For a long time, Web3 tried to make the case that decentralization alone would lead to widespread acceptance. So far, it hasn't happened on a large scale. Most people and organizations aren't primarily interested in censorship resistance or new ways to use tokens.

Instead, they desire systems that are reliable, fit into the current rules, and don't introduce new risks that they have to explain to those in charge.

That’s why the focus is shifting to regulated real-world assets (RWAs). This is also where Dusk finds itself, in a space that many crypto projects tend to avoid.

The idea is simple: Money is not against blockchains, but it dislikes not knowing what to expect.

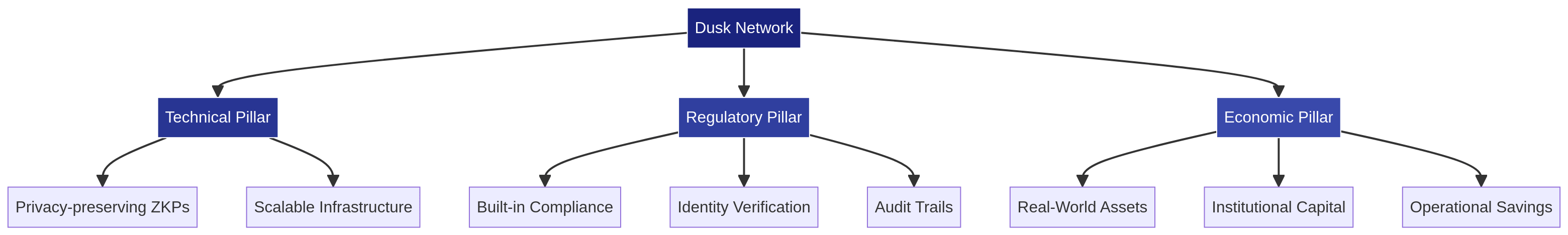

The finance world deals with digital forms of value already. Stocks, bonds, and other financial tools are mainly database entries. Institutions are interested in clear ownership, final transfers, enforceable compliance, and maintained privacy, not whether something is on-chain. Early Web3 systems focused on openness but missed everything else.

