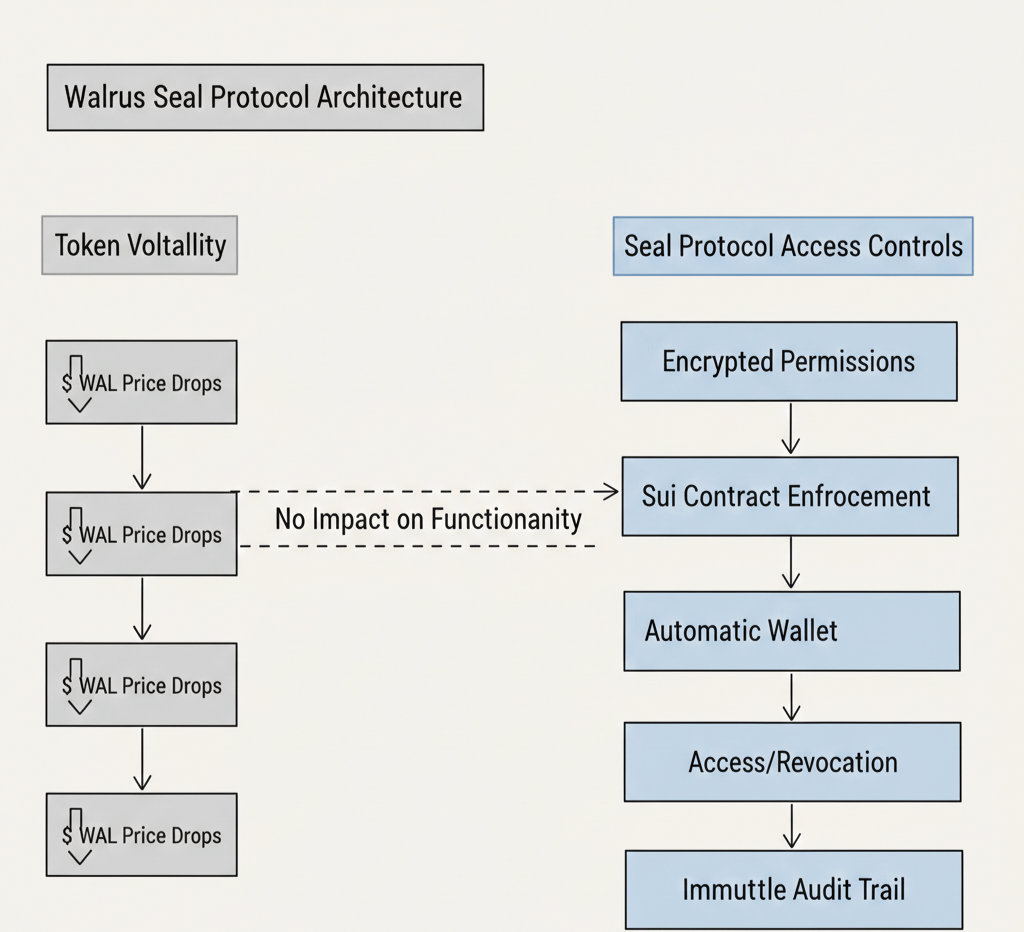

I've been asking developers what Walrus features actually matter when building applications and everyone mentions Sui integration first but Seal Protocol second. WAL sits at $0.0907 today with RSI jumping to 47.81 from yesterday's 22.41—that's a 25-point momentum shift showing some recovery. Volume dropped to $723k as price stabilized. But here's what developers keep emphasizing—the programmable access controls through Seal Protocol keep working regardless of what the token does. That reliability during volatility is infrastructure value that's completely invisible to people watching charts.

Most people think Walrus is just decentralized storage. Store files, retrieve files, basic functionality. That misses half of what makes it useful for real applications.

