I've been around long enough to know the difference between real reversals and fake bounces that go nowhere. Real recoveries have massive volume behind them, price smashing through resistance like it means business. Fake bounces happen when things get so beat down that some buy orders trigger automatically, then everyone realizes nothing actually changed and it fades within a week.

Plasma hit $0.0932 today after touching $0.0898 yesterday. RSI rocketed from 28.63 to 53.30, going from crazy oversold to dead neutral. Volume bumped to 14.95M USDT from 11.19M yesterday. The swing from $0.0898 to $0.1015 intraday is about 13% off the bottom. Looks like maybe something's happening.

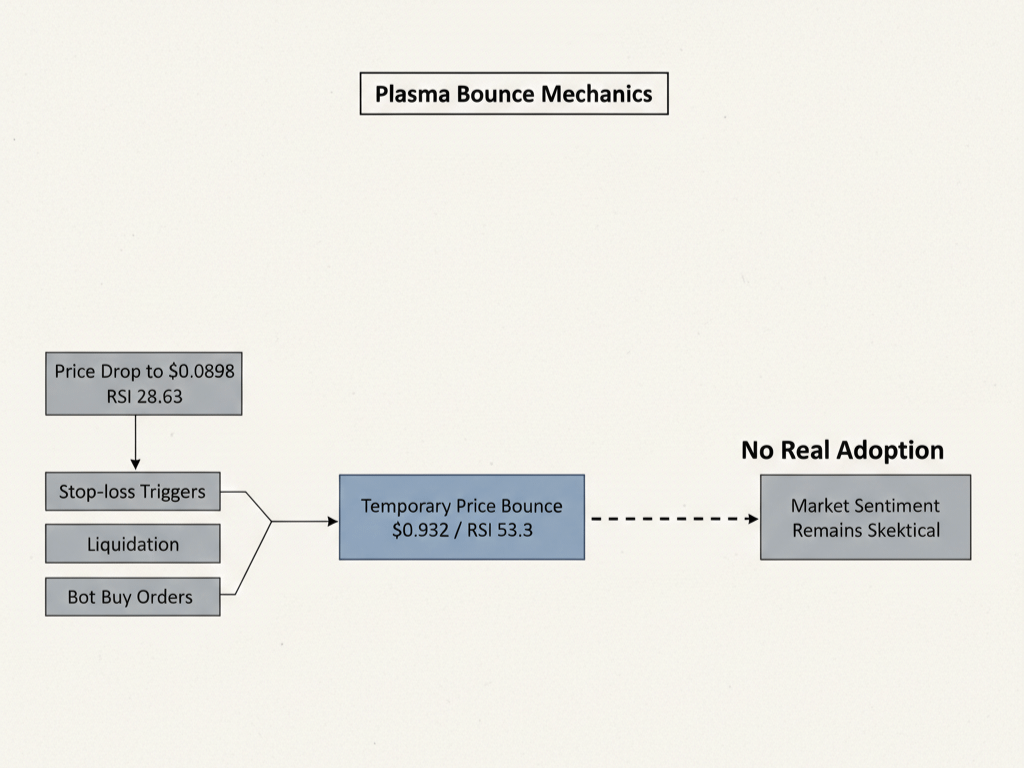

Except it's not. This is textbook oversold bounce stuff. RSI at 28.63 yesterday was deep enough that trading bots start buying on autopilot. Price hitting $0.0898 probably blew out stop losses and liquidated some leveraged positions, flushed out whoever was left selling, then bounced when there was nobody left to dump. Volume at 14.95M is higher sure, but it's not the kind of explosion you'd see if real buyers were stepping in with conviction.

XPL sitting at $0.0932 means we're still down 87% from that September launch around $0.73. Still under the $0.10 psychological level that everyone watches. Still in a nasty downtrend no matter what today's bounce looks like. Nothing changed fundamentally between yesterday and today that would make markets suddenly believe in Plasma again. Just technical stuff correcting itself without any real belief behind it.

