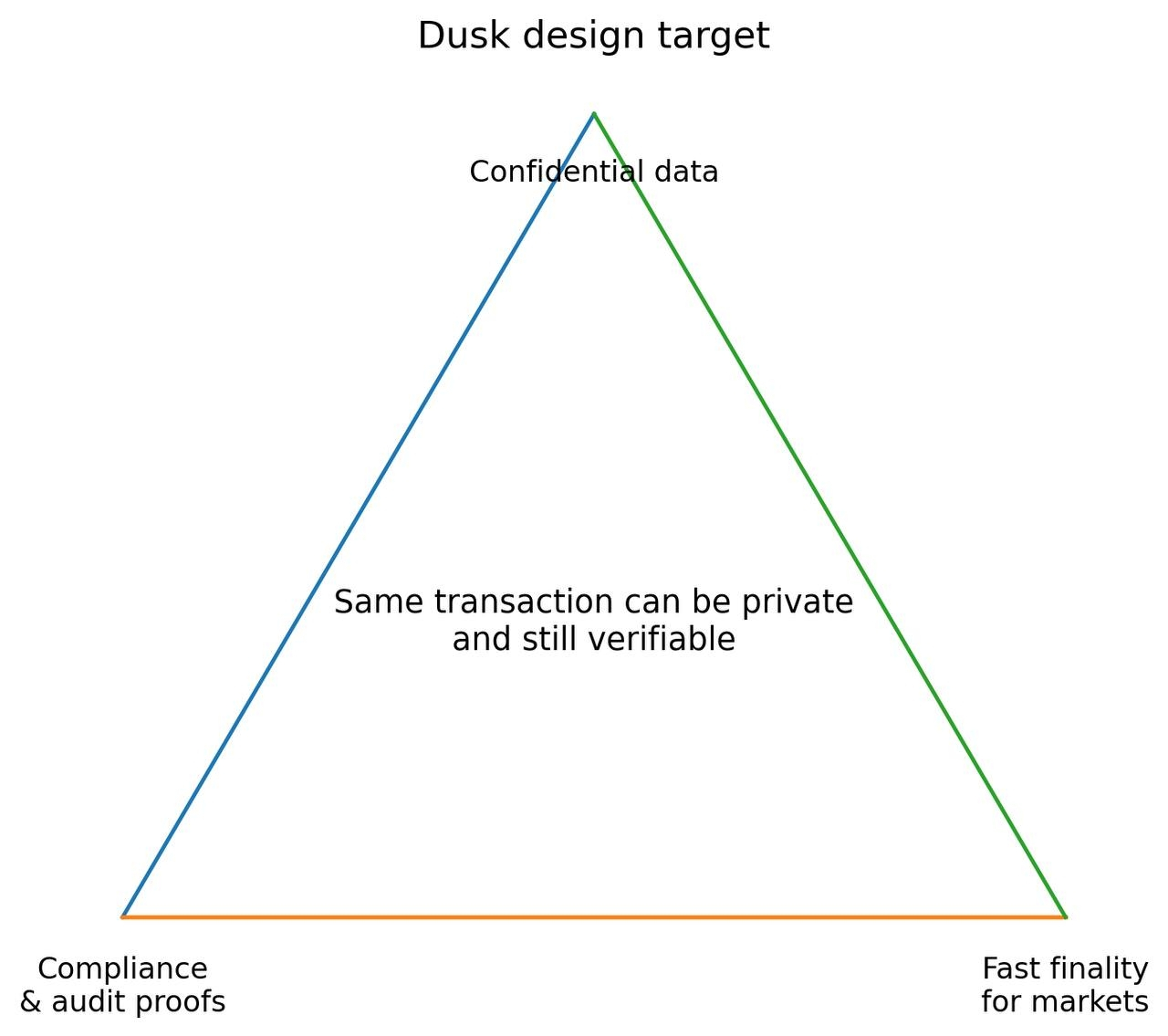

There’s a quiet truth in regulated finance: most of the value is public, but most of the reasons must stay private. Order sizes, identities, allocations, underwriting terms, internal risk limits, these are the levers that make markets work, and they’re exactly what traditional blockchains tend to expose by default. Dusk’s obsession is not “privacy for vibes.” It’s privacy as an operational requirement, confidential where it needs to be, provable where it must be.

That’s why @Dusk keeps landing in the same lane: tokenized securities, compliant settlement, and real institutions that can’t afford data leakage. The stack is designed to let parties execute logic without publishing the sensitive parts of the story, while still leaving a verifiable trail that auditors and regulators can rely on. Dusk describes this as confidential smart contracts, public infrastructure with private execution details, instead of private infrastructure with public marketing.

