My Article Title: Plasma Overview: Core Features, Tokenomics & Roadmap Explained

Author: @Ayesha白富 美 - Dated: 05 / 02 / 2026

Plasma is a Layer 1 blockchain purpose-built for stablecoins, featuring native USDT integration for instant, fee-free transfers, alongside Plasma One, a stablecoin-focused neobank designed to make holding and spending digital dollars more accessible.

Introduction

When I look at Plasma, I don’t see it as just another Layer-1 chain entering an already crowded market. I see it as a response to a very specific and very real problem: stablecoins are already being used at scale, but the infrastructure underneath them still feels inefficient, fragmented, and expensive.

Plasma is a high-performance Layer-1 blockchain built specifically for stablecoins, with a clear focus on digital dollar usage. The network’s mainnet beta is scheduled to go live on September 25, 2025, alongside the launch of its native token, XPL. From the start, Plasma positions itself not as a general-purpose experiment, but as core infrastructure for near-instant, fee-free stablecoin transactions with institutional-grade reliability.

What stands out immediately is the scale Plasma is targeting from day one. At launch, the network is expected to support more than 2 billion dollars in stablecoins across over 100 DeFi and fintech partners. That level of initial liquidity places Plasma among the largest blockchains globally by stablecoin deposits right from inception, something very few networks have achieved.

The project has also secured 24 million dollars in seed funding, led by Framework Ventures, with backing from well-known industry participants, including figures closely tied to the stablecoin ecosystem. This funding context matters because it signals long-term intent rather than short-term experimentation.

Plasma Blockchain (Layer-1)

Plasma’s Layer-1 blockchain is engineered around stablecoin usage rather than treating it as a secondary use case. Every core design choice reflects that priority.

• High Throughput & Low Latency

Plasma uses a Byzantine Fault Tolerant consensus mechanism designed to process thousands of transactions per second with sub-second finality. This level of performance is essential for stablecoin payments at global scale, where delays are simply unacceptable. The chain is fully EVM-compatible, allowing Ethereum-based smart contracts to be deployed without modification. This lowers friction for developers while preserving performance.

• Zero-Fee USDT Transfers

One of Plasma’s most distinctive features is its approach to gas fees. On Plasma, USDT transfers can be made without paying any transaction fees and without holding a native gas token. The network achieves this through a built-in paymaster system that sponsors gas for USDT transactions. This design removes one of the biggest barriers to stablecoin adoption and makes digital dollar transfers feel closer to traditional payments.

• Custom Gas Tokens

For non-USDT activity, Plasma allows transaction fees to be paid using whitelisted assets such as USDT or even $BTC . Users are not forced to manage a separate gas token just to interact with the network. This flexibility simplifies the experience, especially for users who primarily think in stablecoins rather than network-native assets.

• Confidential Transactions

Privacy is a growing concern in stablecoin usage, particularly for businesses and institutions. Plasma’s roadmap includes confidential transaction support that will allow transaction details to be obscured while remaining compatible with compliance requirements. This feature is planned to roll out progressively as the network matures and governance frameworks solidify.

• Native Bitcoin Bridge

Plasma plans to integrate a trust-minimized Bitcoin bridge that allows BTC to enter Plasma’s EVM environment without relying on centralized custodians. This pBTC bridge is designed to bring Bitcoin liquidity into the Plasma ecosystem while maintaining strong security guarantees, expanding the network beyond stablecoins alone.

Plasma One (Stablecoin Neobank)

Alongside the blockchain, Plasma is launching Plasma One, a stablecoin-native neobank designed to make holding and spending digital dollars feel practical and familiar.

