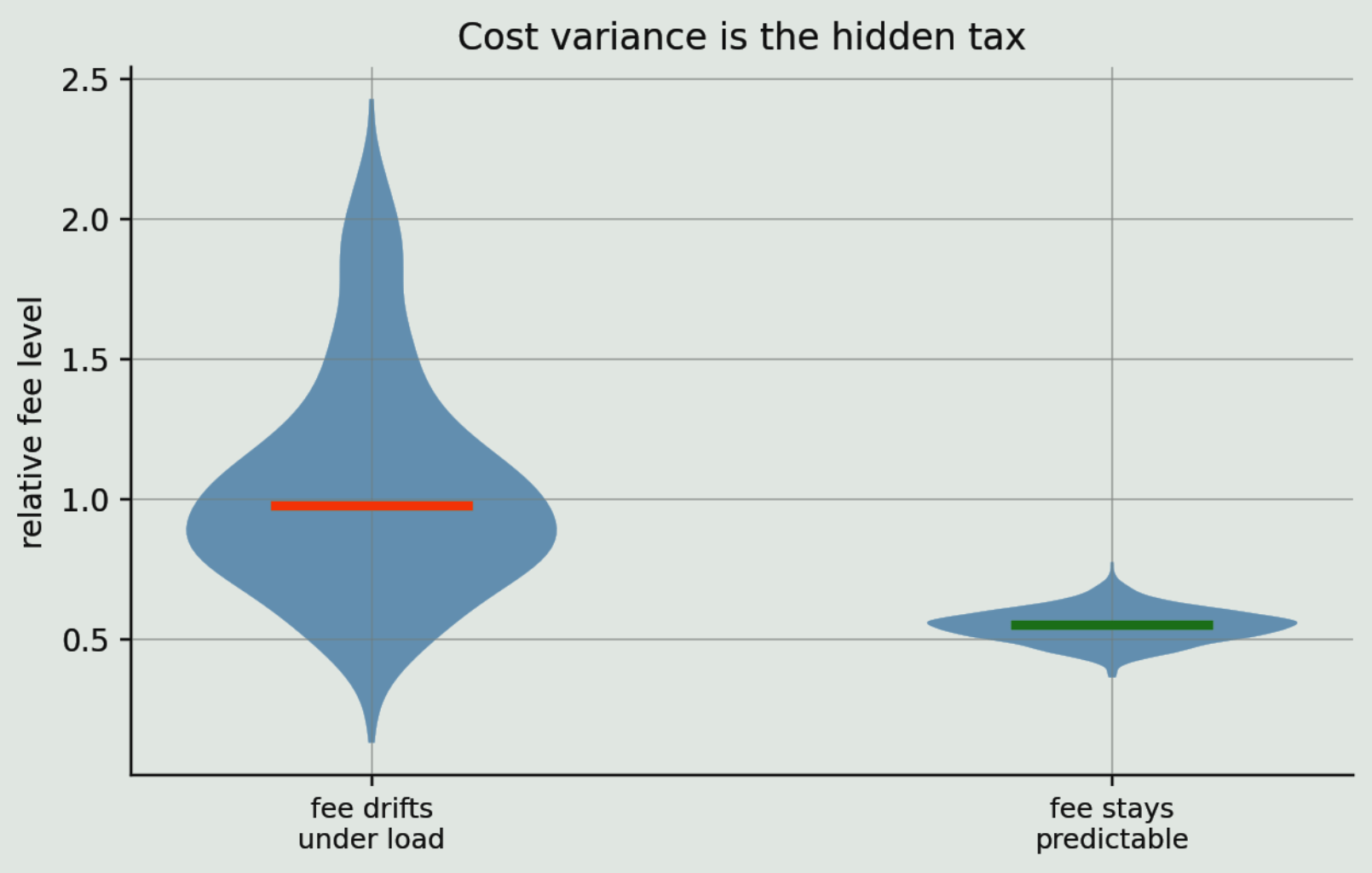

What’s actually missing is not motion. It’s meaning. Meaning is what operators call control: predictable costs, consistent confirmation, and outcomes you can explain without resorting to folklore about “network conditions.” Stablecoins don’t become infrastructure when they move. They become infrastructure when finance teams can trust their behavior under stress, on the busiest day, without rewriting processes around volatility.

