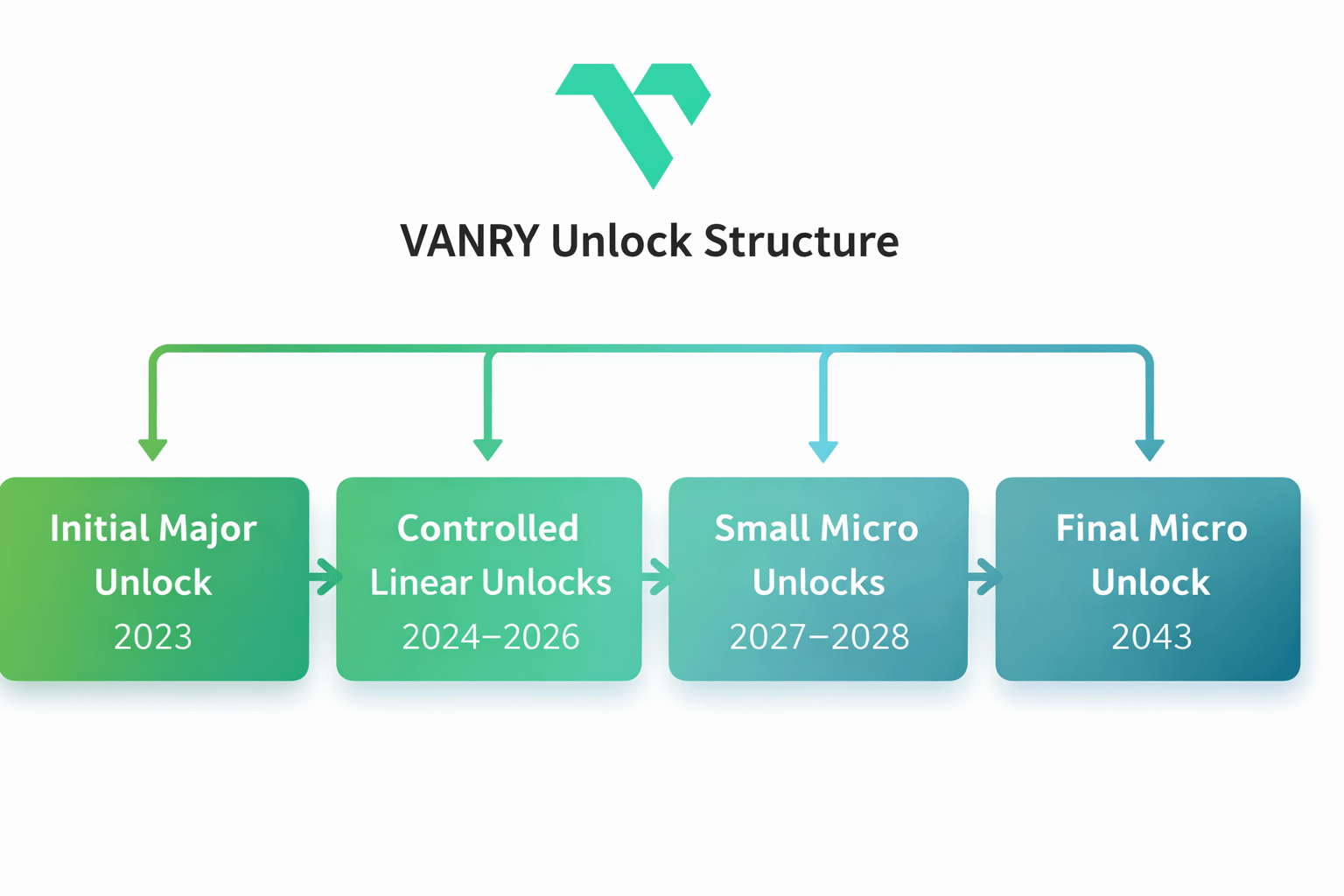

The VANRY unlock schedule has become one of the most important structural elements of the Vanar Chain ecosystem because it shows how supply enters the market, who receives it, and how the distribution aligns with long term incentives. Many people look at token unlock charts and assume danger, but the deeper truth is that unlocks only become a threat when a project lacks growth, demand, or real utility. Vanar Chain is building something fundamentally different, an AI native Layer 1 built around semantic memory, reasoning modules, and intelligent on chain systems. Because of this, the unlock timeline reads more like a controlled release curve rather than a dilution event.