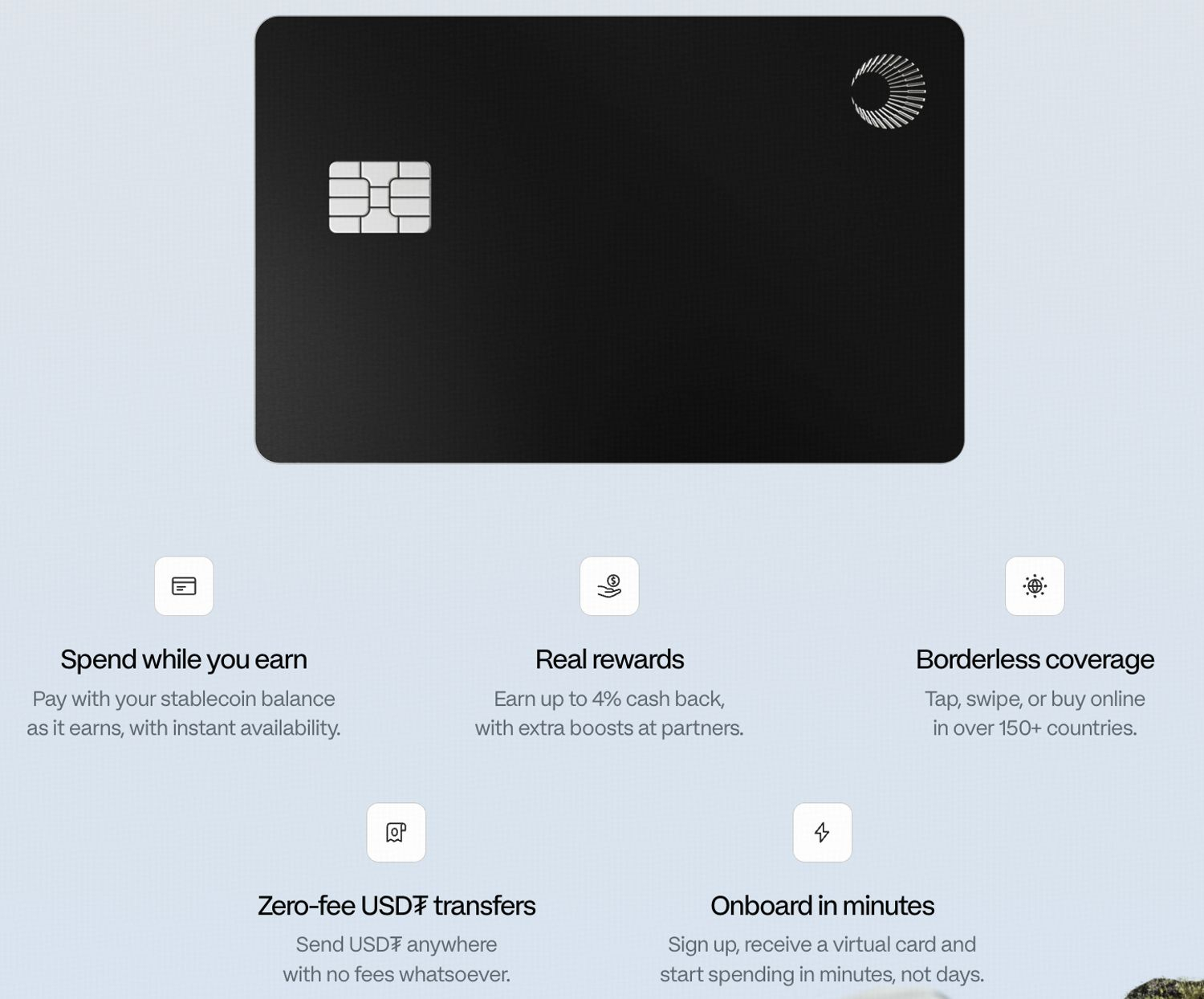

• Earn While Spending

Plasma One allows users to spend directly from their stablecoin balance while still earning yield on those holdings. Initially focused on USDT, balances accrue yield with no lockup, using Plasma’s DeFi infrastructure in the background. The idea is simple: users should not have to choose between liquidity and returns.

• Real Rewards

The Plasma One card, available in both virtual and physical formats, offers up to 4 percent cashback on everyday purchases. Rewards are paid in stablecoins, reinforcing the idea that digital dollars can function as real money rather than speculative assets.

• Borderless Spending

The card is designed to work across more than 150 countries and millions of merchants worldwide. This allows users to spend stablecoins globally wherever major payment cards are accepted, effectively bridging on-chain funds with real-world commerce.

• Zero-Fee Transfers

Within the Plasma One app, users can send stablecoins instantly to other users with no transfer fees. This enables free peer-to-peer payments and remittances, powered directly by Plasma’s fee-less transaction infrastructure.

• Fast Onboarding

Plasma One emphasizes accessibility. New users can complete KYC and receive a virtual USDT debit card within minutes. This is particularly important in regions where access to traditional banking is slow or unreliable.

Together, the Plasma blockchain and Plasma One app are designed to function as a single vertically integrated system. The chain provides fast, low-cost rails and yield generation, while the neobank delivers a familiar interface for saving, spending, and transferring stablecoins.

Token Utility

XPL is the native utility token of the Plasma network and plays a foundational role similar to $ETH on Ethereum.

XPL secures the proof-of-stake network by incentivizing validators. Validators stake XPL to participate in consensus and earn rewards for maintaining network performance and security. This staking model aligns validator incentives with the long-term health of the chain.

XPL also supports governance and ecosystem growth. Token holders participate in protocol decisions and network upgrades, while XPL is used to fund ecosystem incentives and DeFi programs. Importantly, everyday users sending USDT are not required to hold XPL due to Plasma’s gas sponsorship model, but XPL remains essential behind the scenes for sustainability and decentralization.

