Most AI + blockchain stacks fail long before they hit scale. Not because the models are weak. Not because the chains are slow. They fail because the system can’t reliably complete a paid action.

I’ve seen this pattern repeat. An AI agent can reason. It can retrieve context. It can even decide what to do next. Then it reaches the payment step and everything slows down, breaks, or gets routed through a human workaround. That’s not a UX issue. That’s a system boundary being exposed.

From an operator’s perspective, payments are not a feature. They are a stress test. If a system can’t move value predictably, nothing else in the stack matters.

This is why I think payments are the missing piece in most AI blockchains and why Vanar is at least pointing at the right failure mode.

Most “AI-first” blockchains treat payments as something downstream. First, build agents. Then, integrate wallets. Then, figure out settlement. In practice, this creates a brittle chain of dependencies. AI workflows touch more moving parts than traditional apps: memory layers, inference services, orchestration logic, permissions, and finally value transfer. Every external hop is another place the workflow can stall.

AI agents don’t tolerate that fragility. They don’t retry politely. They don’t wait for manual approval. If a payment step blocks execution, the task just fails. Users don’t debug that. They churn.

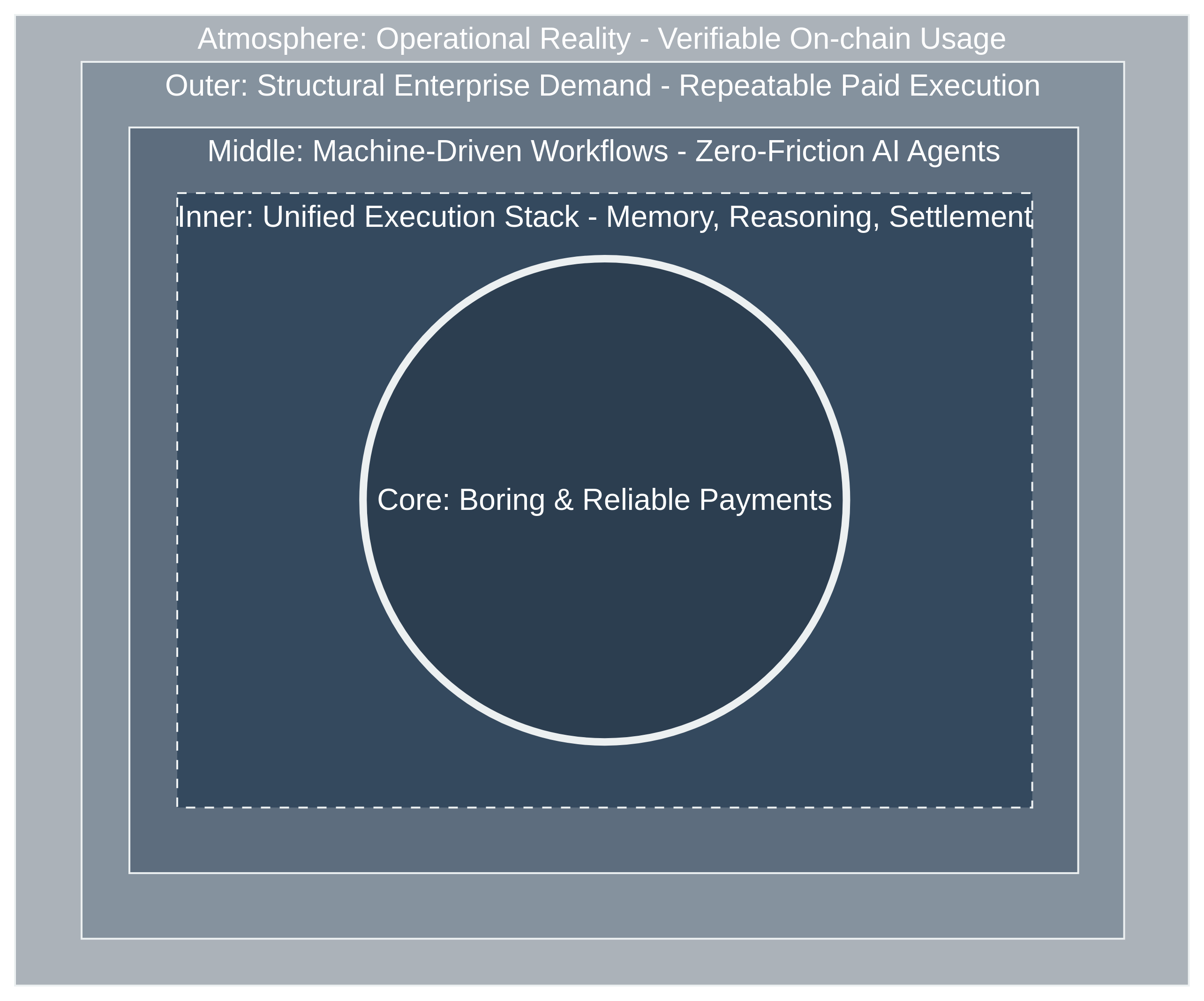

Vanar’s design bet is that payments should not be bolted on at the end. They should be part of the execution fabric. Memory, reasoning, automation, and settlement are treated as one stack, not four products stitched together. That’s not an ideological choice. It’s an operational one.

The interesting part is not that Vanar supports payments. Every chain does. The question is whether payments are designed to support machine-driven workflows, not just human-driven ones. Enterprises care about this distinction more than crypto-native teams do. A human can tolerate friction if the outcome is valuable. An automated system cannot.

This is where the enterprise angle quietly matters. Enterprises don’t lose sleep over whether an AI agent is impressive. They lose sleep over whether a system can prove what happened, who authorized it, and whether value moved correctly. Payments are the convergence point for all of that: permissions, auditability, timing, and finality.

