@Dusk When people talk about SME financing, they often speak as if the challenge is mainly about “access to capital.” In practice it feels more like access to patience. A small company can be healthy, growing, even profitable, and still be treated like an administrative burden. The ticket size is too small for heavyweight processes, and too complicated for lightweight ones. Founders learn this the hard way: the deal isn’t rejected because the business is bad, but because the cost of verifying the business is high, the legal overhead is slow, and the information the company must reveal to earn trust is often the same information that makes it vulnerable.

This is why the idea behind Dusk’s SME tokenization narrative lands differently than a generic “put it on-chain” story. Dusk has been consistent about one premise: regulated finance does not move at scale if everything is broadcast to everyone. The real world demands proof, but it also demands discretion. So the network is built around the tension most systems try to avoid—how to let value move with strong guarantees while keeping sensitive details from becoming public entertainment. That isn’t a moral statement. It’s an operational one.

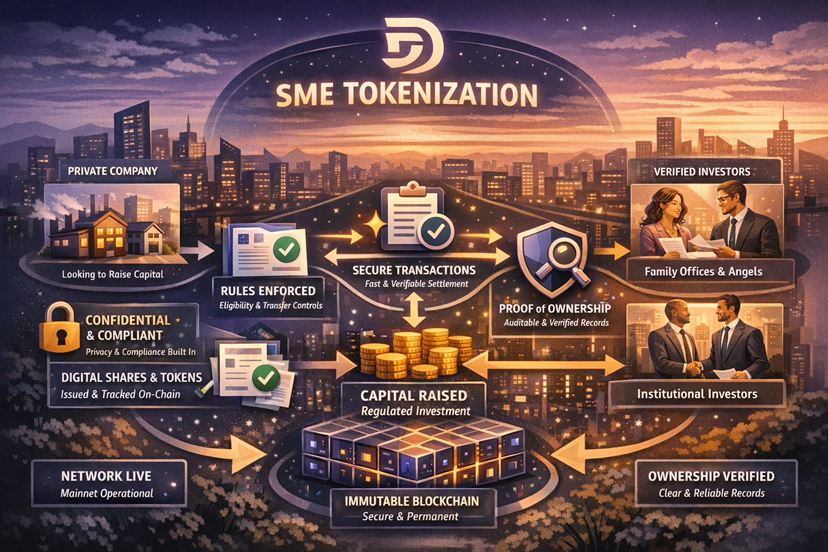

If you zoom in on what SMEs actually need, it’s rarely exotic. They need a way to raise money without turning their cap table into a rumor mill. They need ownership records that do not depend on a single spreadsheet and a single person being careful forever. They need transfer rules that reflect legal reality—who can buy, who can hold, who can receive, under what conditions—without making every transaction a bespoke legal project. Dusk’s framing of tokenization for SMEs points directly at these frictions: the security itself can be issued in digital form, moved under constrained rules, and tracked with continuity, instead of being represented by a stack of documents that always needs reconciliation.

What makes this relevant now is that private markets have grown up, but their tooling often hasn’t. SMEs increasingly operate in cross-border contexts: suppliers in one jurisdiction, customers in another, investors scattered across networks of family offices, angels, and strategic partners. Meanwhile, financing has become more cautious in many places, and when caution rises, documentation demands tend to rise with it. The irony is painful. The moment a business needs speed and flexibility, the system often responds with longer checklists and slower cycles.

Dusk’s bet is that some of this slowness is not a law of nature. It’s a product of how records are maintained and how trust is constructed. The story is not that tokenization replaces judgment. It’s that it can reduce the waste around judgment. When ownership and transfer restrictions live inside the same system that settles transfers, you reduce the surface area for clerical mistakes, duplicated checks, and “we’ll update the register later” workflows that create disputes. For SMEs, disputes are not academic. A messy ownership record can kill a future round, spook a bank, or turn an acquisition into a months-long negotiation about what is even being bought.

There is also a quieter human angle that rarely gets talked about: confidentiality is not only about hiding wrongdoing. It is about preserving negotiating power and emotional stability.When a small business is raising money through a convertible note, revenue-based deal, or a small equity round, it usually doesn’t want its valuation, cash runway, or investor list shown to everyone. If that information becomes public, competitors react differently, staff get uneasy, suppliers push harder, and the founder loses sleep. Dusk’s identity as a privacy-oriented regulated-finance network matters here because it is trying to make confidentiality a first-class property rather than a workaround. The psychological difference between “this is private by design” and “this is public unless we do something clever” is enormous once money is real and relationships are fragile.

In Dusk’s own SME tokenization discussion, the promise is not instant liquidity or frictionless fundraising. It’s a more disciplined lifecycle for private securities. The words sound simple, but the implications are heavy: issuance that can be tracked; transfers that can be limited to eligible investors; ownership that can be proven without revealing everything; and a system where compliance is not an afterthought stapled onto a public ledger. If you have ever watched a small company try to onboard a regulated investor, you know the pain isn’t only legal. It’s operational. Everything becomes a chain of emails and attachments and repeated identity checks, and the same information is re-entered in multiple places. That repetition is where errors breed.

Progress matters because SMEs cannot be early adopters of shaky infrastructure. They can tolerate some novelty, but they cannot tolerate uncertainty about finality, continuity, or whether the “system” will still exist when a dispute arises. Dusk’s mainnet rollout milestones—activation in late 2024 and the first immutable block in early January 2025—are not marketing trivia in this context. They are the kind of dates that signal the network is moving from “idea” into “operating environment.” SMEs, especially those courting professional investors, need to be able to point to something concrete: this network is live, this is the moment it became irreversible, this is the base we are relying on.

Of course, tokenization can also introduce new risks if it is handled carelessly. The most obvious one is false confidence: assuming that because a record is digital, it is automatically correct. If onboarding is sloppy, you can still put the wrong person on the cap table—just faster. If issuer controls are weak, you can still create governance confusion—just with better-looking interfaces. So a serious SME path has to be built around process discipline, not just technology. That is where Dusk’s “regulated finance” posture becomes more than a slogan. It implies a system designed to support the boring requirements: clear roles, verifiable states, controlled disclosure, and the ability to satisfy scrutiny without turning privacy into a casualty.

The real long-term value, if Dusk’s approach works, is not that SMEs become “crypto companies.” It’s that SMEs gain an issuance and ownership layer that behaves more like modern infrastructure: composable, consistent, and less dependent on manual reconciliation. Over time, that changes the economics of small raises. When the overhead falls, more deals become worth doing. When records are cleaner, diligence becomes less adversarial. When transfers can be constrained without being opaque, more regulated capital can participate without demanding that the company expose its internal life to the entire market.

I find the most compelling part of this story is how ordinary it is. It isn’t about chasing a new narrative. It is about taking the everyday pain of private company financing—slow cycles, fragile trust, invasive transparency, administrative drag—and treating those as engineering problems with human consequences. Dusk’s SME tokenization angle is, at its heart, an attempt to make financing feel less like a cliff edge and more like a structured path: you can raise, record, transfer, and prove ownership while keeping sensitive details protected and compliant expectations intact.

This doesn’t mean tokenization will solve every funding challenge for SMEs. A business still lives or dies by demand, cash flow, and trust. What Dusk is aiming for is more realistic: make funding less exhausting by reducing the unnecessary steps that waste time and energy.If it succeeds, the biggest change won’t be a flashy new market. It will be the quiet relief of founders and investors spending less time wrestling with paperwork fear, and more time making real decisions with records they can trust.