Blockchain promised transparency.

Institutions demanded compliance.

Users asked for privacy.

For years, these three ideas have clashed.

Public blockchains expose everything. Privacy chains hide too much. Regulators remain uncomfortable. Enterprises stay on the sidelines. And everyday users are stuck choosing between convenience and confidentiality.

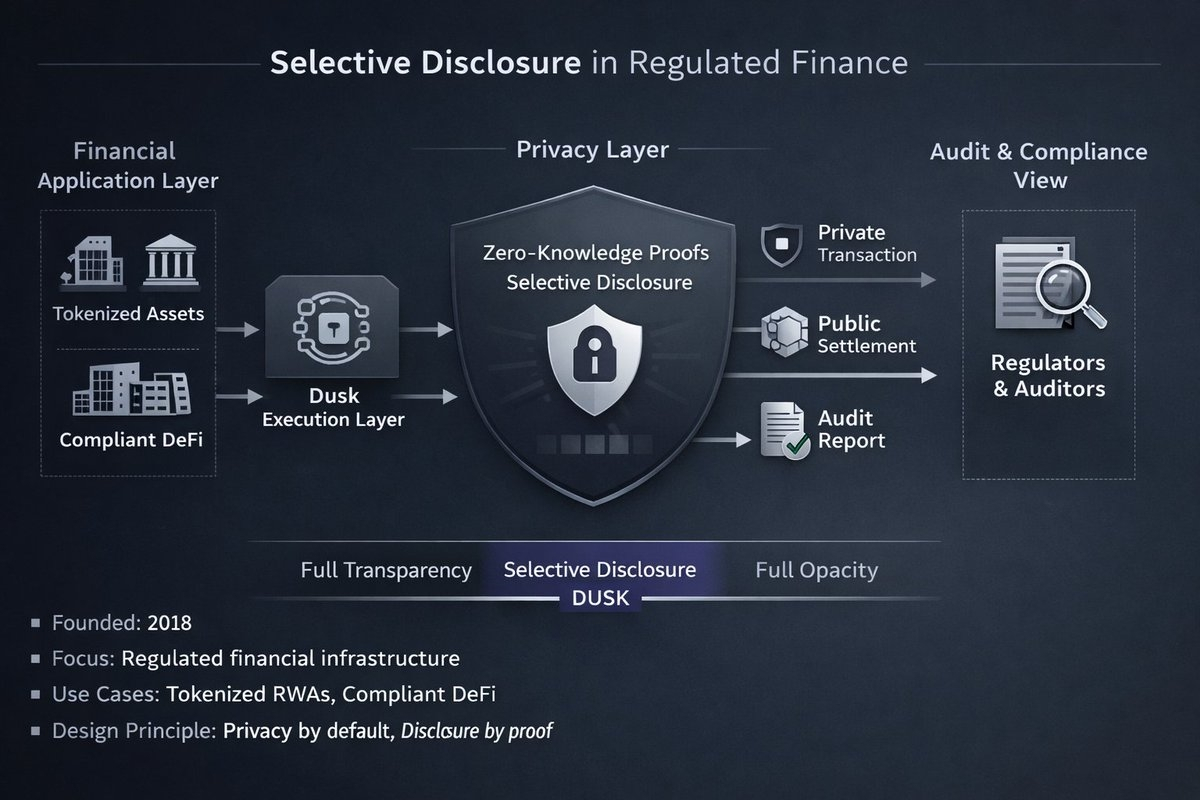

@Dusk is attempting something far more ambitious: creating infrastructure where privacy, transparency, and regulation coexist.

Not as compromises but as complementary design principles.

At the center of this effort sits $DUSK, a blockchain ecosystem focused on selective disclosure and privacy-preserving identity. Instead of treating privacy as an all-or-nothing feature, Dusk introduces controlled visibility where users decide what to reveal, when to reveal it, and to whom.

This approach quietly reshapes how digital finance, identity, and asset ownership can function.

Why Traditional Blockchain Privacy Falls Short

Most existing blockchains follow one of two models.

The first is full transparency. Networks like Ethereum make every transaction publicly visible. Anyone can trace balances, interactions, and wallet histories. While this supports auditability, it completely ignores personal and institutional privacy needs.

The second model is full anonymity. Some privacy-focused networks obscure everything by default. While this protects users, it creates serious problems for compliance, enterprise adoption, and regulated financial products.

Neither approach fits the real world.

Banks, funds, and enterprises cannot operate on systems where all activity is public. Regulators cannot accept systems where nothing can be verified. Users should not have to expose their financial lives just to use decentralized applications.

Dusk takes a third path.

Selective Disclosure: Privacy With Control

Selective disclosure is the cornerstone of Dusk’s architecture.

Instead of broadcasting every detail, Dusk allows sensitive information to remain private while still enabling verification when required.

