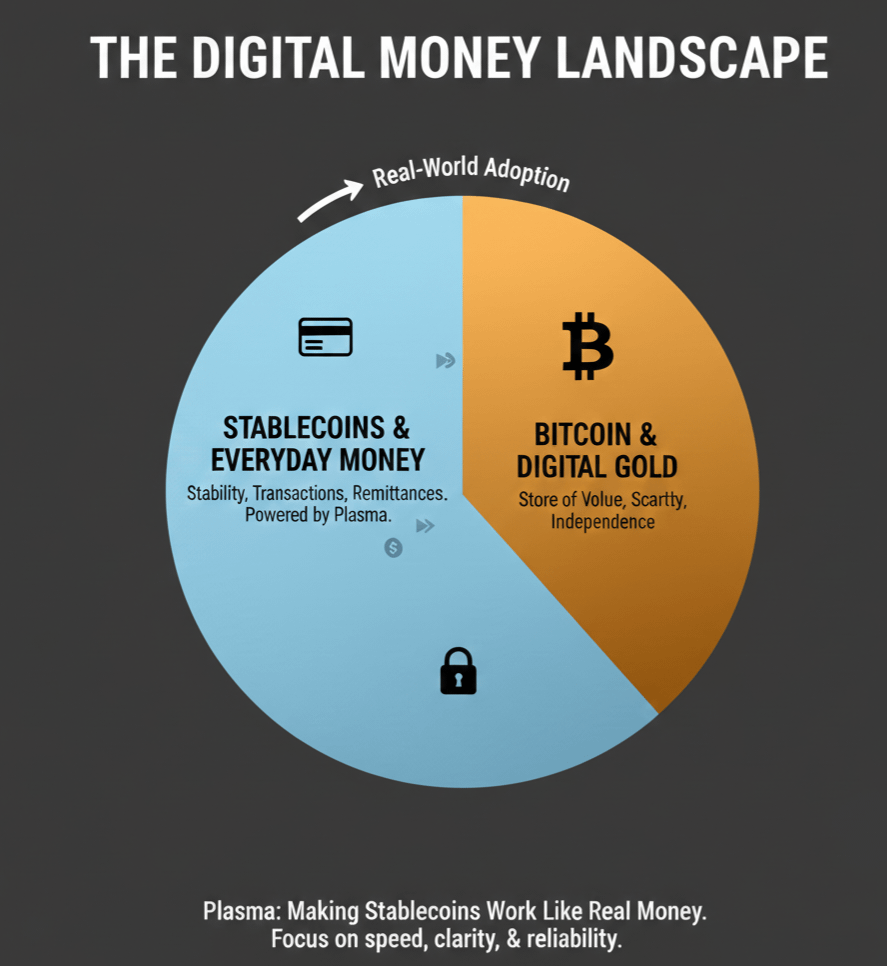

The conversation around digital money is getting louder every day, and while Bitcoin still dominates headlines, I think the more interesting shift is happening with stablecoins and the infrastructure behind them. Bitcoin did something revolutionary by proving that money could exist without banks, but it was never designed to feel calm or predictable. Its price moves, sometimes wildly and that makes it powerful as an asset but awkward as everyday money. From my point of view, Plasma steps in right where that gap starts to matter.

Bitcoin behaves like digital gold. People hold it, believe in its long-term value and accept the volatility that comes with it. Stablecoins are the opposite. They’re meant to feel boring, steady, and reliable. And honestly, that “boring” part is what makes them useful. You can send them, spend them or save them without constantly checking the price. What I find compelling about Plasma is that it treats this kind of stable money as the main event, not a side feature.

A lot of networks were built with speculation in mind first, then tried to retrofit payments later. Plasma feels like it flipped that order. It starts with the assumption that people want digital money that just works. No stress, no mental math, no surprises. In my opinion, that mindset is exactly what stablecoins need to reach real-world adoption.

Bitcoin’s strength is scarcity and independence from governments and that role isn’t going away. But using it to pay rent, send remittances, or run a business can be uncomfortable because its value can change overnight. Stablecoins remove that anxiety, but only if the network supporting them is fast, simple and trustworthy. That’s where Plasma feels different. It’s less about chasing narratives and more about making everyday money movement feel natural.

What stands out to me is how Plasma seems focused on real behavior, not idealized use cases. People don’t want to think about block times or network congestion. They want to send money and be done with it. Plasma feels designed for that quiet, background role where the tech disappears and the experience takes over.

In places where local currencies are unstable, people often use both Bitcoin and stablecoins for different reasons. Bitcoin is something you hold onto. Stablecoins are something you live on. From my perspective, Plasma strengthens that second layer by giving stable digital money infrastructure that feels ready for real economic life.

I don’t see the future as Bitcoin versus stablecoins. I see them working side by side, each doing what it does best. Bitcoin stores value across time. Stablecoins move value across borders and between people. Plasma positions itself right in the middle of that flow, focused on speed, clarity and reliability. In a space full of noise, that kind of quiet usefulness feels like the real progress.