Most blockchains are still trying to attract their first real users. They launch, bootstrap incentives, publish roadmaps, and hope activity shows up later. VANAR begins from a very different place. It is not asking where users might come from in the future. It is building where users, liquidity, and increasingly AI agents already exist.

VANAR does not treat adoption as a marketing problem. It treats it as an infrastructure alignment problem. Instead of designing abstract primitives and waiting for demand, VANAR looks at where digital activity is already happening and builds systems that fit those environments naturally.

This distinction matters because the center of gravity in crypto is shifting. Usage is no longer driven mainly by early adopters experimenting with protocols. It is driven by applications that feel familiar, intuitive, and embedded into daily digital behavior. Gaming platforms, content ecosystems, social environments, and AI-driven tools are where attention already lives. VANAR positions itself directly inside that reality rather than orbiting around it.

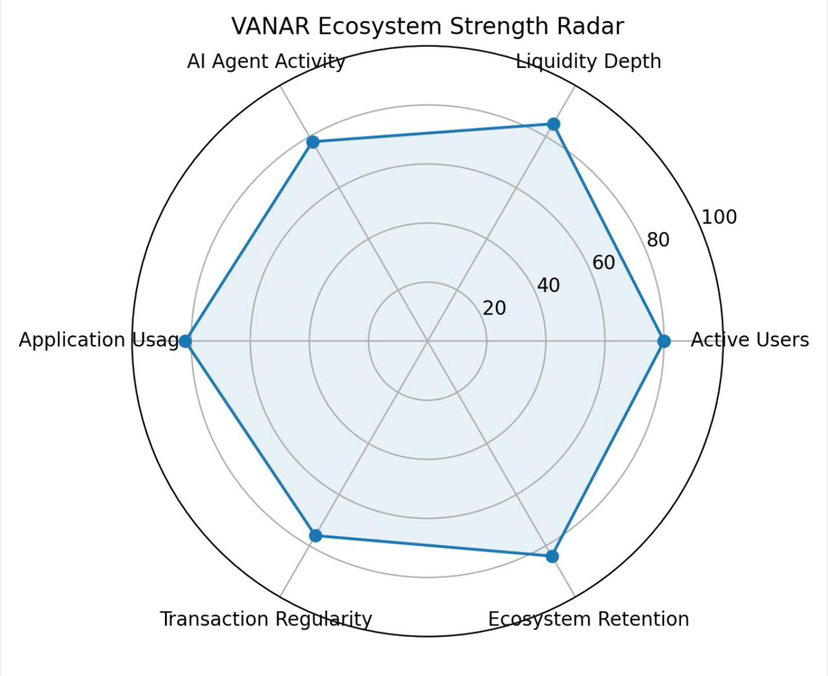

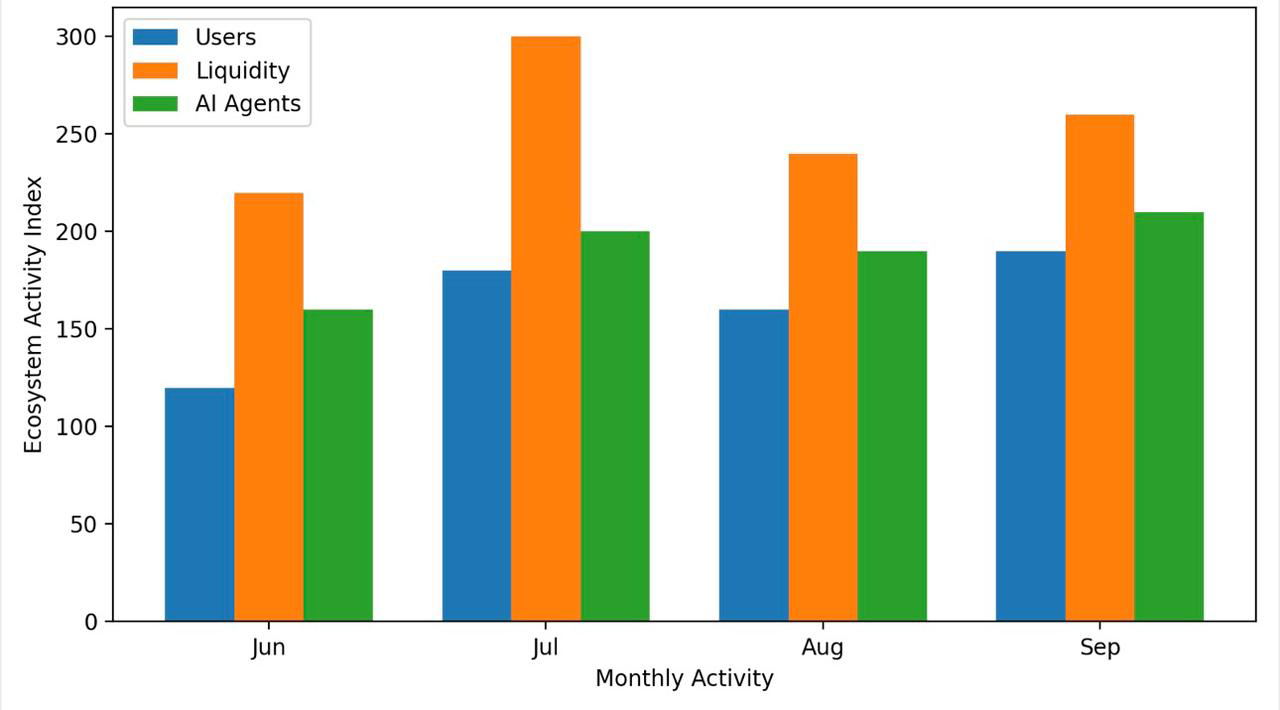

Users are the first signal. On many chains, users are temporary. They arrive for incentives and leave when rewards dry up. VANAR’s users are different because they are not there primarily for yield. They are there to interact with applications. When users come for experiences rather than extraction, they behave differently. They stay longer. They transact more naturally. They generate organic activity instead of mercenary volume.

Liquidity follows this behavior. Liquidity that exists only because it is subsidized tends to be fragile. Liquidity that exists because it supports real usage tends to be durable. On VANAR, liquidity is not floating in isolation. It is embedded into application flows. Assets are used inside games, marketplaces, content platforms, and AI-driven environments. This creates constant circulation rather than idle capital.

Over time, this circulation compounds. A user who earns inside an application spends inside the same ecosystem. A creator who receives payments reinvests into tools or exposure. A platform that generates revenue recycles liquidity back into growth. VANAR’s role is to make these loops efficient, low friction, and predictable. It does not need to manufacture liquidity if liquidity already has a reason to move.

The third pillar is AI agents, and this is where VANAR’s positioning becomes especially forward looking. AI agents are not passive users. They execute tasks continuously. They interact with smart contracts, manage assets, make decisions, and coordinate with other agents. This kind of activity is fundamentally different from human-driven transactions. It is more frequent, more automated, and more sensitive to latency and cost.

