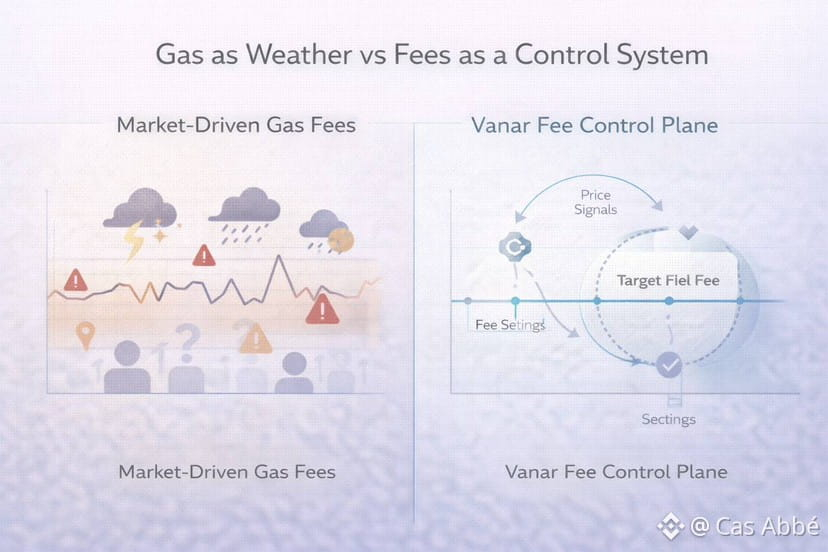

The majority of blockchains are managed in a similar manner to the weather: Sometimes it is not stormy, sometimes it rains down and everybody simply manages to handle it. Vanar takes a different path. It approaches transaction pricing as an engineered system no meme, no market accident, but a control loop.

That is very boring, yet it is one of the most difficult issues with crypto. At times when charges have gone crazy, micro-payment transactions fail, subscriptions fail, and even basic consumer applications are a stressful affair in terms of finances. Then rather than just emphasizing on low prices, the question that arises is, how does Vanar maintain the same fees without deceiving users?

It is the point at which Vanar begins to resemble less precisely like a typical Layer-1 and more like an operating system of on-chain expenditures.

The reason why we do not have a slogan such as predictable fees is because it is a protocol job.

Most chains will assure you low fees when the network is not in use but when demand is high or the price of tokens is fluctuating, the issue emerges. Even a cheap network can be costly when the price of the gas token shoots up or when the network becomes congested triggering bidding wars.

Vanar aims at a fixed fee in fiat currency and adapts the settings of the internal fees of the chain based on the market price of VANRY. Vanar (in its documentation) defines a mechanism that will charge users a predetermined fiat value per transaction by updating pricing on the protocol level, rather than relying on a live auction market.

That changes the message of hope fees remain low to the protocol actually attempts to ensure fees remain low.

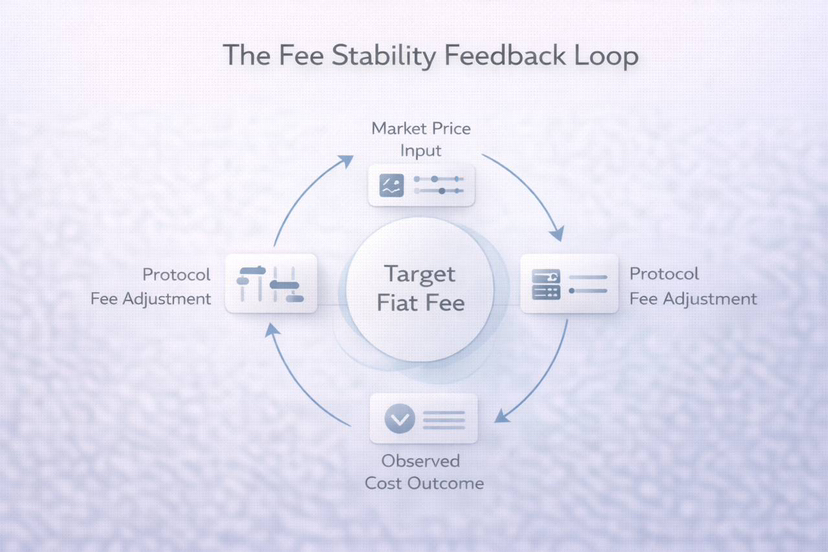

The greatest detail: Vanar updates fees as a loop, and not a one-time parameter.