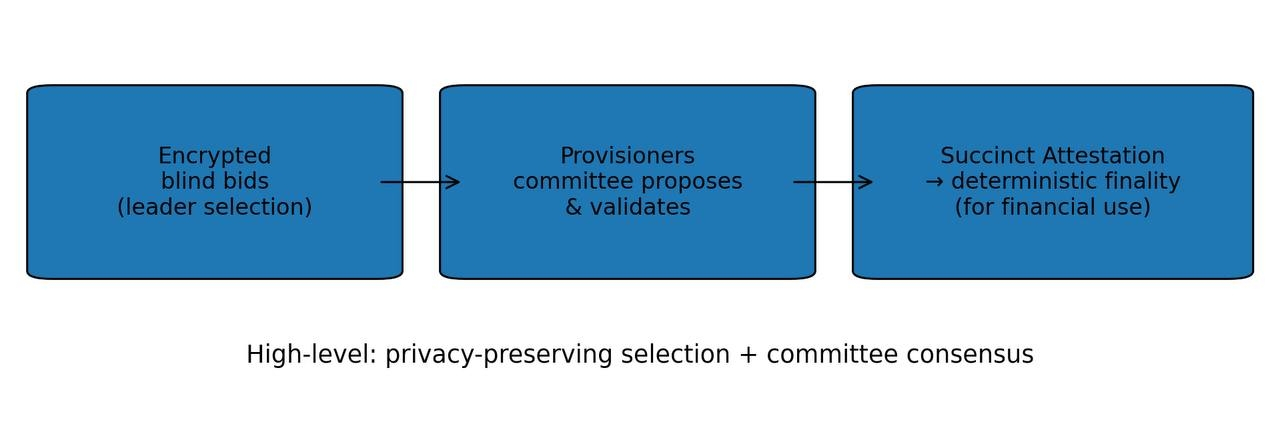

Under the hood, the consensus story matters because “private” networks often cheat by becoming permissioned. Dusk takes a different route: Proof-of-Blind-Bid (a privacy-preserving leader selection mechanism) and a committee-based protocol (Succinct Attestation) aimed at fast, deterministic finality, useful words in finance because they translate to: fewer settlement risks and clearer operational guarantees.

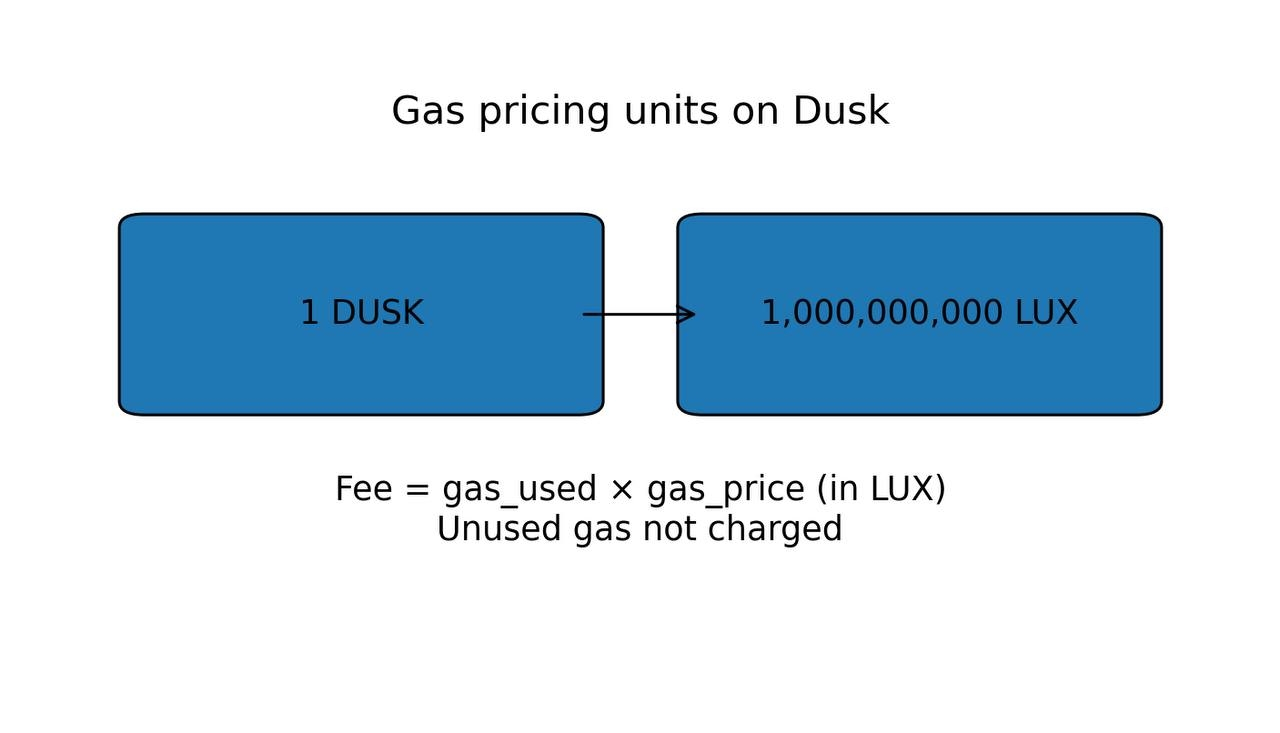

Then there’s the simplest, most underappreciated point: using a chain for markets means dealing with gas like an adult. Dusk’s documentation spells out a standard, transparent fee model—gas used × gas price—with the gas unit priced in LUX (where 1 LUX = 10⁻⁹ DUSK). That may sound small, but it’s what lets applications reason precisely about costs at scale.