In practical terms, this means:

Transactions can remain confidential

Identities stay private by default

Users can prove compliance without exposing personal data

Institutions can audit activity without revealing everything publicly

Think of it as “privacy with permissions.”

A user may prove they meet regulatory requirements without revealing their full identity. A company may confirm transaction validity without exposing internal financial flows. A regulator may receive access to specific records without opening the entire ledger.

This creates an environment where trust is maintained without sacrificing confidentiality.

Privacy-Preserving Identity: Ownership Returns to the User

One of Dusk’s most important innovations lies in identity.

Traditional digital identity systems are centralized. Personal data lives in databases controlled by corporations or governments. Breaches are common. Users have little control. Data is reused endlessly.

Dusk flips this model.

With privacy-preserving identity, individuals hold their credentials themselves. Instead of handing over documents repeatedly, users provide cryptographic proofs that confirm specific attributes:

Age eligibility

Jurisdiction

Accreditation status

Compliance approval

No raw personal data is exposed.

This is self-sovereign identity in practice — where users own their credentials and reveal only what’s necessary for each interaction.

For institutions, this simplifies onboarding while reducing data liability. For users, it restores control.

Phoenix and Zedger: Privacy Meets Financial Infrastructure

Dusk’s privacy model is not theoretical. It’s implemented through purpose-built transaction frameworks designed for financial use.

Phoenix enables confidential transfers that can still be validated by the network. Transaction amounts and participant details stay hidden, while cryptographic proofs guarantee correctness.

Zedger extends this further into tokenized financial instruments.

With Zedger, institutions can issue and manage digital securities while maintaining privacy and compliance. It supports features such as restricted ownership, dividend distribution, governance rights, and regulated transfers all without exposing sensitive market data.

This is critical for real-world assets.

Stocks, bonds, and funds cannot operate on fully transparent ledgers. Dusk provides infrastructure where these instruments can exist on-chain without violating privacy or regulatory expectations.

Measuring Success: What Has Dusk Achieved So Far?

Dusk’s progress can be measured across several dimensions.

Technical Maturity

Dusk has moved beyond experimental privacy concepts into formally verified systems. Its cryptographic models have undergone rigorous validation, providing confidence that privacy guarantees are not merely assumed they are mathematically proven.

This places Dusk among a small group of blockchains with deeply engineered privacy foundations.

Institutional Alignment

Rather than targeting purely speculative use cases, Dusk has positioned itself for regulated environments.

Its architecture supports compliance, reporting, and auditing without compromising confidentiality. This attracts interest from financial institutions exploring tokenization, settlement systems, and digital securities.

Instead of fighting regulation, Dusk designs for it.

Practical Use Cases

Dusk’s infrastructure supports:

Tokenized securities

Confidential DeFi

Private asset transfers

Identity-based access systems

Institutional settlement flows

These are not abstract concepts. They represent real applications where privacy is mandatory rather than optional.

What Dusk Is Working on Next

While current achievements are significant, Dusk’s roadmap focuses heavily on efficiency, scalability, and utility.

Improving Performance

Privacy systems are computationally heavy. Dusk continues optimizing proof generation and verification to reduce transaction latency and increase throughput. The goal is to make private transactions feel as seamless as public ones.

Speed matters for adoption.

Expanding Developer Access

Dusk is actively improving tooling, documentation, and developer environments to lower the barrier for building privacy-enabled applications. Support for familiar programming models allows more builders to create on Dusk without becoming cryptography experts.

A broader developer base means faster ecosystem growth.

Scaling Real-World Asset Infrastructure

Dusk aims to become a foundational layer for tokenized real-world assets. This includes enhancing settlement systems, custody integrations, and identity frameworks so institutions can operate fully on-chain.

The vision is a privacy-first financial network where assets move globally with compliance embedded directly into smart contracts.

Where $DUSK Fits In

$DUSK powers the entire ecosystem.

It secures the network, pays transaction fees, supports staking, and aligns incentives across validators, developers, and users. As privacy-enabled applications grow, DUSK becomes increasingly embedded in real economic activity.

Its value is tied not just to speculation but to infrastructure usage.

Final Thoughts

Dusk Foundation is not trying to build another hype-driven blockchain.

It is solving one of crypto’s hardest problems: how to combine privacy, compliance, and decentralization in a way that works for real institutions and real users.

Selective disclosure allows transparency when needed. Privacy-preserving identity returns ownership to individuals. Confidential smart contracts enable financial products that respect both regulation and confidentiality.

This is not flashy innovation.

It is foundational innovation.

As digital finance matures, projects like Dusk will likely define the next phase of blockchain adoption where privacy becomes standard, compliance becomes native, and users regain control over their data.

Dusk isn’t chasing trends.

It’s quietly building the rails for the future of private, regulated, on-chain finance.