What gets me about watching Plasma fall apart like this is thinking back to launch day. $1.3 billion showed up in the first hour. Jumped to $6.6 billion within 48 hours. Huge institutional money, partnerships with serious DeFi protocols, technology that actually worked exactly as advertised. Everything was perfect on paper for Plasma to blow up. Now here we are five months later with XPL at $0.0932 on weak volume while everyone acts like they never thought it would work anyway.

That's how things die in crypto most of the time. Not some dramatic collapse or exit scam. Just slowly becoming irrelevant while markets get distracted by newer shinier things. Infrastructure keeps humming along, team keeps tweeting updates, but nobody cares anymore because nothing interesting is happening. Plasma turned into background noise while traders moved on to whatever's pumping this cycle.

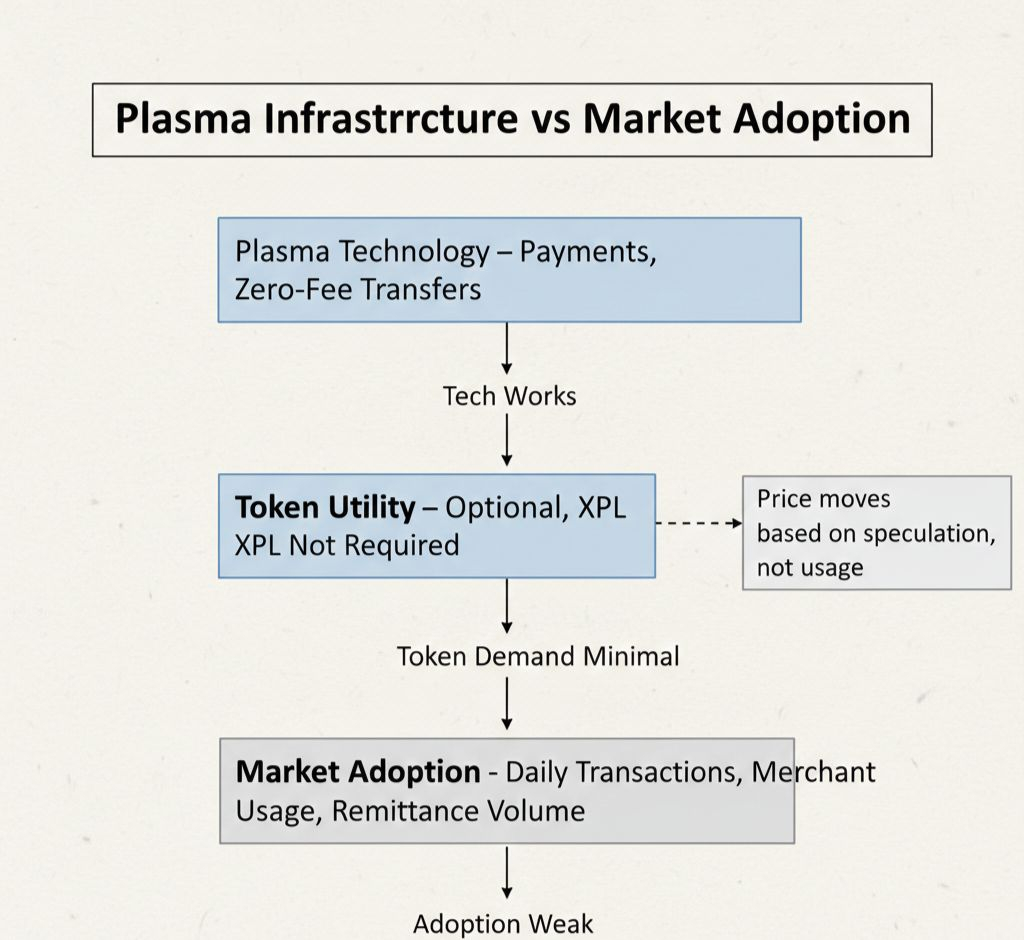

The fundamental problem with Plasma hasn't changed at all. They built payment infrastructure but never proved anyone actually needs different payment infrastructure from what exists. Tron moves insane USDT volume already with fees so tiny nobody complains. Going from nearly free to completely free isn't big enough difference to beat Tron's network effects and user base that took years to build.

