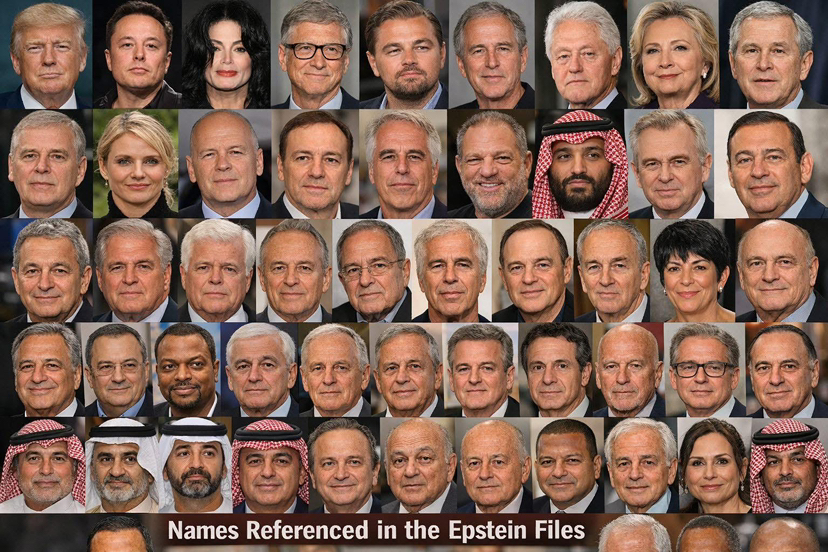

Big political stories don’t just live in headlines — they often ripple through financial markets. With renewed attention around the Epstein files, many traders are asking the same question:

Could this kind of news actually move crypto and other major assets?

The answer isn’t about the documents themselves.

It’s about how markets react to uncertainty, trust, and political pressure.

Let’s break down what could realistically happen.

Markets Don’t Trade News — They Trade Uncertainty

Financial markets rarely move because of a single event. Instead, they react to the chain reaction that follows.

If a major political scandal expands, markets begin pricing in:

leadership instability

public unrest

policy distractions

global uncertainty

And uncertainty is the fuel that drives volatility.

When volatility rises, capital starts moving.

Why Crypto Could Benefit the Most

Crypto has always thrived on one powerful narrative:

Money outside the traditional system.

Whenever trust in institutions weakens, the crypto story becomes stronger.

Here’s why traders watch these events closely:

• Political scandals often increase distrust in governments and elites

• Distrust strengthens the “decentralization” narrative

• New retail attention flows into crypto markets

• Volatility increases trading opportunities

Even if the news has nothing to do with blockchain, the psychological effect can push more people toward crypto as an alternative financial system.

This doesn’t guarantee instant price jumps — but it often creates bullish sentiment and higher trading activity.

Oil and the “Risk Premium”

Oil markets react to one thing more than anything else: global stability.

If political tensions rise, investors start pricing in risk.

That’s called a risk premium.

Possible outcomes:

Political distractions can weaken diplomatic focus

Global tensions can increase uncertainty

Markets hedge against instability by pushing oil higher

Oil doesn’t need supply disruptions to move — sometimes fear alone is enough.

Stocks vs Safe Havens

Traditional markets usually react differently.

Stocks prefer stability, predictability, and confidence.

Large political scandals create the opposite environment.

When uncertainty grows:

Investors reduce exposure to risky equities

Capital rotates into alternative assets

Volatility spikes across global markets

Where does that money typically go?

• Gold

• Cash

• Crypto

This is known as a risk-off rotation.

The Chain Reaction That Traders Watch

It’s not about the files themselves.

It’s about the potential domino effect:

Scandal → Political tension → Market uncertainty → Capital rotation → Volatility.

Crypto often sits right at the center of this rotation.

What Traders Should Watch Next

The real question isn’t “Will this move markets today?”

The real question is:

Will this story grow or fade?

If the news cycle intensifies:

Expect volatility across all markets

Expect stronger safe-haven narratives

Expect crypto trading activity to rise

If the story fades quickly:

Market impact may remain minimal.

Final Thoughts

Politics and markets are more connected than most people realize.

Sometimes the biggest price moves start far away from financial charts.

Smart traders don’t just watch candles — they watch the world.

Stay informed. Stay prepared. Stay ready.