The majority of crypto projects allow you to do operations on a blockchain. The offer quiet made by the plasma is different: it is assured that the chain will act in a predictable and continuous manner even when the pressure is on. That is a very dull thing to say until you take into consideration what Plasma is out to. Stablecoins are not mere game assets, they are actual money to individuals and enterprises. In the case of money, it is not speed that poses the greatest threat but uncertainty. In case a payment rail does not respond identically under load, has edge cases, or cannot be audited, it will not be taken into serious use.

This angle deserves more attention, then, which is the one that Plasma seems to read with: The mindset of a payments-company that is running a stable-coin chain. Operational reliability is the main plot. The design decisions are reasonable when you pose one question: So how do we cause this to act like real infrastructure?

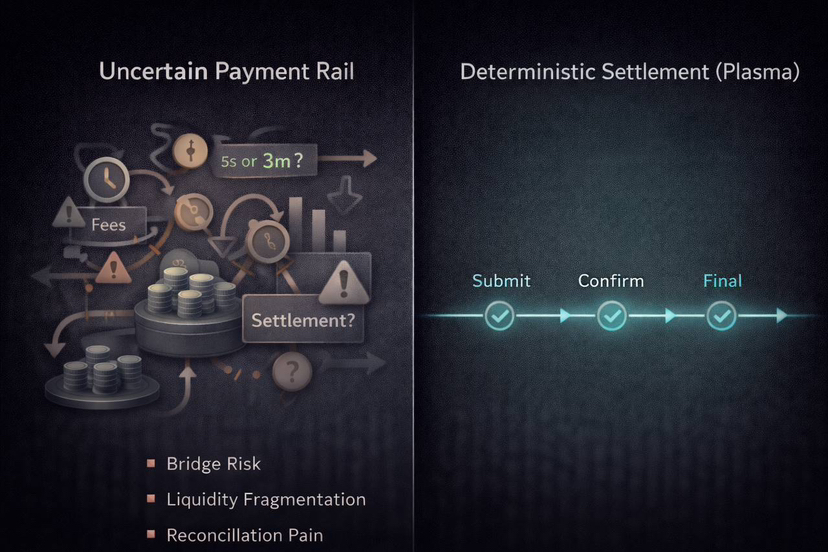

The case of determinism in Stable-coin rails versus hype.

Flex in conventional cryptolexical use means fast. In the payment game, it is determined who wins. Determinism implies that the system is predictable. Fees don’t become chaotic. Confirmations aren’t random. Finality does not involve guessing. Observing and recovery directions are obvious. Once a transaction is verified, the transaction remains verified. The failure of a node does not make the network remain a mystery.

That is what makes a difference between a chain that is enjoyable to operate, and a chain that a company can create without fear. Stablecoins should be considered as part of the second world. In the event that Plasma is made the workhorse of stable-coin activity, it should perform the function of a settlement mechanism, and not a social experiment.

Stack rust: an indicator of both safety and non-preference.

The majority of the readers are not concerned with the language a chain is written in. The builders and the companies which depend on it do. Rust is extremely popular on the execution and consensus side of plasma. It is not to do with performance but because safety. Payments infrastructure desires a code more amenable to reasonable understanding, incapable of silent failure, and subject to serious testing. Rust does not fix security, but even the decision to use a modern and safety-sensitive stack is an indication that the team is building toward the world where outages, bugs, and operational headaches are the most expensive rather than throughput benchmark.