Feedback is needed on stable prices. According to the docs of Vanar, the workflow would consist of having the protocol check the price of VANRY in a regular frequency and change fees frequently, with changes occurring every several minutes, and checks being based on block cadence.

This is a large conceptual dissimilarity. It is a mechanism that uses a thermostat logic: a signal (price of tokens) is read and a parameter (setting of fees) is manipulated to ensure a desired outcome (stable fiat fee). That is what a control plane is all about.

It also gives the reason why the story about fees by Vanar is not merely marketing. They put it in print on how it works, not how it feels.

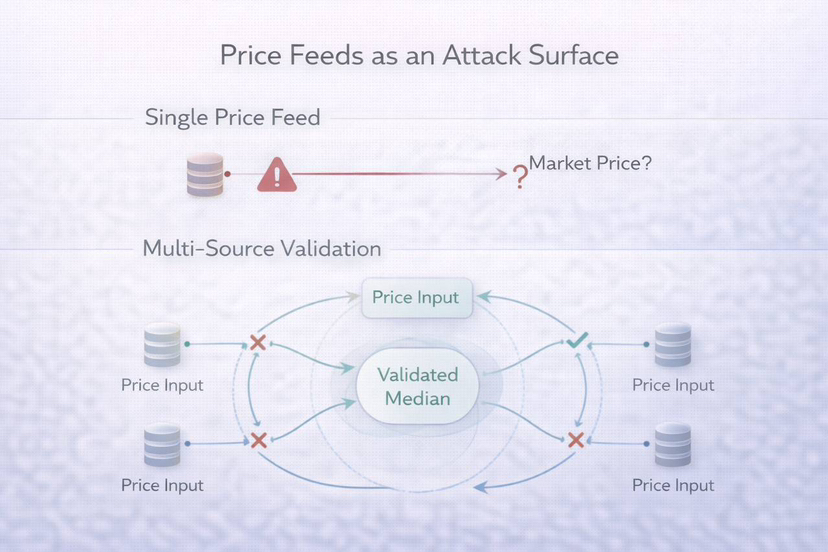

The subactive struggle with manipulation is multi-source price validation.

The fixed-fee model is as good as its input in terms of pricing. Mispricing of fees will occur in case of a misaligned price feed. When the feed can easily be manipulated, the attackers have the ability of pushing the fee model off balance.

This is an obvious incentive, both to fool a chain into believing that the gas token is more or less valuable than it actually is, and to potentially pay less money than you would when required or even to upset the economics of the network.

Vanar specifically talks about how the market price is substantiated using various sources such as centralized exchanges, decentralized exchanges as well as common market data providers. According to the docs, there are such sources as CoinGecko, CoinMarketCap, and Binance, which are used as a part of a multi-source validation solution.

This is not a small detail. It is Vanar acknowledging the ugly reality, price is an attack surface, which is answered with redundancy and cross-checking.

FeePerTx: a protocol truth and not a UI number.

The alternative cautious decision is to put the information of fee directly in the protocol data. In his documentation, Vanar specifies that the tier-1 transaction fee is recorded in the block headers in a key.

Why does this matter? Since it shifts cost off what the UI says is the case today to a network-level fact which can be seen and verified. Deterministic reading of parameters on the fees can be designed by builders. Auditors are able to reason concerning cost rules in the past. Indeed, indexers would be able to recreate precisely what the chain believed to be the right fee at the time.

This technicality has a straightforward effect; it will lead to less ambiguity.