Most blockchains were not designed with this workload in mind. They assume bursts of activity followed by quiet periods. AI agents create steady pressure. They do not sleep. They do not speculate emotionally. They act according to logic and incentives. VANAR anticipates this shift by building infrastructure where agents can operate without friction. Predictable execution, low fees, and reliable state transitions become essential rather than optional.

What makes this powerful is the convergence of these three elements. Users generate demand. Liquidity enables interaction. AI agents scale activity. When these elements exist separately, ecosystems struggle to grow. When they exist together, growth becomes endogenous. VANAR is one of the few chains deliberately designed around this convergence rather than treating AI as a future add-on.

There is also an important philosophical difference in how VANAR approaches intelligence onchain. Many projects talk about AI integration in abstract terms. VANAR focuses on practical intelligence. Agents that remember past states. Agents that reason within defined constraints. Agents that can enforce outcomes through smart contracts. This turns the blockchain from a passive ledger into an active coordination layer.

This matters because the next wave of digital systems will not be driven by humans clicking buttons. It will be driven by software acting on behalf of humans. Finance, gaming economies, digital marketplaces, and content distribution will increasingly be managed by autonomous logic. VANAR positions itself as the environment where this logic can operate safely and efficiently.

Another overlooked aspect is how VANAR treats complexity. Instead of exposing users to the full cognitive load of blockchain mechanics, it pushes complexity downward into infrastructure. Users interact with applications, not with chains. Liquidity flows behind the scenes. AI agents handle orchestration. This mirrors how successful Web2 platforms scaled. They hid infrastructure and emphasized experience. VANAR applies this lesson without abandoning decentralization.

The result is an ecosystem that feels lived in rather than theoretical. Activity is not simulated. It is organic. Transactions are not inflated. They are functional. Growth does not depend on constant narrative renewal. It depends on usage reinforcing itself. This is harder to build, but far more resilient once it exists.

My take is that VANAR represents a quiet shift in how blockchains should be evaluated. Instead of asking how many features a chain supports, the more important question is whether it fits the direction digital behavior is already moving. Users are congregating inside applications. Liquidity is becoming utility driven. AI agents are transitioning from experiments to operators. VANAR does not promise that these things will arrive someday. It assumes they are already here and builds accordingly. That assumption may turn out to be its strongest advantage.