That framing is why Plasma is worth attention. It reads less like a general system that can do payments, and more like a payments rail engineered to do one job exceptionally well: high-volume, low-cost transfer with the kind of consistency stablecoin settlement demands.

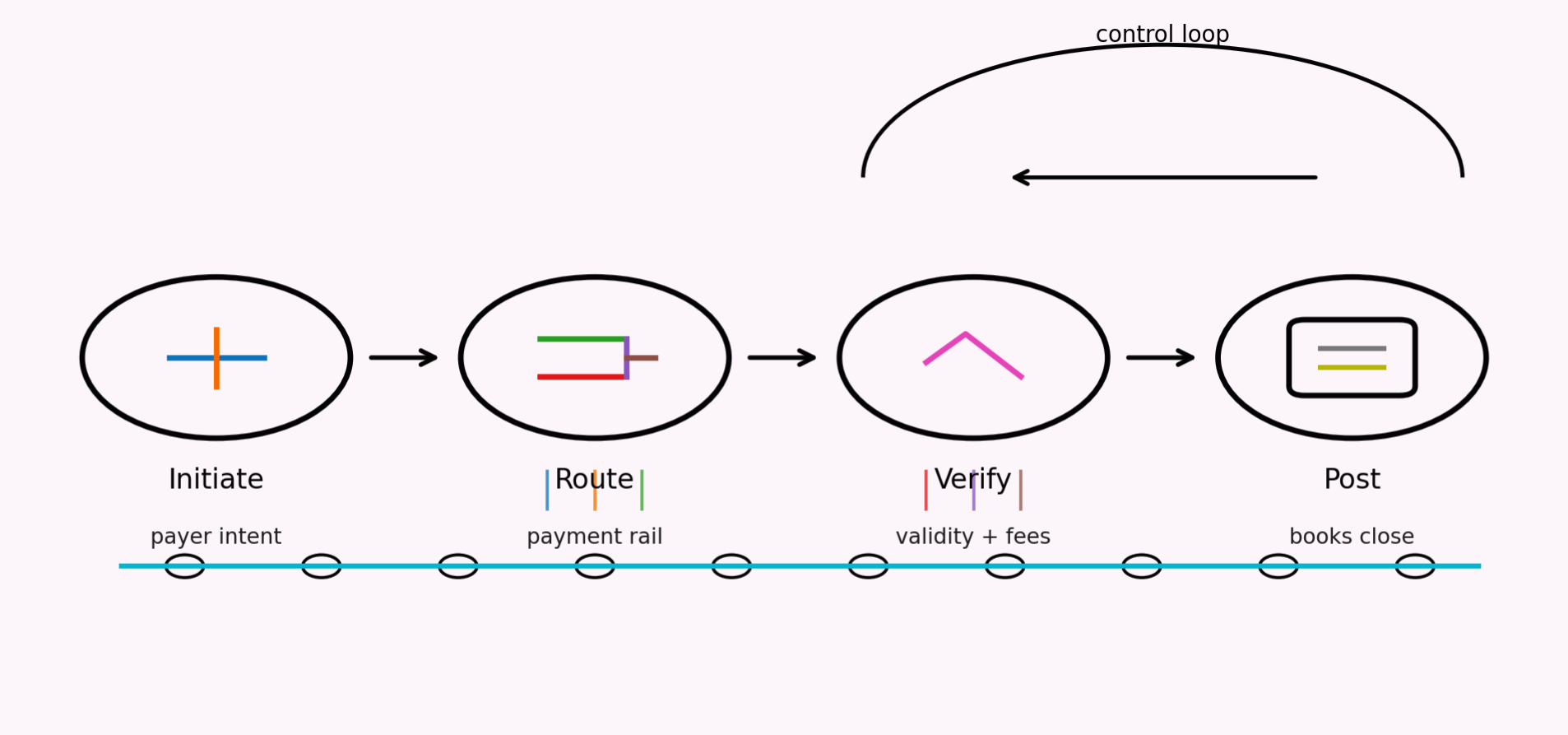

Think of payments less like a “fast car” problem and more like an assembly line. A fast car is impressive once. An assembly line is impressive because it repeats the same outcome ten thousand times with tight tolerances. Payments are industrial work. The value is not a single burst of speed, it’s the system’s ability to produce the same result, continuously, with minimal variance.

A second analogy is air traffic control. Flights are motion. Air traffic control is meaning. The job isn’t to make planes fly faster. The job is to prevent chaos when the sky gets crowded, to sequence arrivals, to maintain safe separation, and to keep the schedule legible to everyone downstream. Payments at scale have the same shape: you need coordination, predictability, and outcomes that remain readable under load.

Plasma’s “designed from the ground up” claim matters most in that context. When the primary workload is payments, the design priority shifts from maximal expressiveness to repeatable performance. The system’s job is to make stablecoin transfers boring in the best sense: consistent, low-friction, and operationally legible.

Consider a grounded use case: a marketplace settling thousands of seller payouts each day. Not a one-time batch, but a continuous stream of small settlements that must land predictably. Every additional cent in fees isn’t a rounding error, it’s a margin leak at scale. Every surprise delay isn’t “latency,” it’s customer support load and a finance team that loses confidence in automation.

In some environments, if a payments rail can keep per-transfer costs roughly in the sub-cent range, it stops behaving like a premium feature and starts behaving like utility infrastructure. That changes product choices. It becomes rational to pay out more frequently, split settlements, reduce counterparty exposure, and keep balances lean simply because the rail is dependable.