Zero-fee USDT transfers on Plasma sound amazing until you think about what actually stops crypto payment adoption. It's not cost. Complexity stops people. Regulatory mess stops people. Merchants not accepting it stops people. Worrying about volatility stops people. All stuff that Plasma's zero-fee thing doesn't fix even slightly.

International remittances is the one place zero fees genuinely matter. Someone sending $500 home every month saves legit money using Plasma versus Western Union taking $30-40. But grabbing that market needs way more than just cheap infrastructure. Plasma needs deals with local exchanges in receiving countries, needs brand trust in communities, needs support in ten languages, needs regulatory approval everywhere. That's the brutal hard part that takes years and piles of cash.

Has Plasma built any of that distribution stuff? Who knows because they won't publish numbers that answer it. No daily transaction counts for Plasma payments. No merchant adoption data. No remittance volume stats. Just silence, which pretty clearly means the numbers are awful.

Volume at 14.95M USDT is middling. Not terrible but not growing. RSI at 53.30 is perfectly neutral after being crazy oversold yesterday. This bounce from $0.0898 to $0.0932 might keep going if momentum shows up, or it dies tomorrow when nobody bothers following through. Charts don't tell you which way it breaks.

What would actually change how people think about Plasma? Same thing I keep saying. Show real payment adoption with actual numbers. Tens of thousands of daily transactions for buying actual stuff, not DeFi gambling. Merchants accepting Plasma growing every month with brands people recognize. Remittance data proving it works at real scale. Plasma Card going public with user growth showing people want it.

Those things would force markets to reconsider everything. Without them, buying XPL means believing adoption happens eventually despite five months showing nothing. That worked right after launch when everyone was hyped. Doesn't work now that it's put-up-or-shut-up time.

The Plasma tokenomics problem keeps getting more obvious too. By killing the need to hold XPL to use the network, Plasma destroyed the natural demand that creates price floors. When utility tokens crash, buyers usually show up eventually because people need the token to do stuff. That demand exists whether people are speculating or not.

Plasma doesn't get that cushion because you can use everything Plasma does without ever owning XPL. Incredible for users, disaster for trying to build sustainable demand for the token. Only people buying XPL are gamblers hoping price goes up later or validators chasing staking yield. Neither creates the steady natural demand that would stop these crashes.

Maybe staking changes things when it finally launches on Plasma. If enough XPL locks up in staking contracts, supply in circulation drops and price might stabilize just from less tokens floating around. But staking only pulls capital if people think Plasma validator returns beat other options. At $0.0932 with growth looking sketchy, why lock money in Plasma staking when you could just hold stablecoins earning safe yield?

Competition isn't getting easier for Plasma either. Tron keeps crushing USDT transfer volume with stuff that works. Ethereum has all the liquidity even with expensive gas. Solana keeps pulling developers with speed and actual activity. New chains keep launching with fresh money and stories that grab attention Plasma used to have.

Plasma is wedged in this weird spot where the tech works great but markets don't care because tech alone doesn't create adoption. You need distribution channels, you need go-to-market plans, you need to solve problems big enough that people will deal with switching. Plasma has infrastructure but no obvious path to the adoption that justifies having built it.

Today's bounce to $0.0932 might keep going if we're actually bottoming out. Or it fades tomorrow and we retest $0.0898 or go lower. The charts won't tell you. What tells you is whether Plasma starts dropping metrics proving real payment adoption is actually happening. Without that, this is just random noise in a downtrend that keeps going until something real changes.

RSI at 53.30 says neutral momentum after yesterday being oversold. XPL at $0.0932 says still trending down hard despite the bounce. Volume at 14.95M says some interest but not conviction. Markets are sitting there waiting for proof that Plasma actually matters, and that proof needs to be usage numbers showing thousands of daily transactions for real payments, not just another technical bounce that disappears by next week.

Right now Plasma just keeps drifting lower on declining relevance while the infrastructure processes basically nothing and the team stays quiet on metrics that would show adoption exists. That's not what bottoming looks like. That's what a dying project looks like when it takes forever to finally admit it's done. Maybe I'm completely wrong and things turn around. But five months of this with zero real usage to show suggests markets already made up their minds.