@Plasma is a Layer 1 blockchain tailored for stablecoin settlement, which is a fancy way of saying it treats “moving digital dollars reliably” as the main job, not a side quest. Instead of assuming every transaction is a speculative trade, it assumes the thing being sent is a unit of account that a business actually depends on. That single assumption changes what matters: predictable costs, clean confirmation, and settlement that feels closer to payments plumbing than crypto culture. Plasma’s public positioning leans hard into USD₮ payments at scale and a design built around stablecoins rather than generalized activity.

Now look at what happened on January 22, 2026: Confirmo, a payments processor that says it handles $80M+ in monthly volume for 800+ enterprise clients, announced a partnership with Plasma to enable “zero gas fee” stablecoin payments for its merchant base.That’s the kind of detail that matters for the “merchant adoption” conversation, because it reframes the question. It’s not “will merchants someday use stablecoins?” It’s “what makes a mature payments company bother integrating a new rail right now?”

The answer is that e-commerce is a margin business disguised as a growth business. When everything is going well, the friction in payments is annoying but tolerable. When conditions tighten—higher acquisition costs, more fraud, more cross-border sales pressure—that same friction turns into a direct threat to unit economics. And traditional rails have friction baked in: card networks, acquirers, FX spreads, settlement delays, dispute processes. None of it is evil; it’s just heavy. It was built for a different era of commerce.

Cross-border is where the pain becomes visible. Fees stack in ways that are hard to explain to a non-payments person without watching their expression change. A cross-border fee alone can be around 2% on top of agreed transaction fees in some setups, before you even talk about currency conversion spreads or other layers.If you’re a large merchant selling globally, two percent isn’t a rounding error. It’s the difference between “we can afford to ship this category” and “we can’t.” In that context, the idea of a stablecoin rail that can settle quickly with very low incremental cost becomes less like a crypto experiment and more like an operational lever.

Fraud and disputes add a different kind of pressure. Chargebacks aren’t just lost revenue; they’re time, overhead, and a constant sense that you’re one bad week away from a platform risk review. Industry reporting around 2024–2025 highlights rising dispute pressure and the compounding cost of chargebacks and fraud for merchants. A stablecoin payment doesn’t magically solve fraud—nothing does—but it changes the shape of the problem. A card payment is designed to be reversible under a dispute framework. Stablecoin settlement is designed to be final. That finality can be scary if you treat it like a card replacement, but it can be calming if you treat it like a new category: a push payment rail where policies, customer education, and risk controls are designed accordingly.

This is where “rails” start to matter more than “coins.” Merchants don’t wake up wanting stablecoins. They wake up wanting fewer failure states: fewer mysterious declines, fewer days waiting for settlement, fewer surprise fees, fewer cross-border headaches, and fewer nights spent arguing with a payments stack that feels like a black box. The reason Confirmo is an important datapoint is that it sits between crypto and normal commerce. It describes itself as a stablecoin payment platform serving enterprises across e-commerce and other operational sectors, and it’s explicitly integrating Plasma to make networks more efficient for those clients.That’s not a hobby integration. It’s a business response to business demand

The “why now” part is also about stablecoins themselves becoming too large to ignore. USDT’s scale is no longer niche; in early January 2026, CoinMarketCap’s historical snapshot shows USDT market cap around $187B. When a digital dollar instrument reaches that kind of scale, it stops being a curiosity and starts behaving like a parallel liquidity layer that merchants and payment providers can tap into—especially for cross-border flows where the legacy experience still feels slow and fee-heavy.

At the same time, there’s a subtle cultural shift happening: stablecoins are increasingly discussed as payments infrastructure rather than trading collateral. Mainstream financial coverage has been focusing on the tug-of-war over stablecoins’ role in the future of money, with regulation and banking politics heating up. You don’t have to pick a side to see what that does to merchant decision-making. When stablecoins move from “unregulated corner of the internet” to “front-page policy debate,” risk teams start paying attention. Payment firms start preparing. Big merchants start asking their providers, quietly at first, “What’s our stablecoin plan if customers want it, or if payouts get easier, or if cross-border becomes cheaper?

