ETFs (Exchange Traded Funds) are financial products that are traded on stock exchanges such as the NYSE and ASX, just like other stocks. However, ETFs are not assets themselves. Instead, they are investment funds whose value is linked to an underlying asset.

For Example, if you buy a Bitcoin ETF, it does not mean that you are buying Bitcoin directly. Rather, you are purchasing shares of a fund whose price is tied to the market value of Bitcoin. If the price of Bitcoin increases, the value of your ETF investment increases as well, and if Bitcoin’s price falls, the value of the ETF decreases accordingly.

ETFs are traded in the open market and do not require you to hold any physical asset. You do not need to visit a jeweler to buy gold or use a crypto exchange to invest in Bitcoin. All you need is a trading account, which allows you to gain exposure to these assets without directly owning or storing them.

Gold And Bitcoin ETFs initiative and The Price Impact.

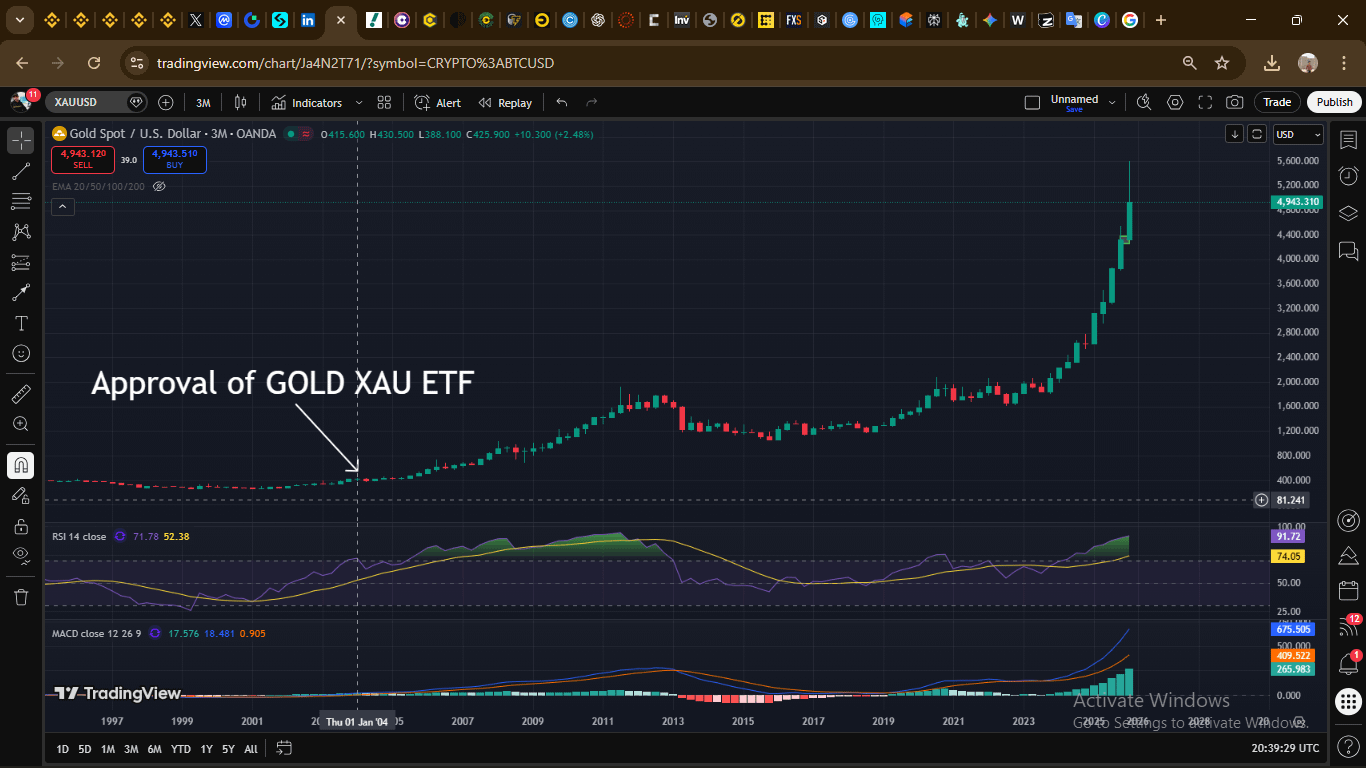

The first Gold ETF was launched in 2003 on the Australian Stock Exchange (ASX), and in 2004 it received approval to trade in the United States on the NYSE.

During the time of launching the price of Gold $XAU was near $400-$500 per ounce and now it has made an ATH near $5600. And it has never got drop near the price on which ETFs was initiated. Or we can say that the actual bullish rally was started after the ETFs approval and it is still continue since last 2 decades.