Where this becomes more than architecture is DuskTrade and the partnership narrative around NPEX—a regulated venue context that keeps showing up in Dusk’s own communications and in related coverage. The important takeaway isn’t a headline number; it’s the direction of travel: regulated issuance and trading workflows on infrastructure that doesn’t force every participant to reveal their business logic to the entire internet. That’s what “compliant privacy” actually looks like when you stop treating compliance as an afterthought.

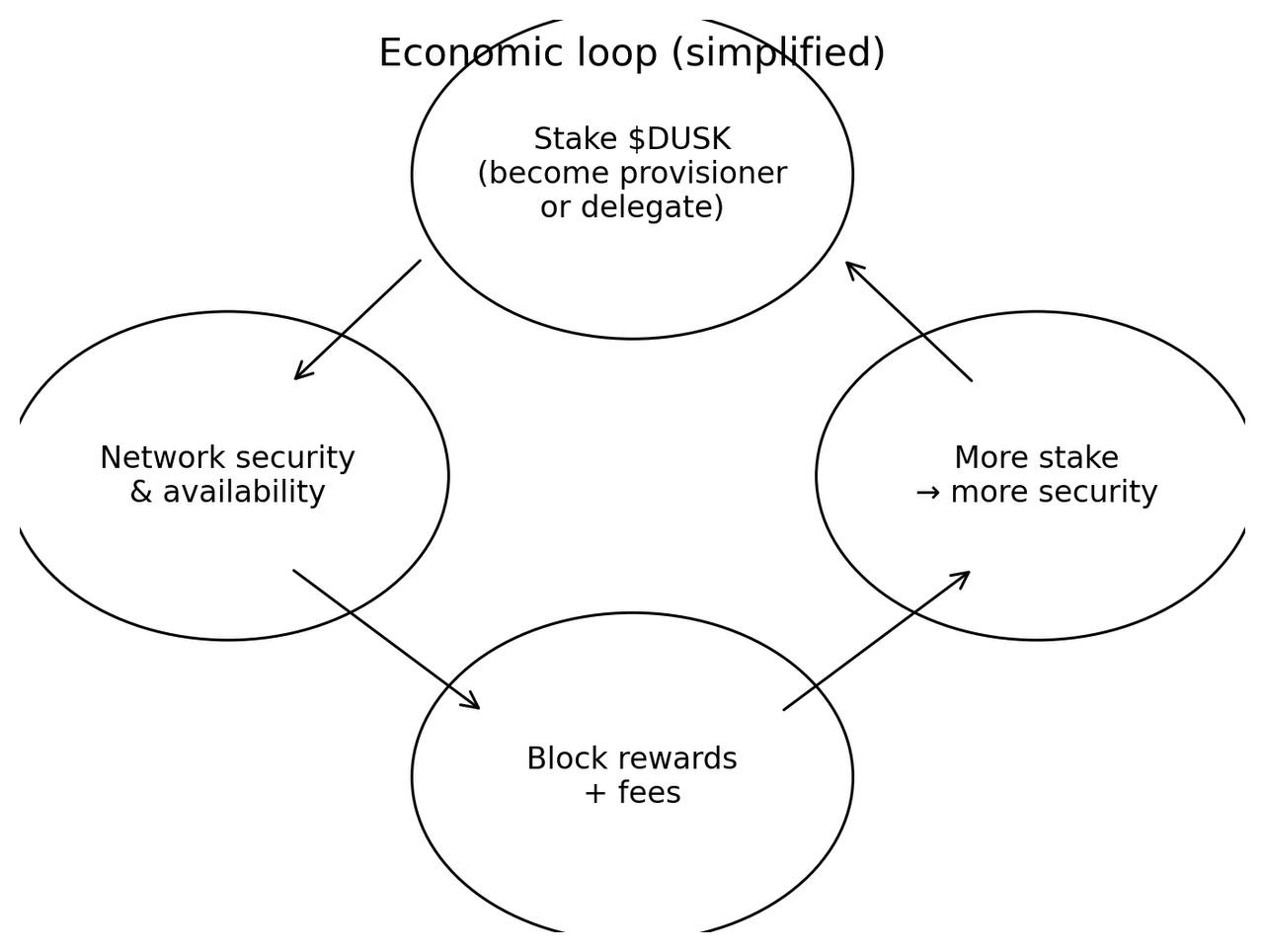

So how does $DUSK fit, beyond being a ticker people argue about? It’s the economic core for the network: it underwrites participation (staking/provisioners), pays for execution (fees), and anchors the incentive loop that keeps the system live when markets are noisy. If Dusk succeeds, $DUSK isn’t “a privacy coin.” It’s the security budget for a chain that can host regulated assets without demanding that issuers and traders sacrifice confidentiality just to get programmability.

My lens for Dusk is blunt: the long-term winners in RWAs won’t be the chains that shout the loudest; they’ll be the ones that let institutions deploy without rewriting their risk model. Dusk is building exactly that bridge, public verification, private intent, deterministic settlement. If that combination becomes boringly reliable, it becomes extremely valuable.

@Dusk $DUSK #Dusk