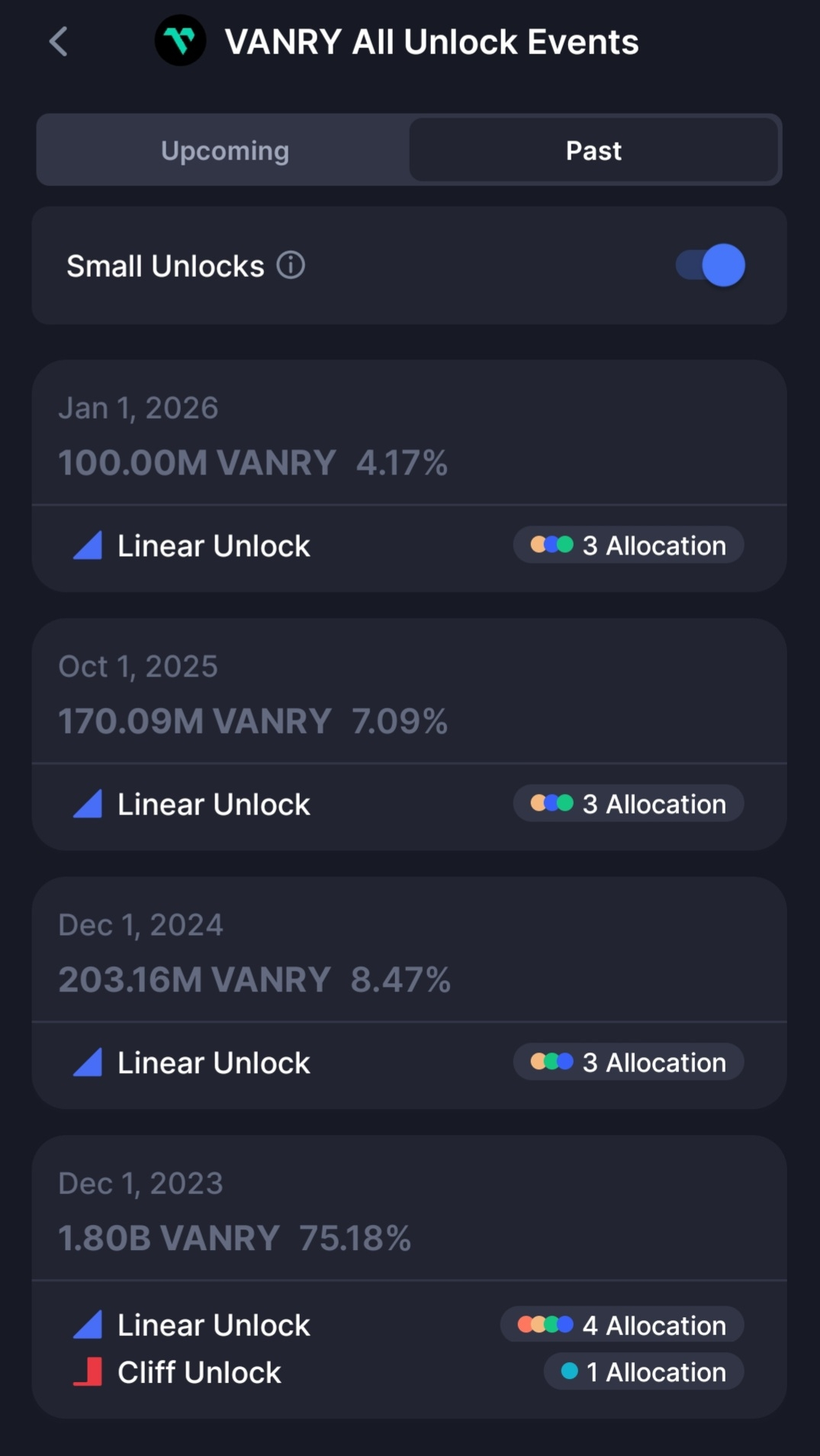

The largest unlock in Vanar’s history already occurred on December 1 2023 when roughly 1.80 billion VANRY entered circulation, accounting for over 75 percent of the total supply at that stage. This early foundational unlock included both linear allocations and a single cliff allocation and marked the initial distribution phase for ecosystem contributors. Although the number was massive, the market absorbed it because Vanar was still in its foundational phase and because early token concentration needed to transition into broader distribution. This was the event that shaped the rest of the supply curve. Once such a large unlock happens early in a project’s life cycle, every unlock afterward becomes significantly smaller and safer.

After that, the following year introduced a more moderate injection. On December 1 2024 a total of 203.16 million VANRY unlocked, representing 8.47 percent of supply. This was fully linear and spread across three allocations. By this time Vanar had started to gain real traction through developer interest, new AI centric updates and increasing visibility across platforms. The unlock passed smoothly with no disruptive market impact, showing that supply pressure is manageable when network demand grows in parallel.

The next unlock on October 1 2025 released 170.09 million VANRY or 7.09 percent of supply. Again this was linear and structured, and came at a point when Vanar’s narrative was strengthening because of its growing AI ecosystem and the progress around Neutron and Kayon. Developers and early adopters had begun to understand that Vanar was not simply another chain but an intelligence oriented network. Predictable unlocks during periods of rising utility typically get absorbed without major price volatility.

Moving ahead the January 1 2026 unlock will release 100 million VANRY, a small 4.17 percent of supply. This marks one of the cleanest unlock windows because by this time Vanar’s usage curve is expected to be significantly higher. Stable emissions are healthier when the ecosystem is expanding, and this unlock sits squarely inside that growth phase.