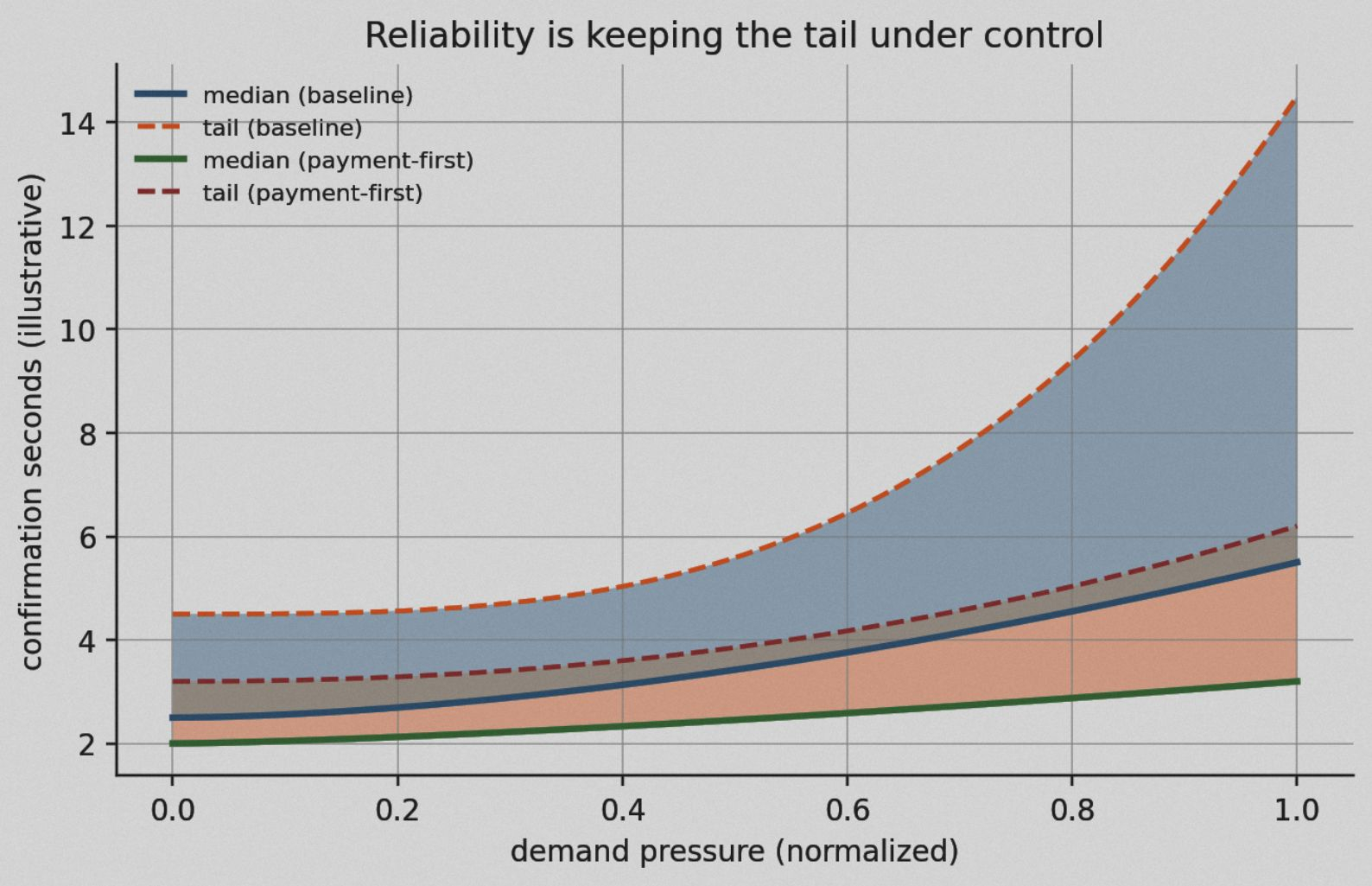

Early signs in payment-optimized stacks also suggest confirmation expectations tighten when the system is tuned for settlement. If users can expect confirmation in a handful of seconds rather than “whenever congestion clears,” behavior changes. Merchants begin to treat incoming stablecoin payments as usable cash flow, not as pending intent.

And depending on workload, systems engineered for repetitive transfers can sometimes sustain throughput measured in the thousands of transactions per second at peak. Not as a perpetual promise, but as a plausible operating range when the entire stack is designed around one dominant traffic pattern. The point isn’t the headline. The point is avoiding the hidden tax that unpredictable throughput imposes on real payment loops.

This is the difference between noise and signal.

Noise is when the same action yields a different experience minute to minute: costs drift, confirmation stretches, and operational teams compensate with buffers and manual checks. Signal is when a system has stable texture, where outcomes are consistent enough to plan around.

A controlled critique belongs here.

The risk in building a chain optimized for a single dominant use case is trading breadth for focus. A payments-first design may feel less flexible to builders who want maximal generality. There’s also concentration risk: if stablecoin payment volumes grow slower than expected, the system can look overfit to a future that arrived late.

That critique is real. It’s also incomplete.

Infrastructure is not judged by how many things it can be. It’s judged by how reliably it performs the job the market demands. Stablecoin payments are not a niche workload. They are a credible contender for default digital dollar movement. The demand is not for novelty. The demand is for operational certainty.

Specialization isn’t constraint when the job is clear. A rail built for stablecoins isn’t trying to win a creativity contest. It’s trying to reduce friction until settlement becomes quiet enough to be trusted.

In that sense, Plasma isn’t selling speed as spectacle. It treats speed as a way to compress uncertainty. It treats low cost as a way to remove hesitation. And it treats scale as a way to prevent the system from changing character under load.

Motion makes good demos. Meaning makes durable systems.

If stablecoins are going to be more than a story, they will need rails that leave clean, reconcilable footprints in operations, not just impressive trails in metrics. The future of payments won’t be decided by what moves fastest. It will be decided by what remains dependable when volume becomes routine.

#Plasma @Plasma $XPL