Token Allocation

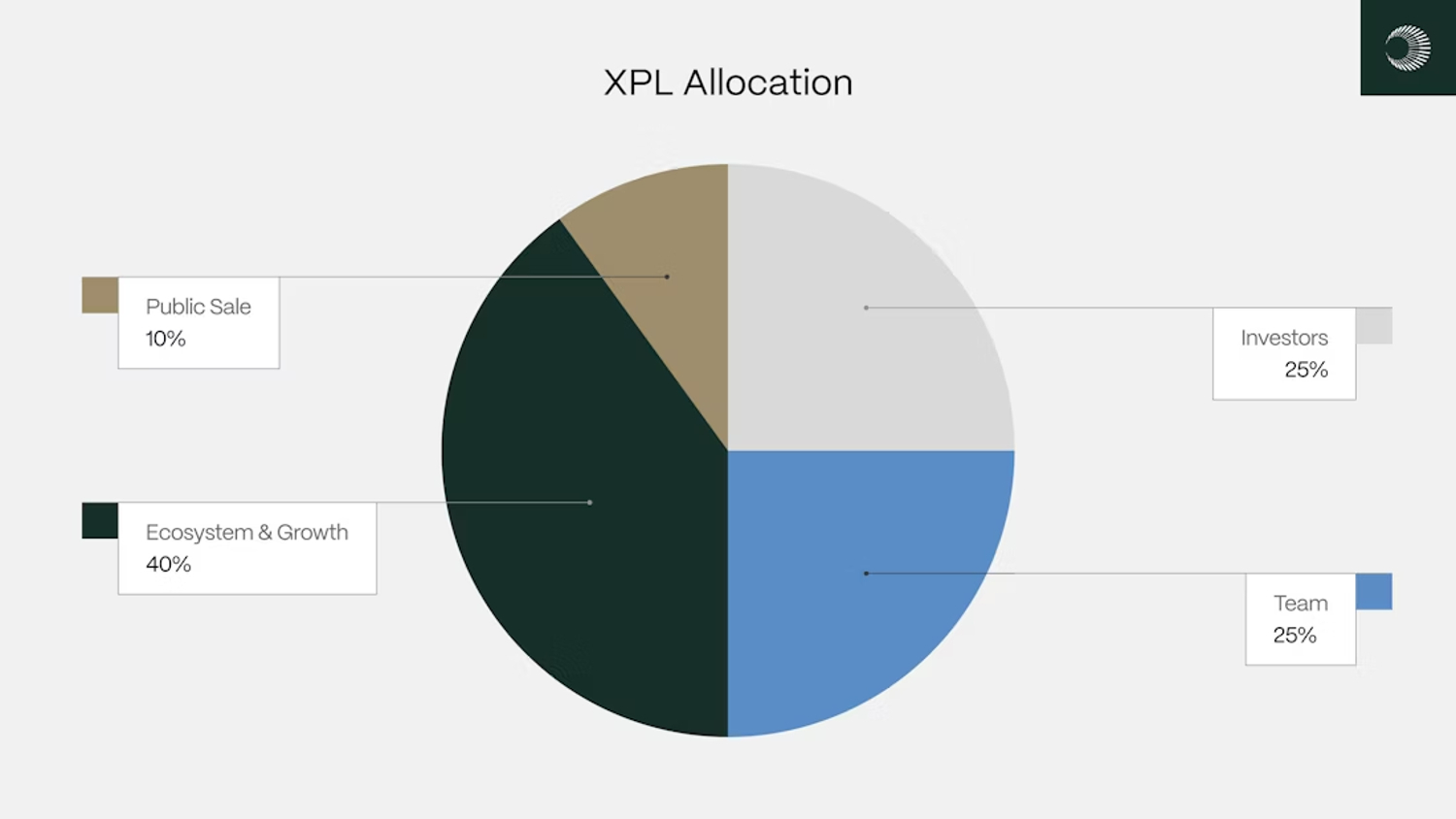

Plasma’s XPL token launches with a fixed initial supply of 10 billion tokens. The allocation is structured to balance community participation with long-term development needs.

• Public Sale – 10%

One billion XPL was allocated to the public through Plasma’s sale and deposit campaign. This allocation focused on decentralizing ownership and giving early community members meaningful participation.

• Ecosystem & Growth – 40%

Four billion XPL is reserved for ecosystem development. These tokens will fund liquidity incentives, partnerships, integrations, and adoption programs aimed at expanding stablecoin usage on Plasma.

• Team – 25%

Two and a half billion XPL is allocated to the core team and future contributors. This allocation is designed to retain talent and align long-term incentives with network success.

• Investors – 25%

Two and a half billion XPL is reserved for private investors who supported Plasma through early funding rounds, including well-known institutional backers.

Future Roadmap

2025 – Phased Launch and Adoption

Following the mainnet beta and XPL launch in September 2025, Plasma’s immediate focus is on stability and adoption. Plasma One will roll out gradually, while partnerships with over 100 DeFi and fintech platforms will help bootstrap liquidity and usage.

The network’s early adoption strategy prioritizes regions with unstable local currencies and strong demand for digital dollars. Markets such as Turkey, Argentina, and parts of Africa are expected to play a key role in demonstrating Plasma’s real-world utility.

2026 – Decentralization and Expansion

In 2026, Plasma plans to expand decentralization by opening validator participation beyond the initial trusted set. Staking access will broaden as the network matures, distributing consensus power more widely.

Additional features will also come online, including the canonical Bitcoin bridge and support for more stablecoins beyond USDT. This diversification reduces dependency on any single issuer and positions Plasma as a broader stablecoin settlement layer.