Crypto still talks about blockchains as if they’re products you use.

Real finance treats infrastructure as something you stop noticing.

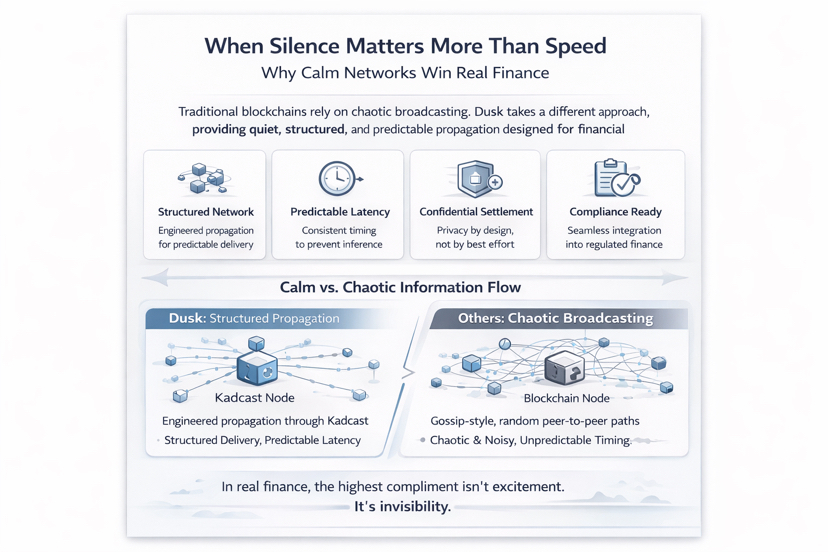

That difference explains why most public chains feel impressive in demos but uncomfortable in regulated environments. They are loud systems. Messages fly everywhere. Timing shifts. States arrive unevenly. From the outside, it looks like decentralization working. From inside a financial market, it looks like risk.

Dusk doesn’t try to solve this at the application layer. It goes lower. It asks a question most chains avoid: what happens before contracts execute, before privacy proofs verify, before settlement finalizes? How does information actually move?

In markets, timing is never neutral. If two participants observe the same state at different moments, advantage appears. That’s true whether the data is public or private. Even perfectly encrypted transactions can leak intent through propagation patterns. Who sees first. Who reacts early. Where congestion forms. Over time, those patterns become a map.

This is why financial infrastructure doesn’t rely on “best effort” networking. Predictability matters more than peak throughput. Calm matters more than noise.

Most blockchains still lean on gossip-style broadcasting. It’s resilient, simple, and socially elegant. But it’s also chaotic. Bandwidth spikes, uneven delivery, and random peer paths introduce variance that markets interpret as uncertainty. For casual transfers, that’s fine. For confidential settlement, it’s corrosive.

Dusk takes a different stance. It treats message delivery as part of the security model, not an implementation detail. By using structured propagation through Kadcast, the network behaves less like a crowd and more like engineered infrastructure. Messages move with intention. Latency becomes predictable. Bandwidth stays controlled.

This isn’t about scaling for headlines. It’s about eliminating invisible leaks.

Privacy in finance isn’t just about hiding balances. It’s about preventing inference. A calm network reduces the surface where inference can form. When propagation stabilizes, timing stops telling stories. Confidentiality becomes believable, not theoretical.

What makes this approach unusual in crypto is how unglamorous it is. There’s no narrative payoff for predictable latency. No viral thread about bandwidth discipline. But institutions don’t reward spectacle. They reward systems that behave the same way tomorrow as they did yesterday.

That mindset shows up elsewhere in Dusk’s design. Developers aren’t asked to relearn everything. EVM compatibility exists because friction slows adoption in regulated environments. Integration paths include APIs, events, and backend-friendly tooling because real finance lives in reconciliations, audits, and monitoring dashboards, not just smart contracts.

Even observability is treated carefully. Visibility exists, but it’s contextual. Public where it must be. Shielded where it should be. Auditable without becoming a permanent broadcast. Privacy here works like controlled lighting, not darkness.

What’s striking is how little of this is framed as innovation. It feels closer to admission. An admission that real markets don’t want experiments. They want systems that survive scrutiny. That don’t melt under load. That don’t behave differently at scale than they did in testing.

The network doesn’t ask participants to trust social enforcement either. In a privacy-oriented system, you can’t rely on crowds to spot bad behavior. Economic enforcement does the heavy lifting. Staking, slashing, and long-term incentives matter more than optics. The token exists to secure the system, not narrate it.

Adoption, by these standards, will look boring at first. Small integrations. Careful pilots. Low visible volume. That’s not a failure mode. That’s how regulated systems move. What matters is not how fast usage spikes, but whether usage sticks once workflows integrate.

If Dusk succeeds, it won’t be because it convinced the world to abandon regulation. It will be because it made regulation compatible with public settlement without turning transparency into exposure.

In finance, the highest compliment an infrastructure can receive isn’t excitement.

It’s invisibility.

And that’s exactly the part nobody tweets about.