Most infrastructure doesn’t fail loudly. It fails quietly, in the spreadsheet. A cost line that cannot be forecast, a settlement that cannot be explained, a user flow that has to be redesigned because conditions changed underneath it. At scale, the story stops being “can it run” and becomes “can we trust it to behave.”

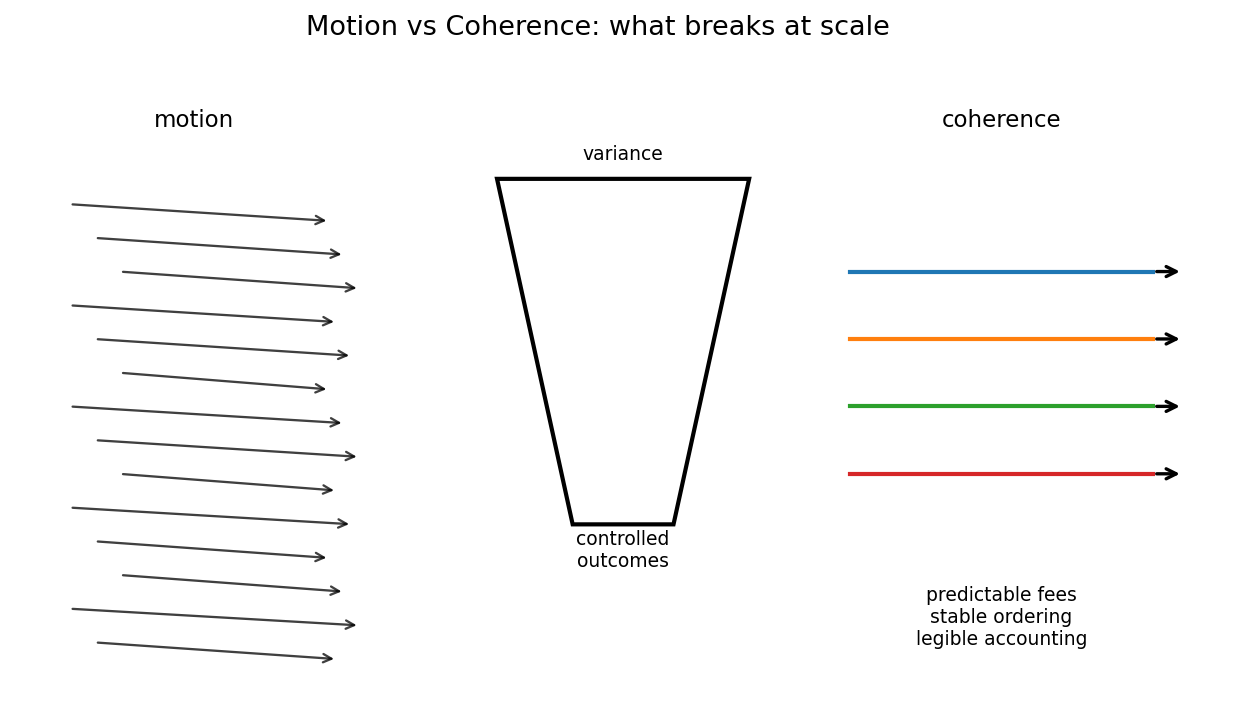

The popular narrative in crypto is that the winning chains are the ones with the most motion. Higher throughput, lower fees, more features, more activity. If the system moves fast enough, adoption will naturally follow.

What’s actually missing is not motion. It’s coherence.

Coherence is what operations teams feel when a platform has stable rules. Fees that do not turn into a variable tax. Ordering that does not become a hidden contest. Data that does not evaporate into off-chain workarounds. In other words, a chain that behaves like infrastructure rather than like a live experiment.

That is the frame where Vanar becomes legible.

Vanar positions itself as an AI-native Layer 1 stack built for PayFi and tokenized real-world assets, with multiple layers designed to store structured data, run on-chain logic, and support “intelligent” workloads. The ambition is not simply to be fast. It is to make the chain feel usable for systems that need predictable behavior, especially when the workload is economic, regulated, or continuous.

Think of Vanar less like a racetrack and more like a container port. A racetrack rewards peak speed. A container port rewards throughput with discipline: standardized handling, predictable queues, and a system that does not change its rules when volume spikes. Real finance does not care about your fastest lap. It cares whether the containers arrive in the same condition, every day, with paperwork that closes.

A second analogy is a balance sheet. A balance sheet is not impressed by technical virtuosity. It cares about control. If a platform cannot make costs legible and outcomes auditable, the balance sheet treats it as risk, no matter how advanced the technology appears.