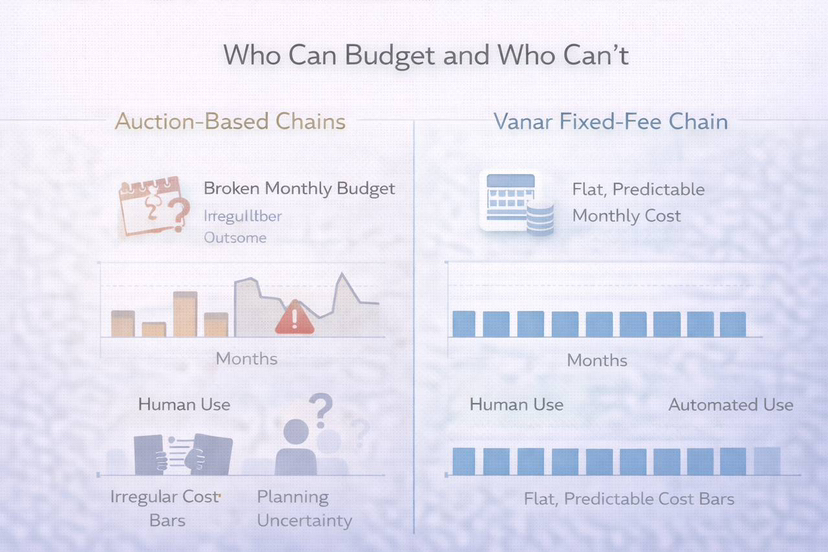

This is where Vanar is payable to machines, and not only people.

Uncertainty is a toleration by humans, as we are in a position to stop and make a choice. Machines don’t work that way. When an AI agent carries out numerous small actions, it must make predictions comparable to the costs that a business makes of cloud spend.

That is what is more profound in fixed fees as a control loop. It renders the chain machine scale budgetable. Where your actions occur at a rate of one a second, sometimes gas spikes is not a convenience thing, it is a deal killer.

That way, despite what the buzzwords say, Vanar fee control plane is a direct investment in the automated future of the world of frequent, small, and continuous transactions.

No hype, social stability is token continuity.

This is an alternative perspective that one overlooks: economics is not just math. It’s trust.

The VANRY supply model offered by Vanar is closely linked to a continuity tale, a token exchange between TVK and VANRY. The announcement made by Vanar refers to a swap of TVK to VANRY, saying that VANRY was an ERC-20 prior to the migration to the mainnet.

Why does this matter? The fact that token transitions have the ability to shred communities when they feel diluted or need to be reset. Holding a chain that alters the brand, narrative and token simultaneously, one is naturally afraid that insiders will take this point in time to redistribute value.

Vanar attempts to minimize such fear in his swap framing which does not regard transition as replacement but as continuity. It may turn out to be a type of decision which does not cause any long-term damage even though markets may or may not reward it at the moment.

Governance is not mere a forum, it is like a steering wheel.

A control plane can only be brought online in a responsible manner. Vanar has also talked about improving the decision power of token-holders by using efforts like Governance Proposal 2.0 that would enable voting on cost-calibration rules and incentive rules in smart-contracts.

This is related to the fee model. In the case of fee as part of the protocol, governance makes decisions, parameters, thresholds, and update policies, making them actual, political decisions, not crypto drama but actual tradeoffs between users.

The builders want stability, the validators want to have sustainable rewards and the users want to have cheap transactions. These interests should be balanced through the control plane in the long run.

The problem: any control plane may be abused or misinterpreted.

Fixed fee systems are not wizardry. They just substitute one problem set with another.

The auction markets are disorderly and tend to self-correct in a short time as the market is entirely market-oriented. A controlled pricing model should demonstrate the ability to respond promptly to actual volatility and is resistant to manipulation.

This is the reason why Vanar emphasizes on regular updates and multi-source validation. The issue of governance is also critical: the mismatched control loop may lead to strange results, such as fees that do not reflect reality or drift incentives.

The advantage lies in the fact that Vanar does not take those matters as mere opinions, but as engineering problems.

Conclusion: Vanar is attempting to make blockchain expenses act as a service.

Vanar can be thought of today best as an attempt to ensure that on-chain costs are used as a cloud, predictable enough that real products can plan on them, and not only free when idle and costly when used.

To do this, the plane of economic control is needed: protocol-level fee adjustments, strong price verifiability, on-chain fee verifiability, and governance that can guide the system conditions to change. The documentation by Vanar shows the open building of these parts as done by infrastructure teams.

In case Vanar succeeds, it will be worth more than cheap transactions, but only once a chain is built where the cost can be forecastable enough to be treated by a machine, a business, and mainstream applications alike as part of reliable backend infrastructure.