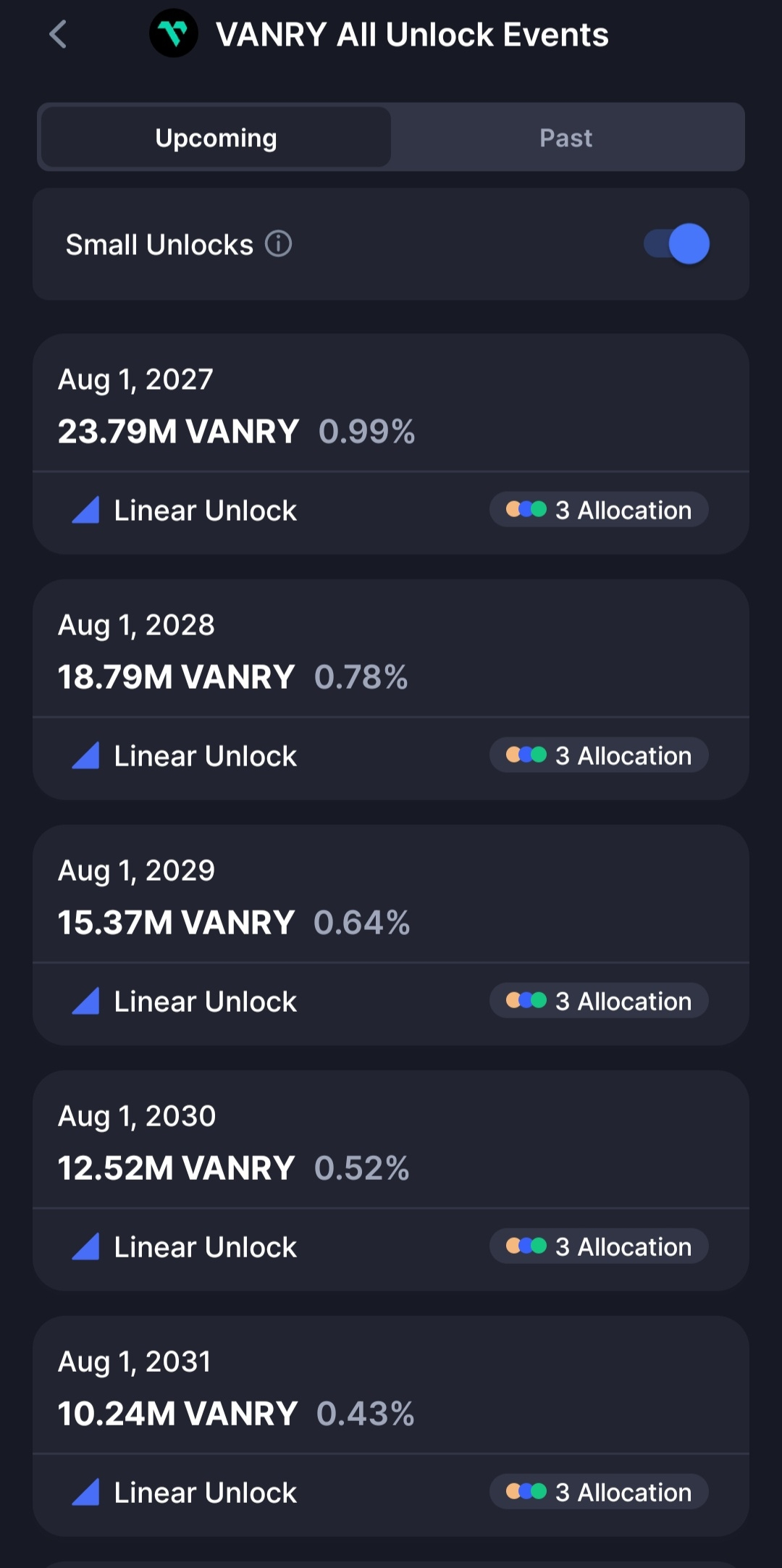

Beyond 2026 the unlock schedule becomes incredibly light. On August 1 2027 only 23.79 million VANRY unlock, representing just 0.99 percent. Then on August 1 2028 only 18.79 million VANRY unlock, which is just 0.78 percent. These are micro emissions that resemble operational emissions rather than major market events. They are predictable, minimal, and aligned with the long term token flow required for a maturing network.