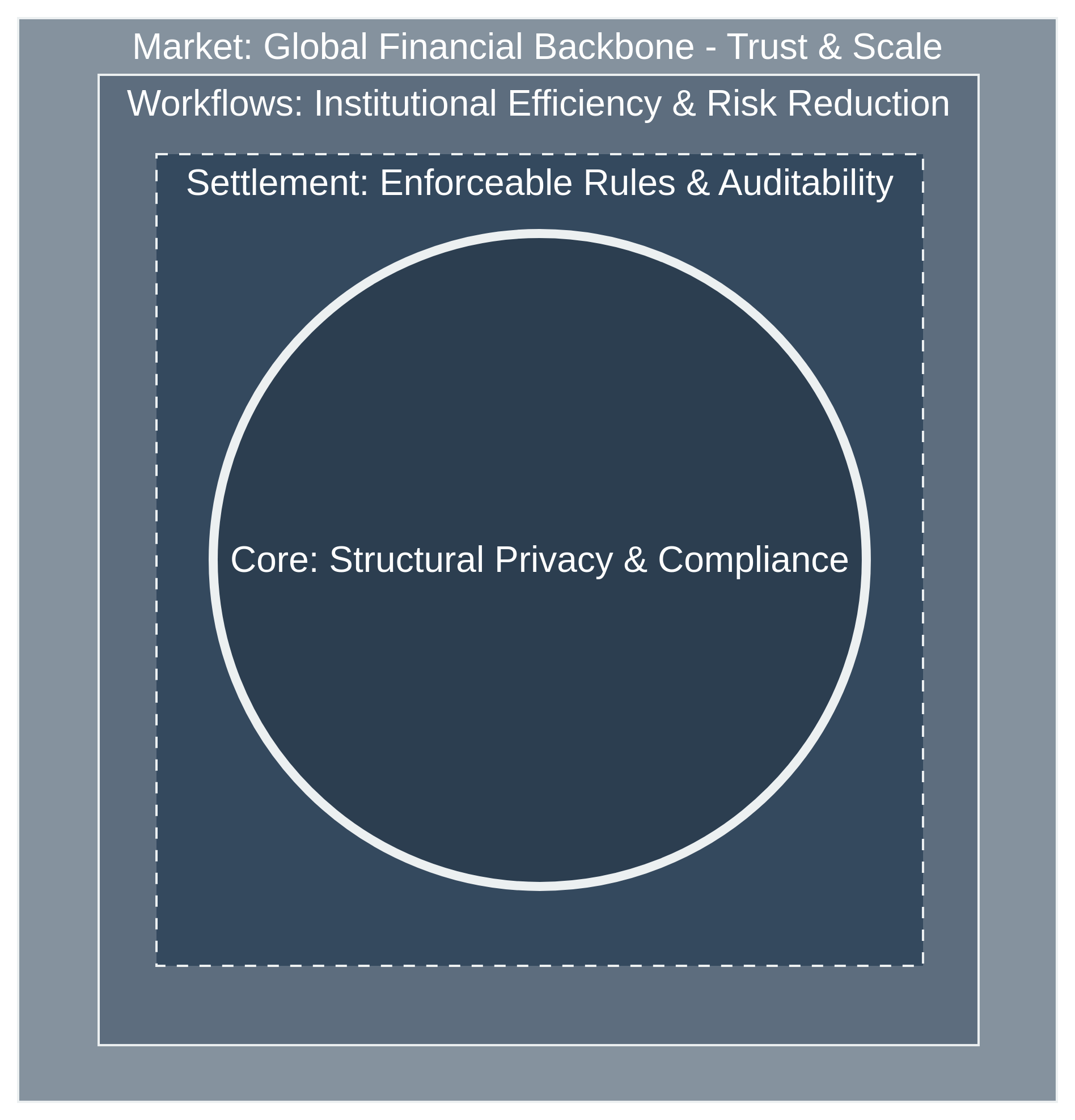

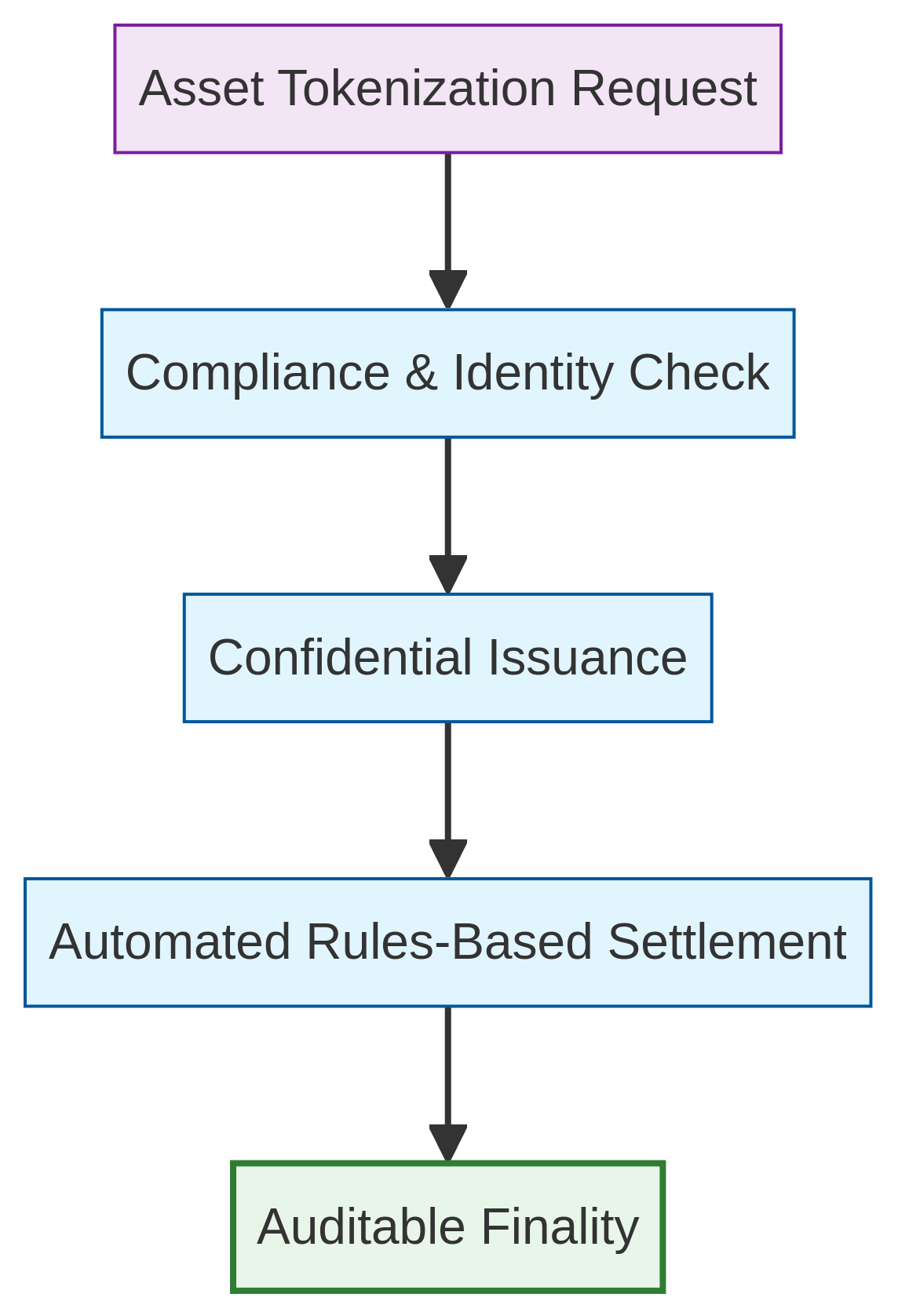

RWAs change the conversation. Instead of asking institutions to adopt crypto behaviors, RWAs bring familiar financial tools to systems that can make things like settlements and audits better. However, this only works if regulation is considered from the start.