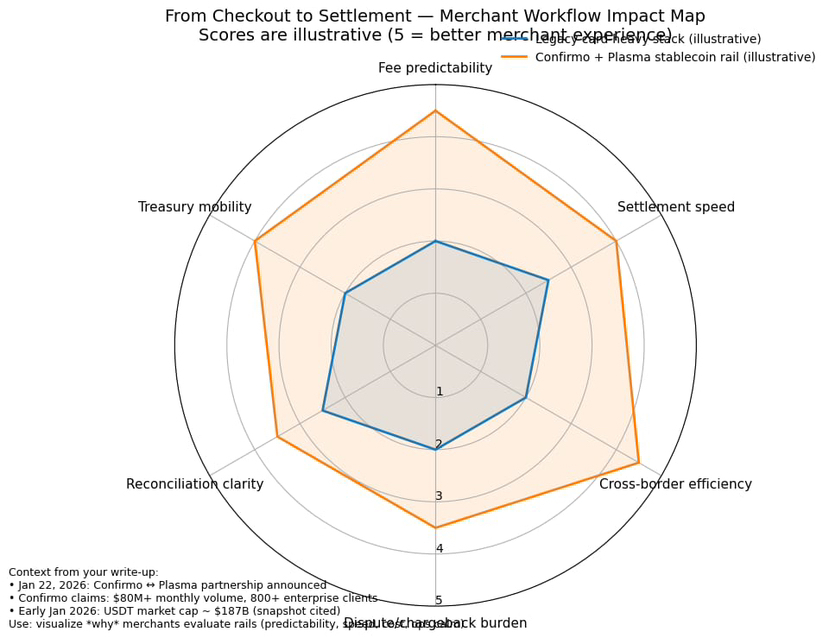

So why Plasma’s “Confirmo rails” specifically? Because the merchants who matter at scale rarely want to be first to build brand-new payment plumbing from scratch. They want to plug into someone they already trust. Confirmo already runs a sizable volume and has a merchant base; Plasma is positioning itself as purpose-built stablecoin payments infrastructure. Put those together and you get something closer to what e-commerce giants actually evaluate: not a chain, but an end-to-end flow. What happens at checkout. How confirmations are handled. How refunds are handled. How accounting sees it. How reconciliation works when thousands of payments hit per hour. How treasury moves funds out to vendors or payroll. The “rail” is the boring part, and boring is exactly what merchants want.

There’s also a psychological detail that people underestimate: fee predictability changes behavior. When fees are volatile, teams build defensive policies. They throttle markets, restrict payment methods, or add buffers that customers feel as friction. Plasma’s messaging emphasizes fee-free or very low fee USD₮ transfers and payment-oriented design choices, and Confirmo is explicitly framing the Plasma partnership around enabling “zero gas fee” stablecoin payments for clients. Whether the exact economics remain stable over time is something merchants will watch closely, but the direction is the point: reduce the “surprise tax” on usage that makes commerce teams anxious

None of this means e-commerce giants are about to flip a switch and abandon cards. Cards are deeply embedded, and customers love what’s familiar. The more realistic story is layering.Stablecoins work best as an extra payment route for what they already do well: sending money across borders, paying vendors, handling business payments, and serving customers who already keep stablecoins. If the process gets easy enough, they can slowly move up into everyday checkout in some regions and product types.

The conclusion is less dramatic than people want, but more important than people realize. Merchant adoption happens when a new rail is not merely cheaper, but operationally calmer. Confirmo’s partnership announcement gives a rare concrete datapoint—real volume, real enterprise client count, a dated integration narrative—that suggests stablecoin payments are moving from “idea” to “implementation” inside existing merchant infrastructure. Plasma is trying to meet merchants where they actually live: in settlement, reconciliation, and cost control, not in crypto novelty. If e-commerce giants are looking at these rails, it’s because the old stack still works—but it works with a kind of friction that feels increasingly out of place in a world where digital dollars can move in one atomic step.