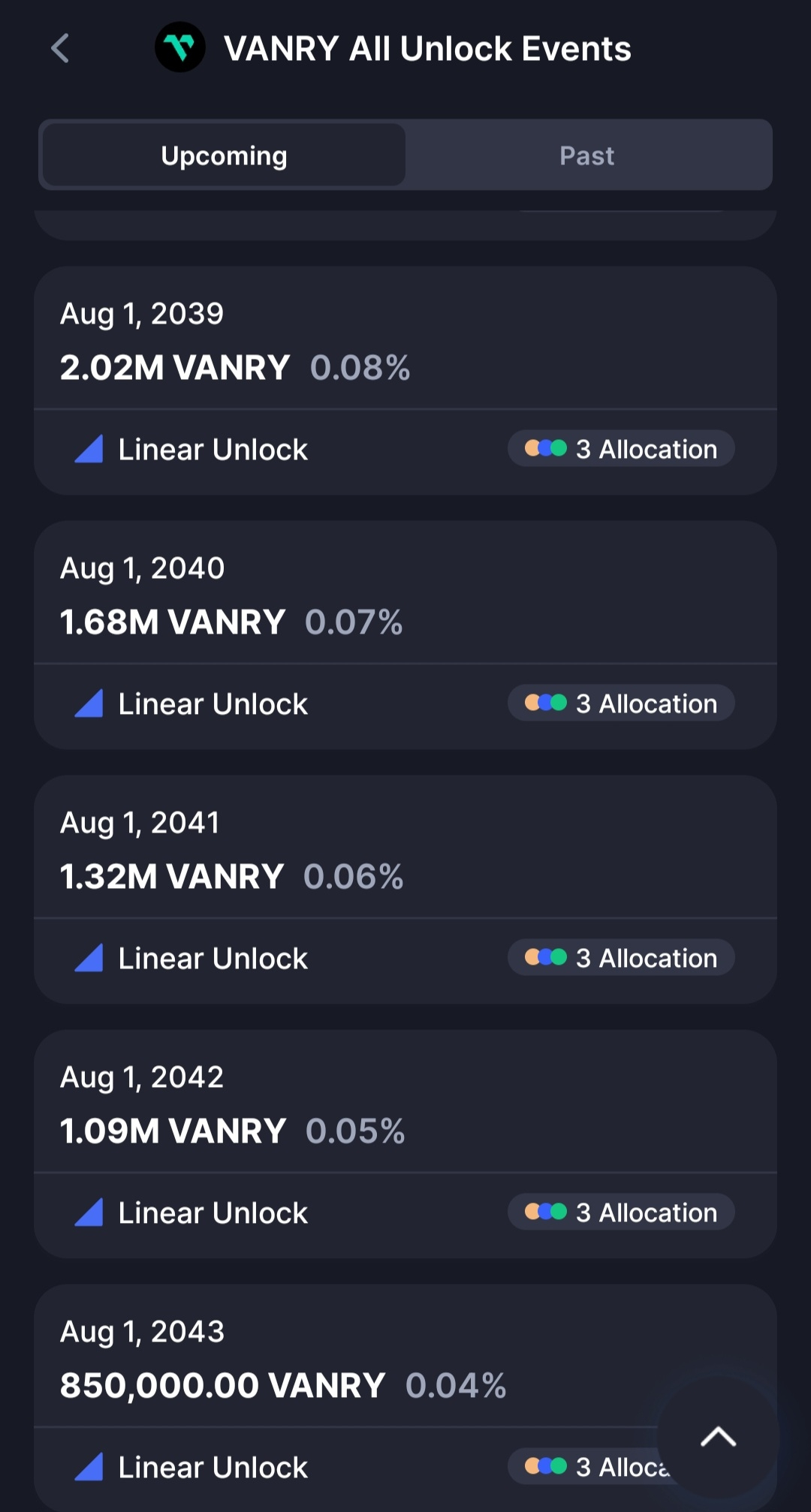

And then comes the final distant unlock, the smallest and least impactful of all. On August 1 2043 only 850,000 VANRY unlock which is a tiny 0.04 percent of supply. This is the type of unlock that barely moves the needle because by that time the network will have matured through multiple adoption cycles, countless applications, and AI driven systems running at scale. A 0.04 percent release is essentially symbolic rather than market moving. Including this final unlock completes the entire timeline, showing how Vanar has designed a long arc of predictable, ultra low emission releases after the initial distribution phase.

Looking at the full unlock schedule from the massive foundational release in 2023 to the micro unlock in 2043 a very clear pattern emerges. Vanar deliberately front loaded the majority of emissions early, allowing the rest of the supply curve to be smooth, tiny, and predictable. This is a strategic design because Vanar is building an AI centric chain that requires long term stability, not sudden supply shocks. When a project expects to scale with real world adoption, enterprise partnerships, and consumer facing AI applications, it cannot afford unpredictable token dynamics.

The real question investors ask is always the same. Does the network grow faster than the supply unlock. For Vanar the answer increasingly leans toward yes. The momentum around semantic memory systems, Neutron’s meaning aware architecture, Kayon’s reasoning layer and the expanding developer ecosystem suggests that usage, demand and on chain activity may outpace the slow unlock curve. When utility becomes the dominant force linear unlocks lose their influence on the market.

Unlocks only matter when fundamentals are weak. Vanar is not in that category. It is building a next generation AI native L1 where meaning, memory and reasoning become part of the chain itself. The unlock timeline reflects this mission because the heavy supply is already behind us while the future unlocks are minimal predictable and aligned with long term growth. With the last unlock not arriving until 2043 and representing only 0.04 percent of supply the supply curve shows maturity rather than risk.