way to describe it is this: it’s a Layer 1 blockchain that’s been built almost entirely around stablecoins, especially USDT. Not as an add-on or a side feature, but as the main point of the chain.

The idea is pretty simple. Plasma wants to be the place where stablecoins move fast, cost basically nothing to send, and actually make sense for everyday payments, not just trading. Things like remittances, payroll, merchant payments, treasury transfers — that sort of stuff. Less speculation, more settlement.

At the core, Plasma runs its own custom consensus system called PlasmaBFT. It’s inspired by Fast HotStuff and tuned for speed. From what’s been shared, it can handle well over a thousand transactions per second and finalizes blocks in under a second. In practice, that means payments feel instant instead of “wait and see.”

At the core, Plasma runs its own custom consensus system called PlasmaBFT. It’s inspired by Fast HotStuff and tuned for speed. From what’s been shared, it can handle well over a thousand transactions per second and finalizes blocks in under a second. In practice, that means payments feel instant instead of “wait and see.”

What’s interesting is that Plasma didn’t try to reinvent the developer side of things. It’s fully EVM-compatible and uses the Reth execution layer, which is a Rust-based Ethereum client. So developers can deploy normal Solidity contracts, use MetaMask, Hardhat, Foundry — all the usual Ethereum tools — without changing how they work. That lowers the barrier a lot.

Another big piece is Bitcoin. Plasma doesn’t just connect to Bitcoin loosely; it anchors parts of its state back to the Bitcoin main chain. There’s also a trust-minimized bridge that lets Bitcoin move into Plasma and be used inside smart contracts. The goal there seems to be borrowing Bitcoin’s security and neutrality rather than competing with it.

Where Plasma really tries to stand out is how it treats stablecoins at the protocol level. Basic USDT transfers can be gasless thanks to built-in paymaster contracts. Even when fees exist, you’re not forced to hold XPL just to move stablecoins. You can pay gas in USDT or other approved assets like BTC. That sounds small, but it removes a lot of friction for non-crypto-native users.

Where Plasma really tries to stand out is how it treats stablecoins at the protocol level. Basic USDT transfers can be gasless thanks to built-in paymaster contracts. Even when fees exist, you’re not forced to hold XPL just to move stablecoins. You can pay gas in USDT or other approved assets like BTC. That sounds small, but it removes a lot of friction for non-crypto-native users.

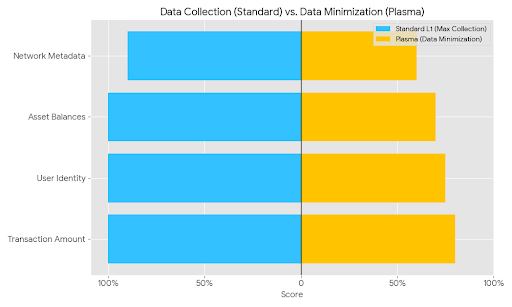

There’s also talk of confidential payments coming later. The plan is to add privacy features that hide transaction details while still keeping things auditable and composable. It’s not live yet, but it’s clearly on the roadmap.

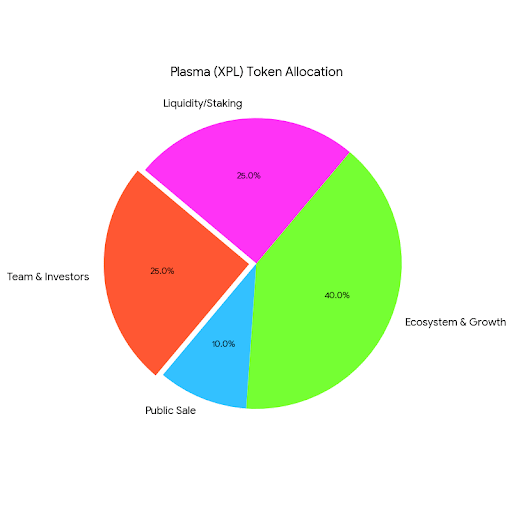

Plasma does have a native token, XPL. Total supply is around 10 billion. Inflation starts at about 5% per year and slowly drops toward 3%, with a burn mechanism similar to EIP-1559 to offset fees. Allocation-wise, roughly 10% went to a public sale, a large chunk is set aside for ecosystem growth, and about a quarter is reserved for the team and investors with vesting. Validators stake XPL to secure the network, and regular holders can delegate to earn rewards.

As for launch status, Plasma’s public beta mainnet went live on September 25, 2025. Pretty quickly, it attracted a lot of stablecoin liquidity — billions of dollars moved onto the chain within days, according to multiple observers. Some of that is clearly incentive-driven, but it still shows there’s real interest.

XPL is already trading on major exchanges, and there have been early campaigns like launchpools and trading incentives to bootstrap activity. Nothing unusual there for a new L1.

On the funding side, Plasma raised around $24 million across seed and Series A rounds. Framework Ventures led, with backing connected to Bitfinex and Tether, plus other institutional names. That connection matters, especially given Plasma’s heavy focus on USDT — it’s hard to ignore the strategic alignment.

For developers and infrastructure, Plasma looks fairly standard in a good way. RPCs, WebSockets, SDKs, MetaMask support — all there. Infrastructure providers like Alchemy are involved, which helps with node access, analytics, and reliability.

In terms of who this is for, Plasma seems aimed at two main groups. On one side, everyday users in regions where stablecoins are already used as money. On the other, institutions — exchanges, payment companies, custodians — that need fast, predictable settlement without Ethereum-style fee surprises.

The main use cases are pretty clear: cheap or free USDT transfers, merchant payments, cross-border settlement, and DeFi that mixes Bitcoin and stablecoins. If the privacy module ships, it could also appeal to more regulated or enterprise-style flows.

Market-wise, Plasma is entering a crowded space. Ethereum, Tron, and newer payment-focused chains aren’t standing still. Plasma’s edge is the combination of stablecoin-first design, Bitcoin anchoring, and EVM compatibility. Whether that’s enough long-term depends on execution and real usage, not just early liquidity.

Some people are excited. Others are cautious, especially about how much of the early activity is incentive-driven. That tension is pretty normal for a new chain.

Overall, Plasma feels less like “just another L1” and more like a specific bet: that stablecoins deserve their own settlement layer, one that’s fast, cheap, and doesn’t force users to care about gas tokens. If that bet pays off, Plasma could matter a lot. If not, it’ll blend into a very competitive field.