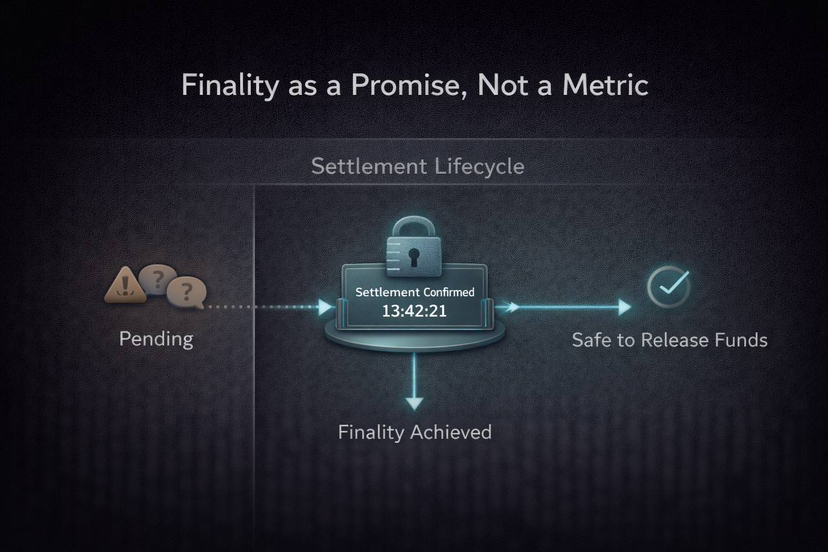

Finality is not a number, it is an assurance to users.

Finality is a promise to customers and corporations; people tend to think of finality as less than one second or a few seconds, as a sports stat. When you are paying a supplier or a batch pay out, you must be aware of when the cash is done. Buffers are caused by slow finality. All finality is inconsistent, which causes workarounds. Non-finality causes mistrust. The consensus mechanism in plasma is concerned with high-latency finality and high guarantees. Marketing speed is not important; it only matters that Plasma attempts to make settlement settlement. That saves unconscious expenses on payments: waiting, two-way-checking, and manual confirmation logic.

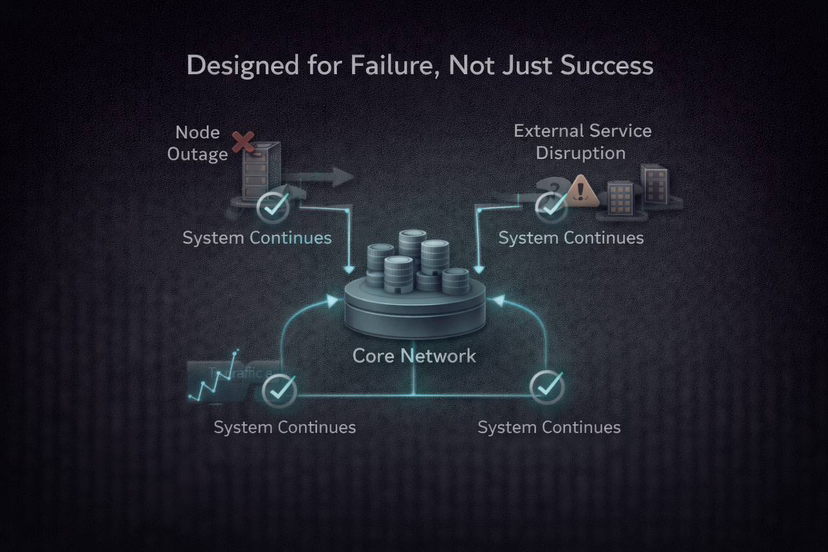

A stable-coin chain has to strategize on failures, not only successes.

Happy path is not the most difficult aspect of financial infrastructure; it is the bad days. Failure of nodes, network segments, bursts in volume, edge-cases spamming, or service outages elsewhere. A serious chain should not hope never to happen; it plans their occurrence.

The node structure of plasma combines a lightweight observer-based approach with full execution. Although you do not need to operate a validator, you can operate a node to track the chain and provide applications. That is important since numerous independent operators are needed to be fully adopted. The higher the number of eyes, the greater the redundancy, and the number of state-checking ways, the higher the reliability. The more profound aspect is straightforward: the chains driving finance ought to reason like SRE-teams. The product includes: monitoring, redundancy and recovery paths.

Modular data availability: underestimated design decision.

Several individuals overlook this issue up until it strikes them: not all applications require equal data availability price. Other protocols desire utmost protection. Others require low cost, compressed data. Others on the external data availability do so on the basis of cost. One hardened model obliges all apps to become as costly as possible even when it is unnecessary.

