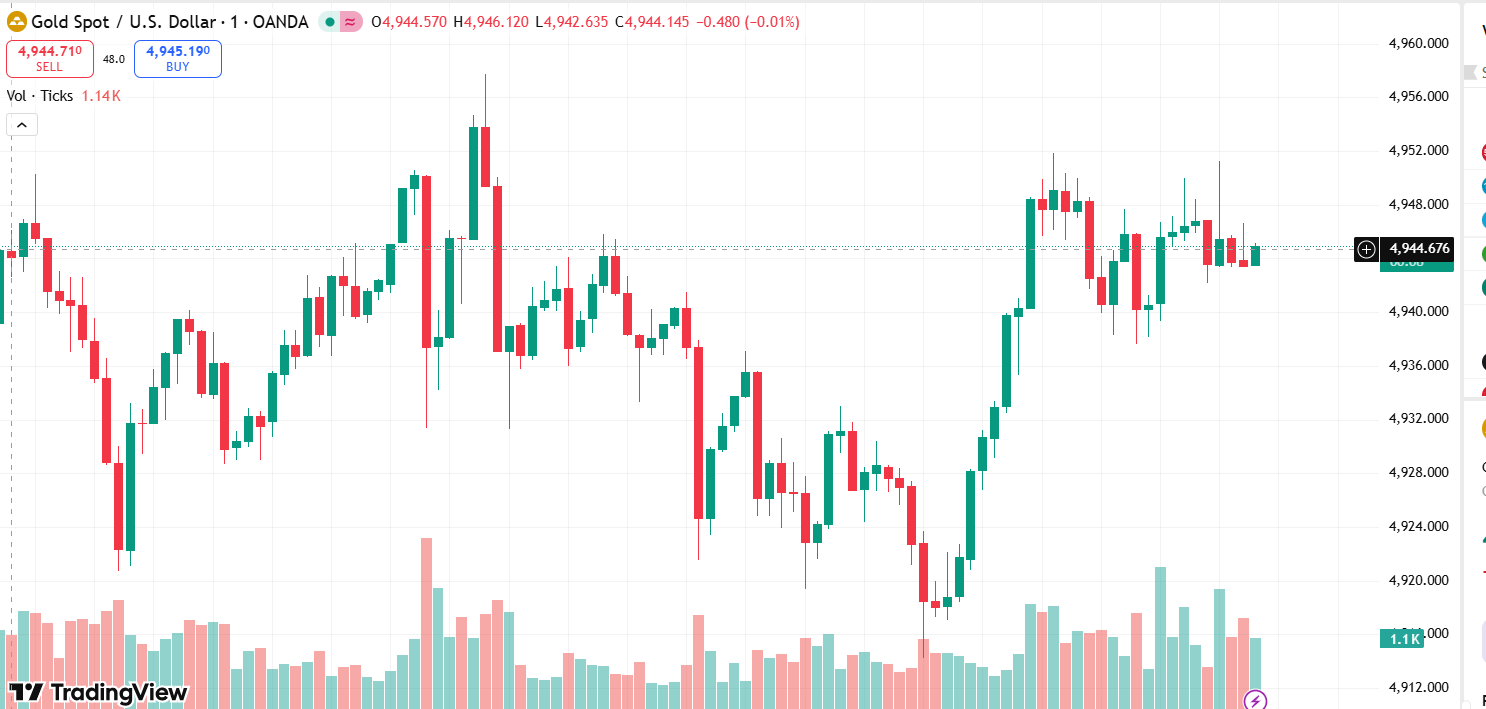

🔥 Market Moves & Price Trends

Gold rebounded sharply above $5,000/oz after a massive sell-off last week — one of the steepest in decades. Prices surged over 6% late last session as dip-buyers returned and technical support kicked in.

This comes after gold briefly fell from record highs near $5,600/oz to below $4,400/oz amid macro uncertainty tied to US Fed chair nomination news (hawkish policy expectations strengthened the dollar and triggered selling).

📊 Volatility & Market Sentiment

Despite the rebound, volatility is at historical extremes, with realized swings reaching record levels. That has challenged gold’s reputation as a traditional safe-haven, though long-term technical buyers remain active.

Multiple analysts point to heavy swings driven by:

Speculative trading

Central bank reserve shifts

Safe-haven rotations amid geopolitical stress

📌 Bullish Forecasts & Price Targets

Major global banks and analysts are widely bullish for 2026:

J.P. Morgan forecasts gold could reach $6,300/oz by end of 2026 — driven by sustained central bank buying and structural demand.

Deutsche Bank maintains a $6,000 target, despite recent churn.

Goldman Sachs lifted its year-end forecast to $5,400/oz.

Central bank purchases are expected to remain substantial through 2026, supporting underlying price strength.

🧠 What’s Driving Gold Now

🏦 Central Bank & Structural Demand

Central banks (esp. China, Poland, other emerging markets) continue aggressive gold accumulation — central banks buying at elevated rates.

Heavy ETF inflows & institutional allocators are reshaping market dynamics — investment demand strong.

🌍 Safe-Haven & Macro Themes

Geopolitical tensions, de-dollarization concerns, and inflation hedging demand are fueling safe-haven flows.

Expectations of Fed policy shifts / rate cuts later in 2026 reduce the opportunity cost of holding non-yielding gold.

🧨 Risks & Headwinds

Current volatility challenges gold’s short-term predictability.

Hawkish monetary cues and dollar strength can trigger swift downside moves.

#XAUUSD #PreciousMetals #Binance #Trading #Crypto

$XAU