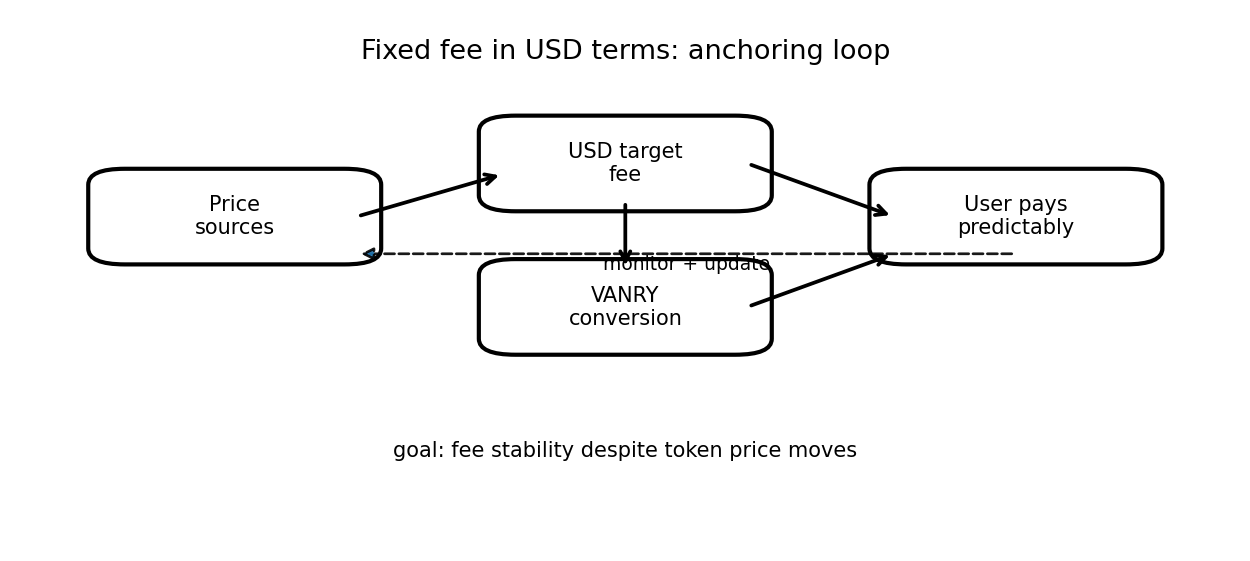

Vanar’s most explicit coherence move is its fee model.

Vanar documentation describes a fixed-fee approach designed to keep transaction costs stable and predictable, including an explicit target of charging a fixed fee in fiat terms, commonly framed as $0.0005 per transaction. It also documents a protocol-level mechanism for updating the VANRY token price using multiple sources so that the user-facing fee can remain anchored to a fiat value rather than drifting with token price.

This matters at the macro level because fee variance is not just a pricing problem. It is a planning problem.

In some environments, even a small swing in fees forces product teams to redesign behavior: fewer interactions, more batching, more friction, more waiting. A fixed, legible fee changes the posture. It allows teams to treat transaction cost as a stable input, not an unpredictable constraint.

If you want a grounded use case, take a marketplace or a gaming economy paying out thousands of micro-rewards daily. The business isn’t trying to “use blockchain.” It’s trying to run a loop: earn, settle, confirm, reconcile. If the cost per action is roughly stable at a fraction of a cent, it becomes rational to settle more frequently, split payouts cleanly, and reduce the time funds sit in limbo.

Early signs in payment-style workloads are that user experience is shaped less by best-case performance and more by variance. When confirmation time and fees behave consistently enough to predict, the product feels calm. When they drift, the product feels fragile. Vanar’s fixed-fee design is a direct attempt to compress that variance into something businesses can budget and audit.

