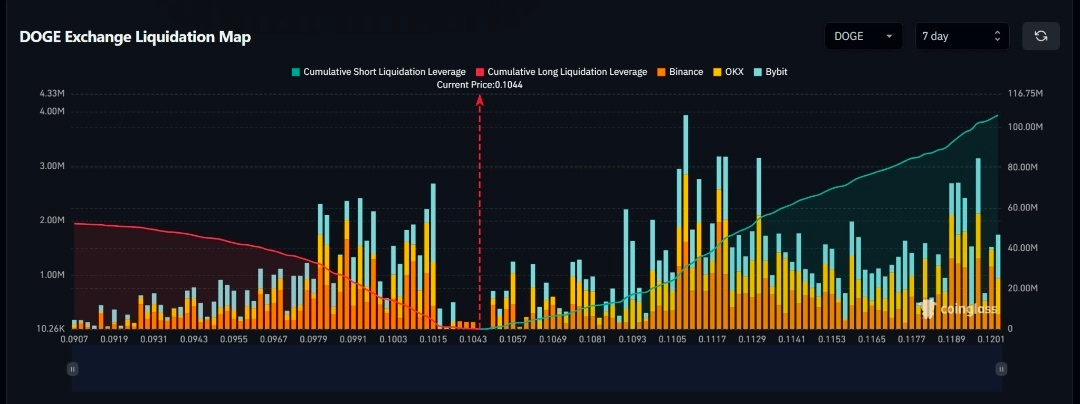

📊 $DOGE — 7-Day Liquidation Map

Index ~0.1044

🔎 Quick Overview

Price is currently sitting near a thin liquidity pocket, which means volatility can expand quickly once direction is chosen.

Below price (long liquidations):

0.1015–0.1003 → 0.1003–0.0991 → 0.0991–0.0979 → 0.0967–0.0955

Deeper sweep: 0.0943–0.0931 → 0.0919–0.0907

Above price (short liquidations):

0.1057–0.1069 → 0.1081–0.1093 → 0.1093–0.1117 → 0.1129–0.1141

Further extension: 0.1153–0.1165 → 0.1177–0.1189 → 0.1189–0.1201

🧭 Higher-Probability Path (Bullish Bias if Pivot Holds)

If price holds or reclaims 0.1043–0.1057, momentum favors a push higher:

Break through 0.1081–0.1093

Short squeeze potential at 0.1093–0.1117

Continuation toward 0.1129–0.1141

Strong follow-through could extend to 0.1153–0.1165, then 0.1177–0.1189

🔁 Alternate Path (Bearish Scenario if Pivot Fails)

If price loses 0.1043–0.1057, downside liquidity becomes the magnet:

Initial fade into 0.1015–0.1003

Continuation toward 0.0991–0.0979

Further downside at 0.0967–0.0955

Deeper sweeps may tag 0.0943–0.0931, even 0.0919–0.0907

📌 Key Navigation Levels

Pivot zone: 0.1043–0.1057

Bull confirmation: Strong closes above 0.1093–0.1117 (ideal acceptance: 0.1129–0.1141)

Support reactions:

0.1015–0.1003 · 0.0991–0.0979 · 0.0967–0.0955

(Lower: 0.0943–0.0931 · 0.0919–0.0907)

Resistance levels:

0.1081–0.1093 · 0.1093–0.1117 · 0.1129–0.1141

(Higher: 0.1153–0.1165 · 0.1177–0.1189 · 0.1189–0.1201)

---

⚠️ Risk Notes

Liquidity is thin around spot, so expect sharp moves and fakeouts.

Best setups are break-and-retest plays around the pivot, with tight risk control.

Above ~0.1177, consider trailing stops — liquidity thins quickly and range expansion can accelerate fast.