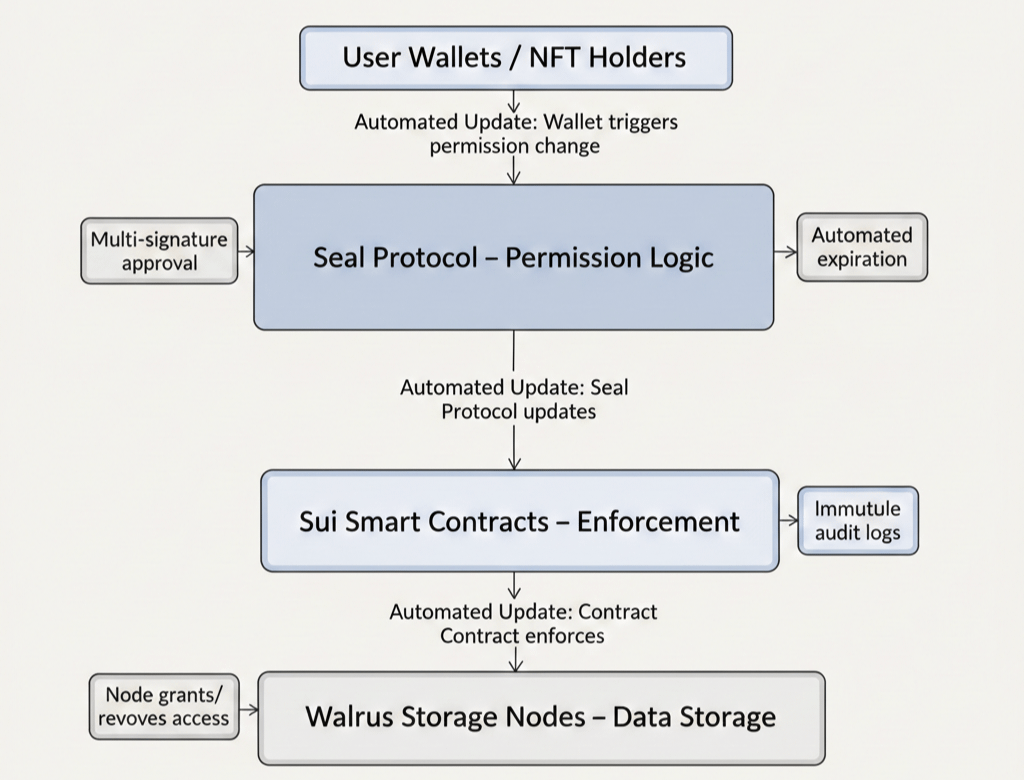

Seal Protocol gives Walrus stored data programmable permissions that run on Sui smart contracts. Not just "this file is public or private." Complex access rules like "only token holders can view," "only verified addresses can modify," "only after specific date can access." The permissions are enforced cryptographically and integrated natively with Sui's object system. That creates use cases centralized storage can't match and other decentralized storage doesn't provide.

Here's what caught my attention talking to an NFT platform developer. They store high-resolution artwork on Walrus with Seal Protocol controlling access. Only current NFT holders can view the full files. When someone buys an NFT, their wallet automatically gets permission to access the Walrus blob containing the artwork. When they sell the NFT, permission revokes automatically. All of this runs through Sui smart contracts without any centralized server managing permissions.

They told me the critical part is reliability. When WAL crashed from $0.16 to $0.089, their access controls kept working perfectly. Buyers got access. Sellers lost access. The token price didn't matter because Seal Protocol runs on Sui's consensus, not on WAL value. The infrastructure layer is completely separated from token economics for actual functionality.

If they had built this on IPFS or traditional storage, they'd need centralized middleware to manage permissions. A server checking wallet balances, updating access lists, hoping it doesn't go down. Single point of failure. Centralization risk. Walrus plus Seal Protocol eliminated that entirely through cryptographic access controls that run trustlessly.

The circulating supply of 1.58 billion WAL out of 5 billion max means future token volatility is guaranteed. More unlocks coming. More price swings. Applications can't build reliable user experiences if core functionality breaks when tokens crash. Seal Protocol gives them access control reliability independent of WAL price. That's what infrastructure needs.

Walrus processed over 12 terabytes during testnet specifically to validate that Seal Protocol worked at scale. The cryptography was sound in theory. The question was whether it performed adequately with real workloads. Could permissions update fast enough? Did verification create bottlenecks? Would access control logic integrate cleanly with Sui contracts? Five months of testing proved it was production-ready before mainnet launched with real user data.

Walrus: access controls that run on blockchain consensus rather than token price create reliability centralized solutions can't match.

Here's a concrete example of what programmable permissions enable. A corporate project stores sensitive documents on Walrus with Seal Protocol managing multi-signature access. Documents require approval from three of five executives to view. When executives change, permissions update automatically through Sui contract logic. When documents expire after retention periods, access revokes automatically. Everything auditable on-chain without centralized management.

They evaluated alternatives. S3 with IAM permissions. IPFS with custom middleware. Traditional document management systems. Chose Walrus because Seal Protocol provided the permission complexity they needed with cryptographic enforcement they could prove to auditors. The fact that it runs on blockchain consensus means no single administrator can bypass access controls even with full system privileges.

That use case doesn't care about WAL trading at $0.0907 versus $0.16. The access controls work the same. The cryptographic proofs verify identically. The audit trail remains immutable. Token price volatility doesn't affect functionality. That's infrastructure designed for reliability rather than speculation.

My gut says most Walrus marketing focuses on decentralized storage and misses the Seal Protocol value proposition entirely. Decentralized storage is commodity. IPFS, Arweave, Filecoin—plenty of options exist. Programmable access controls integrated natively with blockchain consensus? That's differentiation. That's why applications choose Walrus specifically rather than just any decentralized storage.

The RSI jumping from 22.41 to 47.81 in one day shows momentum recovering. But applications using Seal Protocol for access controls don't make infrastructure decisions based on RSI. They evaluate whether permissions work reliably. Whether integration with Sui contracts is clean. Whether audit requirements can be met. On those dimensions, Seal Protocol delivers independent of token performance.

Volume of $723k shows decreased trading activity compared to yesterday's $1.71M spike. Speculation cooling off. But Seal Protocol usage on Walrus doesn't correlate with trading volume. Applications keep managing permissions. Keep updating access rules. Keep enforcing cryptographic controls. The infrastructure operates whether speculators are active or quiet.

This is where Walrus competes on technical capability rather than cost. Seal Protocol isn't about cheaper storage. It's about permissions that centralized systems can't provide with the same cryptographic guarantees. Applications needing those guarantees don't have alternatives that deliver equivalent functionality. That's moat that survives token volatility.

The 105 operators running Walrus nodes serve Seal Protocol enforcement automatically. When access rules change through Sui contracts, operators enforce the new permissions without manual intervention. When tokens transfer and permissions update, operators verify credentials cryptographically. The distributed enforcement creates resilience that centralized permission systems can't match.

At $0.0907 with recovering RSI, some applications might be evaluating Walrus again after the token crash scared them off. The ones who understand Seal Protocol value will focus on access control reliability rather than token price. The ones who just need cheap storage will compare costs and probably choose alternatives. That filtering means Walrus attracts applications who actually need what it uniquely provides.

Time will tell whether Seal Protocol becomes widely adopted infrastructure or remains niche feature for specific use cases. But the applications already using it aren't leaving. Not because switching is hard—though it is—but because alternatives don't provide equivalent programmable permission functionality. That's genuine technical differentiation beyond "we're decentralized." That's infrastructure value that persists through token crashes because functionality doesn't depend on token price.