Bitcoin’s crash isn’t random. It’s a liquidity problem.

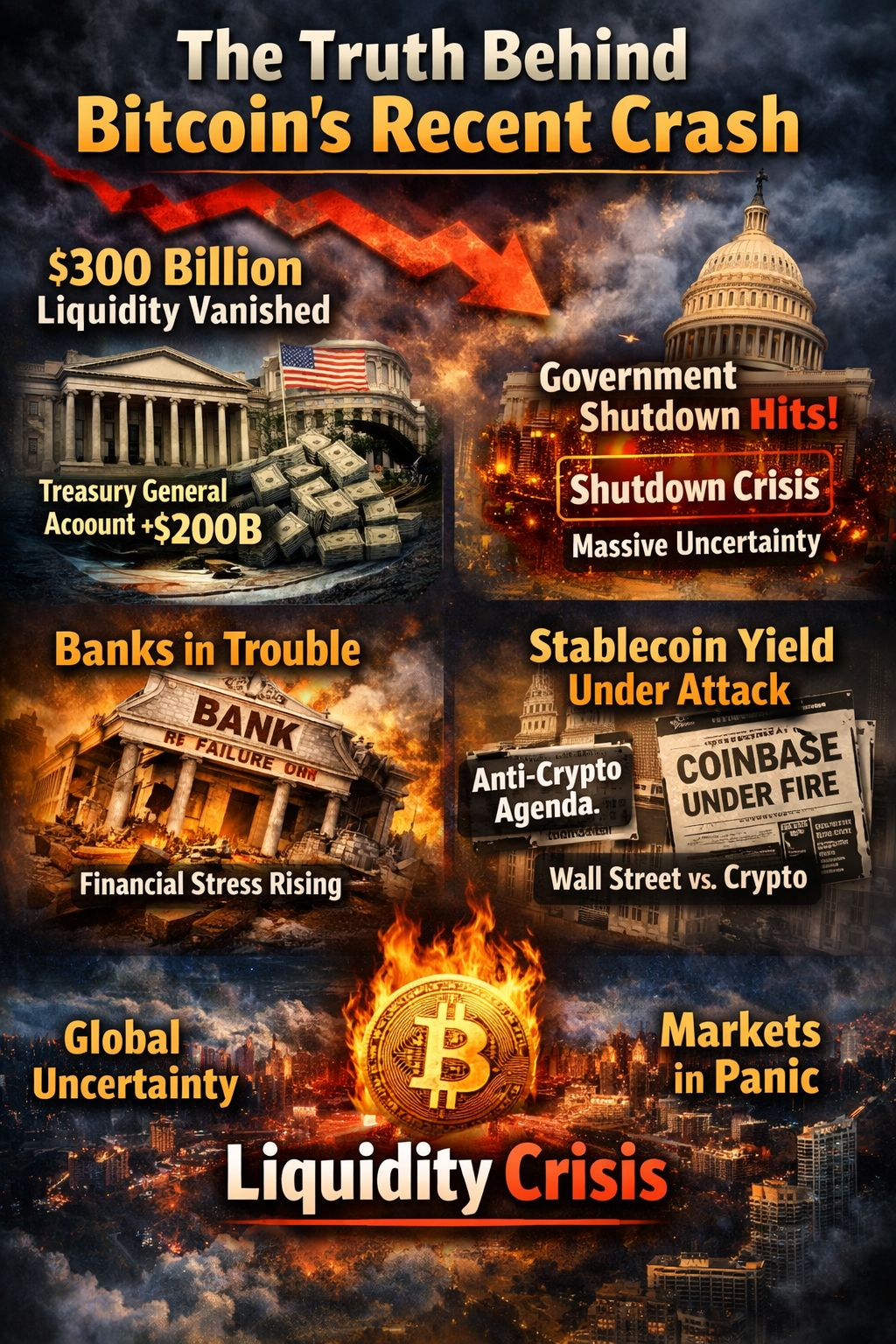

BTC is down for four straight months — something we haven’t seen since 2018. The real reason? Around $300B in liquidity has been pulled from the market. A big chunk of that money moved into the US Treasury General Account (TGA) as the government prepares for a possible shutdown.

When the TGA is filled, liquidity dries up — and Bitcoin falls. When it’s drained, BTC usually recovers. Right now, liquidity is being sucked out fast.

Add to that the first US bank failure of 2026, rising global uncertainty, and investors moving away from risk. Crypto always feels this pressure first.

There’s also a growing attack on stablecoin yields, pushed by traditional banks trying to protect their monopoly on returns.

This isn’t a Bitcoin problem. It’s a liquidity war.

When liquidity comes back, Bitcoin usually follows.