Vanar’s broader stack with Neutron positioned as a data and memory layer only makes sense if payment execution is equally dependable. If an AI system can retrieve the right internal context but can’t reliably trigger or settle a transaction, the workflow stops being automatable. It becomes a demo.

This is also why partnerships should be treated as risk zones, not proof points. When Vanar announced a partnership with Worldpay, the signal wasn’t “adoption is guaranteed.” It was that the system is at least being discussed in rooms where payments reliability actually matters. Global payment processors don’t experiment casually with stacks that can’t speak the language of compliance, reconciliation, and uptime. That doesn’t mean volume is coming. It means the bar is understood.

From a trader’s perspective, it helps to ground this in numbers. VANRY is still a small-cap asset. Price, volume, and circulating supply put it firmly in “option value” territory, not conviction. That’s important. You’re not paying for proven enterprise revenue. You’re paying for the possibility that payment-linked AI workflows turn into recurring usage.

The bull case is not abstract. If Vanar converts even a narrow slice of enterprise or fintech workflows into repeatable, paid execution meaning transactions tied to data verification, permissions, or automated decisions demand becomes structural. Not narrative-driven. Structural. That’s when a small market cap can re-rate meaningfully.

The bear case is simpler and more common. Enterprise pilots stall. Payment integrations stay shallow. “AI + payments” remains a slide, not a workflow. In that scenario, the token drifts. Liquidity stays thin. Price moves faster than fundamentals.

So what would actually change my mind, either way?

On the bullish side, I’d want to see consistent onchain activity that clearly maps to paid workflows, not test transactions. Evidence that AI-driven actions are triggering settlements repeatedly. Case studies that imply ongoing operations, not one-off integrations.

On the bearish side, the signals are silence and abstraction. Vague updates. No measurable payment throughput. No clarity on how agents actually move value end to end.

Payments are boring when they work. That’s the point. If Vanar can make payments boring inside AI workflows predictable, auditable, and automatic then the rest of the stack has a chance to matter. If it can’t, no amount of AI narrative will compensate.

This can work. But only if usage shows up. And payments are where that usage becomes impossible to fake.