I slow down when a system explains itself too easily.

Markets taught me that confidence without evidence is expensive. After years of trading through outages, reorgs, and quiet failures, one lesson stayed clear: when data disappears, trust follows. That’s why data availability quietly became a serious topic again in 2024, especially for infrastructure projects like Plasma that focus on settlement and reliability.

Data availability sounds technical, but the idea is simple. Can users, validators, and observers independently see what happened? Not later. Not summarized. But as it actually occurred. In blockchain systems, data availability ensures that transactions, state changes, and consensus decisions are visible and verifiable. Without it, decentralization becomes theoretical.

Why is this trending now? Because markets matured. Between 2022 and 2023, several networks experienced issues where execution continued but data access lagged or became unclear. Traders felt that risk immediately. By 2024, attention shifted away from raw throughput toward whether systems could prove their own history under stress.

@Plasma ’s architecture leans heavily into this concern. Its design emphasizes deterministic finality and clear data propagation through its consensus layer. In simple terms, when something happens on Plasma, the data required to verify it is available to participants. That reduces reliance on trust. You don’t need to believe a status update. You can check behavior.

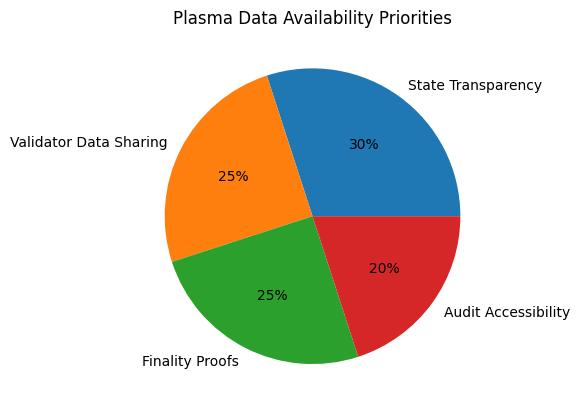

Plasma treats data availability as part of settlement integrity. Settlement isn’t just about balances updating. It’s about knowing why and how they updated. For stablecoin-heavy flows, this matters even more. Institutions, funds, and traders moving stable value care less about speed headlines and more about auditability. Plasma’s focus aligns with that reality.

Progress here has been methodical. Through 2024, Plasma development emphasized consistency in block production, validator communication, and state visibility. These aren’t flashy upgrades. They don’t change user interfaces overnight. But they reduce blind spots. Over time, fewer blind spots mean fewer surprises.

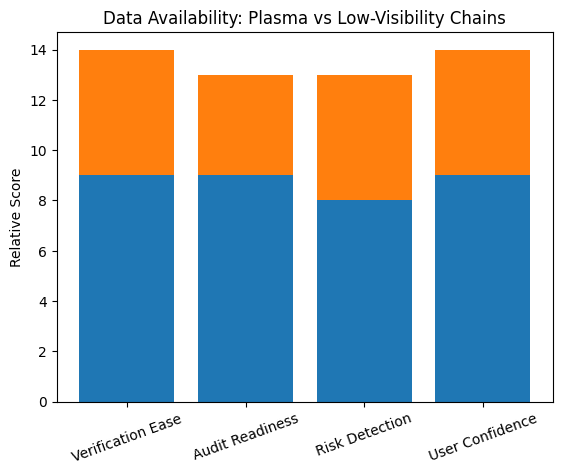

From a trader’s perspective, data availability affects risk management. When data is accessible and timely, you can model behavior. You can react. When data is delayed or abstracted away, you’re guessing. I’ve learned to trust systems where verification is easy, not systems that ask for patience.

There’s also a validator angle. Validators secure what they can see. If data availability is weak, validators either take on hidden risk or disengage. Plasma’s approach makes validator responsibility clearer. Clear responsibility supports better coordination. Better coordination supports resilience.

Philosophically, data availability is about honesty. A system that exposes its full state accepts scrutiny. A system that hides behind summaries avoids it. Plasma appears comfortable with scrutiny. It doesn’t promise perfection. It offers visibility. That distinction matters.

Why does this matter for investors? Because opacity creates tail risk. When you can’t reconstruct events, disputes escalate. Confidence erodes. Transparent systems recover faster because participants agree on what happened. Plasma’s emphasis on data availability supports faster consensus during stress, not just during normal operation.

I’ve watched markets forgive mistakes when facts were clear. I’ve also watched small issues spiral when data was missing. The difference wasn’t the severity of the bug. It was the clarity of the record.

In 2024, as regulatory attention increased and institutional participation expanded, data availability became more than a technical preference. It became a requirement. Systems that couldn’t explain themselves lost relevance. Plasma’s architecture seems built with that expectation.

Philosophically, decentralization without data is theater. Real decentralization lets anyone verify reality, even when it’s uncomfortable. Plasma’s design choices suggest it understands that decentralization isn’t about control distribution alone. It’s about information symmetry.

Trust doesn’t come from optimism. It comes from records. Records require data. Data requires availability. Plasma’s focus on making state and execution visible reflects a mature understanding of how trust actually forms in markets.

In the end, narratives fade. Price moves. Opinions change. Data remains. Systems that preserve it faithfully earn long-term confidence. Plasma’s approach to data availability feels less like a feature choice and more like a philosophical commitment.

Markets reward systems that can show their work. Over time, that matters more than how loudly they speak.