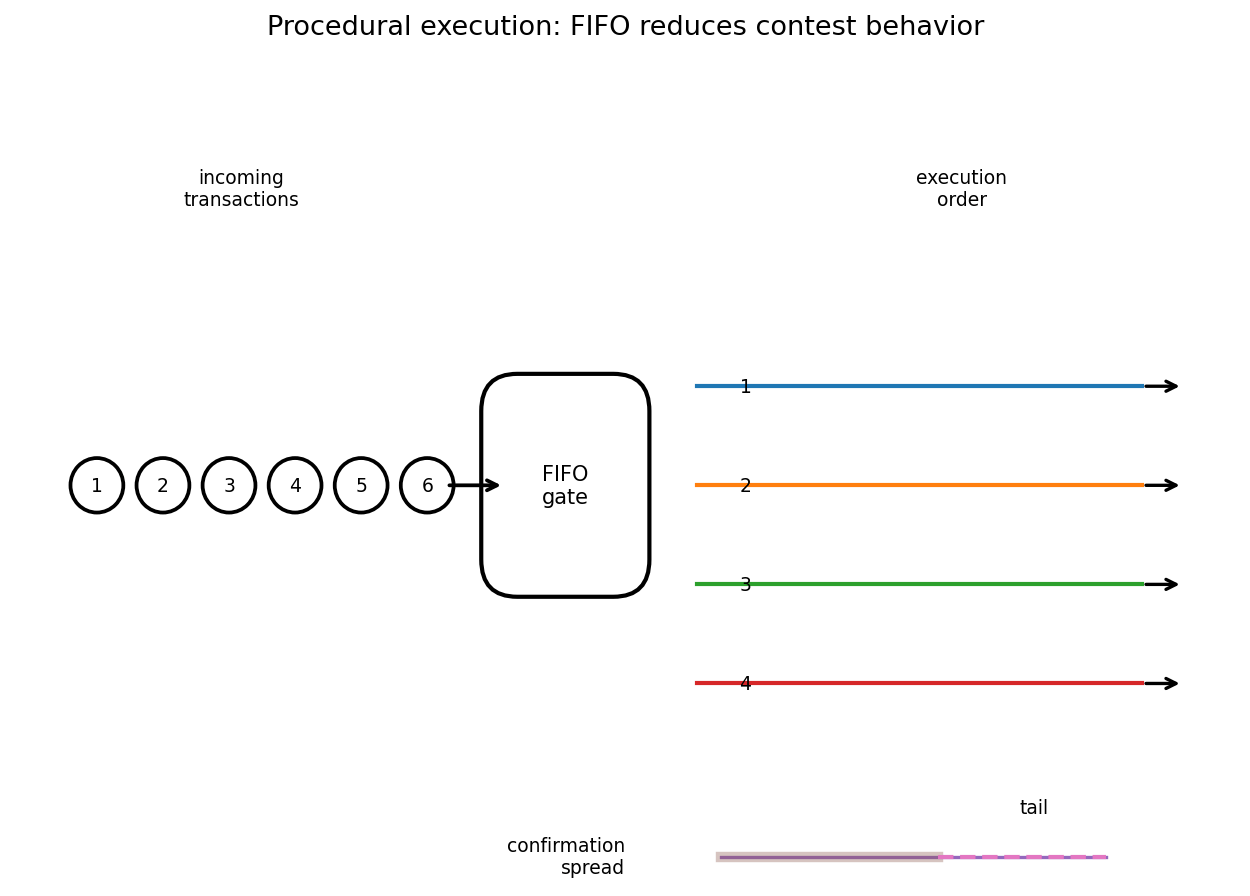

Vanar pairs that with a fairness claim around transaction ordering.

The documentation explicitly references a First-In-First-Out transaction processing model as part of the fixed-fee framework. At the macro level, this is Vanar trying to reduce the sense that access to blockspace is a bidding war. Whether or not any ordering model eliminates strategic behavior entirely, the intent is clear: make execution feel procedural, not adversarial.

Then there is the “AI-native stack” thesis.

Vanar’s public materials describe an integrated stack that includes an execution layer, an on-chain AI logic or reasoning layer (Kayon), and a semantic compression layer (Neutron Seeds) meant to store structured legal, financial, and proof-based data directly on-chain. The important macro point is not a checklist of features. It is the direction of travel.

Vanar is arguing that the next era of chains will be judged by what they can remember and validate, not only what they can execute. That is a “meaning over motion” posture: less emphasis on raw transaction theater, more emphasis on durable data, policy-aware logic, and systems that can support real-world constraints without pushing everything off-chain.

Even its monetary policy narrative is designed to read as predictable.

Vanar’s documentation and whitepaper describe a maximum supply cap of 2.4 billion VANRY, with genesis minting and additional issuance via block rewards according to a predefined issuance mechanism. Whatever one’s view on token design, the macro signal is that the project wants its economics to be legible, not improvisational.

An honest critique belongs in any serious read of this.

Vanar’s ambition is broad. AI-native layers, PayFi, tokenized infrastructure, fixed-fee economics, and a stack that wants to hold more meaning on-chain. The risk is execution complexity. Integrated stacks can become heavy. They can accumulate dependencies. They can create a large surface area where the system must be correct, not just fast.

That critique is real, and it should not be hand-waved.

The mature rebuttal is that coherence is rarely cheap. Systems that aim to serve payments, regulated workflows, and real-world data constraints cannot rely on “figure it out later” architecture. If Vanar’s bet is that the next adoption wave will reward predictable cost, stable execution rules, and on-chain meaning that reduces off-chain operational work, then building the stack deliberately is not a distraction. It is the point.

Vanar, at the macro level, is not trying to win a speed contest. It is trying to win a trust contest.

And in infrastructure, trust is usually built the same way: by making the system boring in the best sense, consistent enough that nobody has to think about it to rely on it.

@Vanarchain #vanar $VANRY