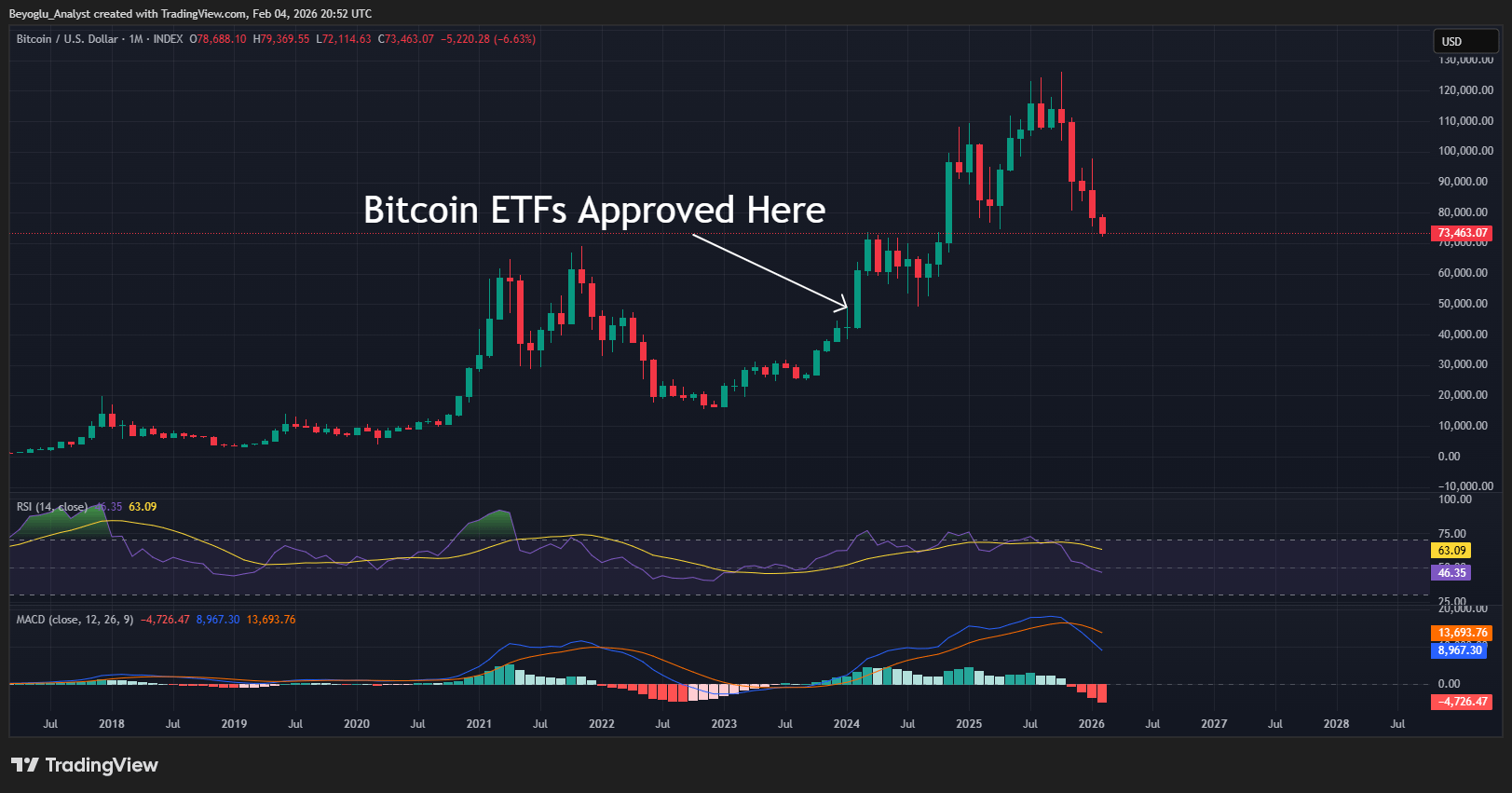

The Spot Bitcoin ETFs got approved in 2024 the price of $BTC was near $42,000, and the Previous all time high was $73,000.World largest firms like BlackRock and Fidelity filed for the approval of Bitcoin ETFs. Bitcoin Breakout the all time high just in 2 months the bitcoin bullish rally keep continue in 2025 and it made an all time high at $126,000. The Price went x3 just in a year after the approval of ETFs.

If you think that the Bitcoin Bullish rally has been end then you may be misjudging the ETFs. The Bitcoin Bullish rally is just begin long term investor are really target $1M Bitcoin.

P.s: Not a financial advice.