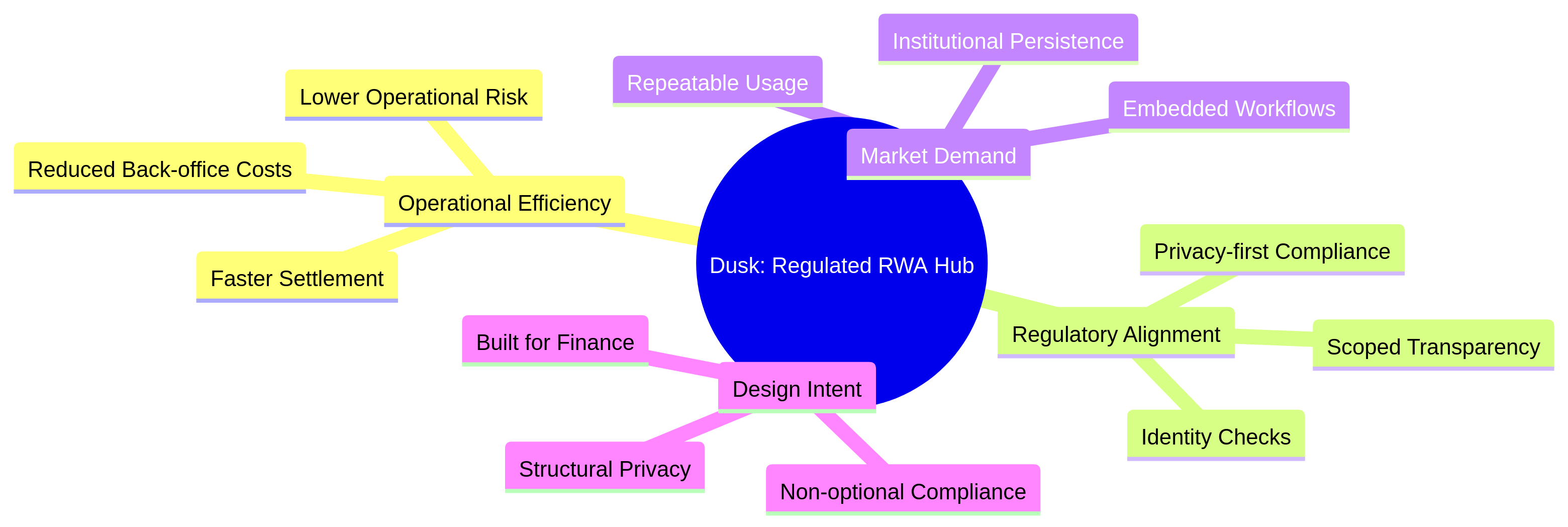

This highlights Dusk's approach. Instead of building a general blockchain and adding compliance later, Dusk is created for regulated finance cases. Privacy is built-in, not optional. Transactions can be checked without being fully public. Identity and compliance checks can happen without sharing sensitive data across the network.

This balance is very important. In regulated markets, openness has limits. Auditors, regulators, and related parties get access, but the public doesn't. Systems that don't consider this are tested but then ignored.

Another reason RWAs are becoming popular is that they can make things run more smoothly. Today's settlement process is slow and costly. Moving assets internationally or between institutions can take days, even for simple transactions. Blockchain-based settlement can shorten this time. But this is true only if it follows legal and regulatory rules.

Dusk is concentrating on compliant settlement instead of focusing on speculative DeFi, which shows where the real demand exists. Managers and financial institutions want to reduce issues, make capital use better, and decrease risk.

RWAs are also more likely to result in regular usage than many consumer-facing crypto apps. Institutions don’t quit as easily as individual users. If a regulated system does its job, it becomes a normal part of the workflow. Usage becomes regular and easy to predict. This is the demand that infrastructure tokens need.

Of course, this doesn't ensure success. Regulated markets are slow. Sales take a long time, and integrations can be difficult. Many RWA tests will remain as just experiments. That’s part of working in this area.

However, the trend is obvious. As regulators get more comfortable with blockchain and institutions start to expect better settlement and privacy, RWAs will change from being interesting to a useful upgrade.

The next phase of Web3 adoption probably won't resemble the last one. It won't be attention-grabbing or based on hype. Adoption will come in the form of quiet integrations, approved platforms, and systems that make things easier without needing people to change their behavior.

Dusk is depending on this future, not by opposing regulation, but by supporting it. If Web3 is going to be relevant outside of its current community, then regulated RWAs provide a sensible way to get there.