One of the most exhausting parts of using stablecoins isn’t the technology itself. It’s the constant decision-making. Which network should I use? Do I have the right gas token? Is this transaction urgent enough to justify higher fees? Should I wait for congestion to drop? None of these questions have anything to do with money — yet they show up every time you try to move it.

Plasma feels like it was designed by someone who noticed how unnecessary that mental overhead has become.

Instead of assuming users want more control, Plasma seems to assume they want fewer choices. That’s a subtle but important shift. In payments, choice often disguises uncertainty. A system that forces you to think is usually a system that hasn’t decided what it’s for.

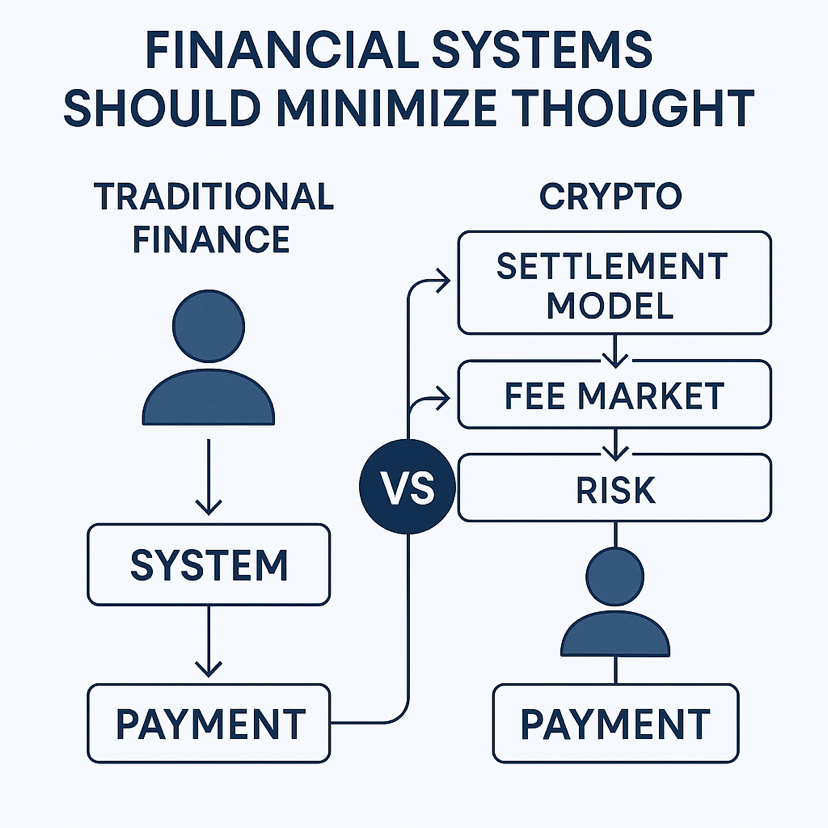

Financial Systems Should Minimize Thought, Not Maximize Options

In traditional finance, most decisions are front-loaded into system design. Users don’t choose settlement models or fee markets every time they pay. They trust the infrastructure to behave consistently. Crypto flipped that model by pushing complexity outward, asking users to actively manage risk with each transaction.

Plasma pushes back on that idea. By treating stablecoins as the default use case rather than an add-on, it removes entire categories of decisions from the user’s hands. Stablecoin transfers behave the same way every time. Fees don’t require forecasting. Finality doesn’t require monitoring. The system decides, so the user doesn’t have to.

That’s not restrictive — it’s relieving.

Why Predictability Feels Like Progress

Plasma’s deterministic finality changes the emotional rhythm of payments. You send. It settles. You move on. There’s no need to check explorers, no “just in case” refresh, no background anxiety about reorgs or delays. That predictability is hard to appreciate until you lose it.

For organizations moving money daily, this matters more than marginal speed gains. Internal processes depend on knowing when something is done, not just that it happened eventually. Plasma’s focus on fast, absolute finality aligns with how accounting systems actually work.

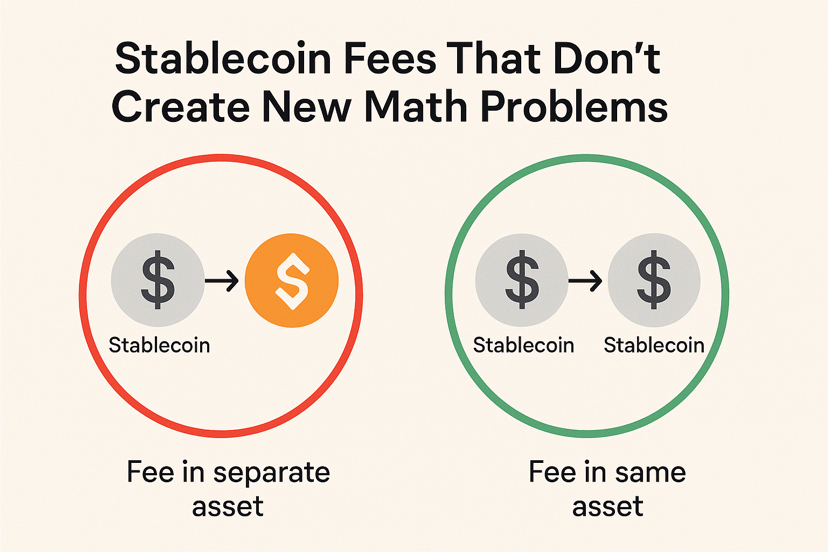

Stablecoin Fees That Don’t Create New Math Problems

Paying fees in a separate volatile asset introduces hidden complexity. It forces users and businesses to track small balances, manage exposure, and reconcile values across units. Plasma’s choice to let fees be paid in stablecoins — and to remove them entirely for narrow, basic transfers — simplifies that mess.

This isn’t about generosity. It’s about alignment. When the unit being transferred and the unit being charged are the same, the system becomes easier to reason about. Less conversion. Fewer surprises. Cleaner records.

Familiar Tools as a Feature, Not a Compromise

Plasma’s EVM compatibility isn’t framed as innovation, and that’s intentional. Reusing known execution environments lowers cognitive and operational risk. Developers don’t need to adapt their mental models. Existing tooling, audits, and practices remain relevant.

In payments infrastructure, novelty is often a liability. Plasma seems comfortable inheriting constraints that others try to escape. That choice makes the system easier to trust, even if it makes it less exciting to talk about.

XPL Exists So Users Don’t Have to Think About It

The role of $XPL fits this broader philosophy. It secures the network and coordinates validators without demanding user attention. Most stablecoin users will never need to interact with it directly. That’s not a flaw. It’s a sign that the system is absorbing complexity instead of exporting it.

Infrastructure works best when its internal mechanics are invisible.

Adoption Through Routine, Not Curiosity

Plasma doesn’t encourage exploration. It encourages repetition. Once a workflow is established — a payroll cycle, a treasury transfer, a settlement loop — it repeats quietly. That kind of adoption rarely shows up as excitement. It shows up as habit.

Habits are powerful. They are also hard to break.

The Quiet Bet Plasma Is Making

Plasma is betting that the next stage of crypto adoption will favor systems that reduce decisions rather than celebrate them. As stablecoins continue to act as real money, the networks supporting them will be judged on how little they demand from users.

If Plasma succeeds, people won’t say it gives them more options.

They’ll say it gives them fewer things to worry about.