The design of plasma to allow configurable data availability is a dial and not a single rule approach to data. Such flexibility is crucial to stable-coin systems since they have different uses: simple transfers, merchant flows, treasury flows, complex programmable finance. Flexibility in this case is not fancy but allows the system to support several workloads of stable-coins without putting them into the same cost box.

Inflation, costs and security: how to motivate to avert the security cliff.

One thing that a stable-coin rail survives or fails is because of scalability of security. The pitfall with many networks is the high cost of security at an early stage, or the low cost of its security at a later stage. The token economics of plasma solve this with the addition of emissions being linked to a wider involvement in the validators and delegation and making the security expenditure proportional to the actual network maturity.

One of the minor aspects is sanctions. With infrastructure, you desire to penalize the bad conduct without undermining trust. Fines that wipe out principle scare operators and delegators. The penalties that are based on rewards make incentives acute and minimize devastating loss to the truthful participants.

The macro aspect is also important: Plasma is interested in long-term plausible security economics, which resembles a robust network, rather than a casino.

Fee burning and predictable expenses are long-run credibility. The users of the stable-coin are not interested in one-day discounts but in a stable price.

In the case when the economics of a network lead to runaway issuance or disorganized fee markets, then it is hard to model. Such randomness does not augur well with the business; they are unable to forecast, budget and price services.

The economics of plasma contain both the mechanisms of balancing issuance and usage, and the mechanisms of limiting the increase in supply as the activity increases based on the fee mechanisms. This is not hype, this is the good, firm plumbing that has operated over the years that operators can depend on.

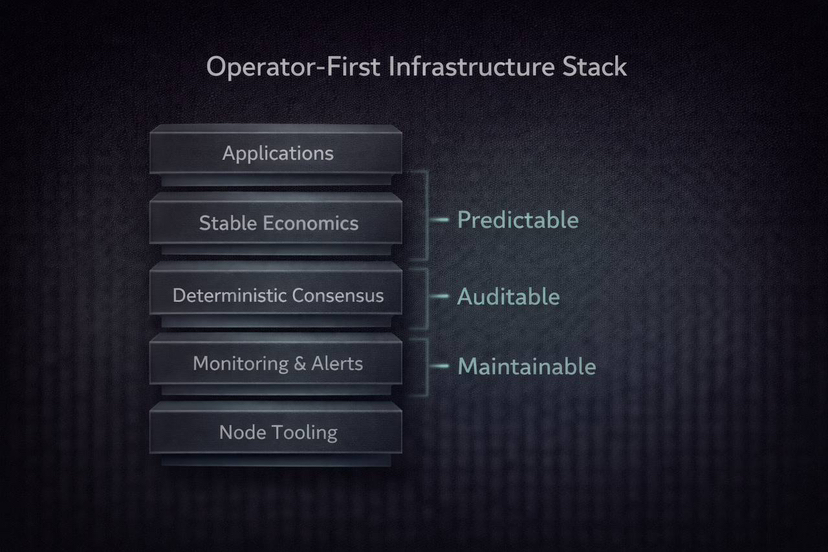

The major change: Plasma is not only user friendly but operator friendly as well.

Simply put, a lot of chains give the end user the first priority; Plasma gives the operator the first priority.

The system is operated by the operators, which include wallets, payment applications, payout platforms, custodians, compliance teams, treasury teams, and others. When operator experience is broken, then user experience also fails to work.

A chain of operators that are first-motivated aims at predictable finality, consistent behavior under load, clean node technology, explicit failure behavior, and economical guidelines, which do not change underfoot.

In the perspective, Plasma is not so much of a stable-coin chain, but rather an infrastructure that, in fact, ought to be operated by businesses.

What success appears to be considering this reliability-first view.

Plasma prevails where people cease discussing it and begin to apply it.

Not because it is confidential, but because it is reliable. Platforms pass flow of stable coins through it to be consistent. The reason it is adopted by finance teams is because it has transparent audit trails and settlement logic. Builders use it in an environment that is familiar and stable. Nodes are operated due to the tooling reasonableness.

That will be the adult type of crypto-subtle, yet more secure.

As long as Plasma remains focused on reliability, its largest competitive advantage will not be a single feature, but trust over time - the same type of trust that supports real payment rails.