Most blockchains are launched quietly, with the hope that liquidity will appear later. Some are launched with fanfare, hoping that nobody notices the usage doesn’t follow. Plasma chose a different route. From the beginning, it centered itself on stablecoins, which already dominate crypto activity.

This choice is important. Stablecoins aren’t naturally speculative. People use them when they care about certainty, such as with payments, treasury management, and cross-border transfers. When stablecoins are active, it usually signals adoption. When they sit still, total value locked (TVL) is just a snapshot in time.

Plasma’s initial interest—measured by large stablecoin balances appearing quickly—is interesting, but not just because “billions in TVL” sounds impressive. It suggests that capital viewed Plasma not as an experiment, but as a place to park and move money. That’s a tougher test than farming incentives or seeking short-term gains.

Yet, TVL alone doesn’t guarantee success. Anyone who’s been watching crypto for a while knows how misleading it can be. Money can come for incentives and leave just as quickly. The real question is what happens to that liquidity once it’s there. Is it being used? Does it settle payments? Does it move easily?

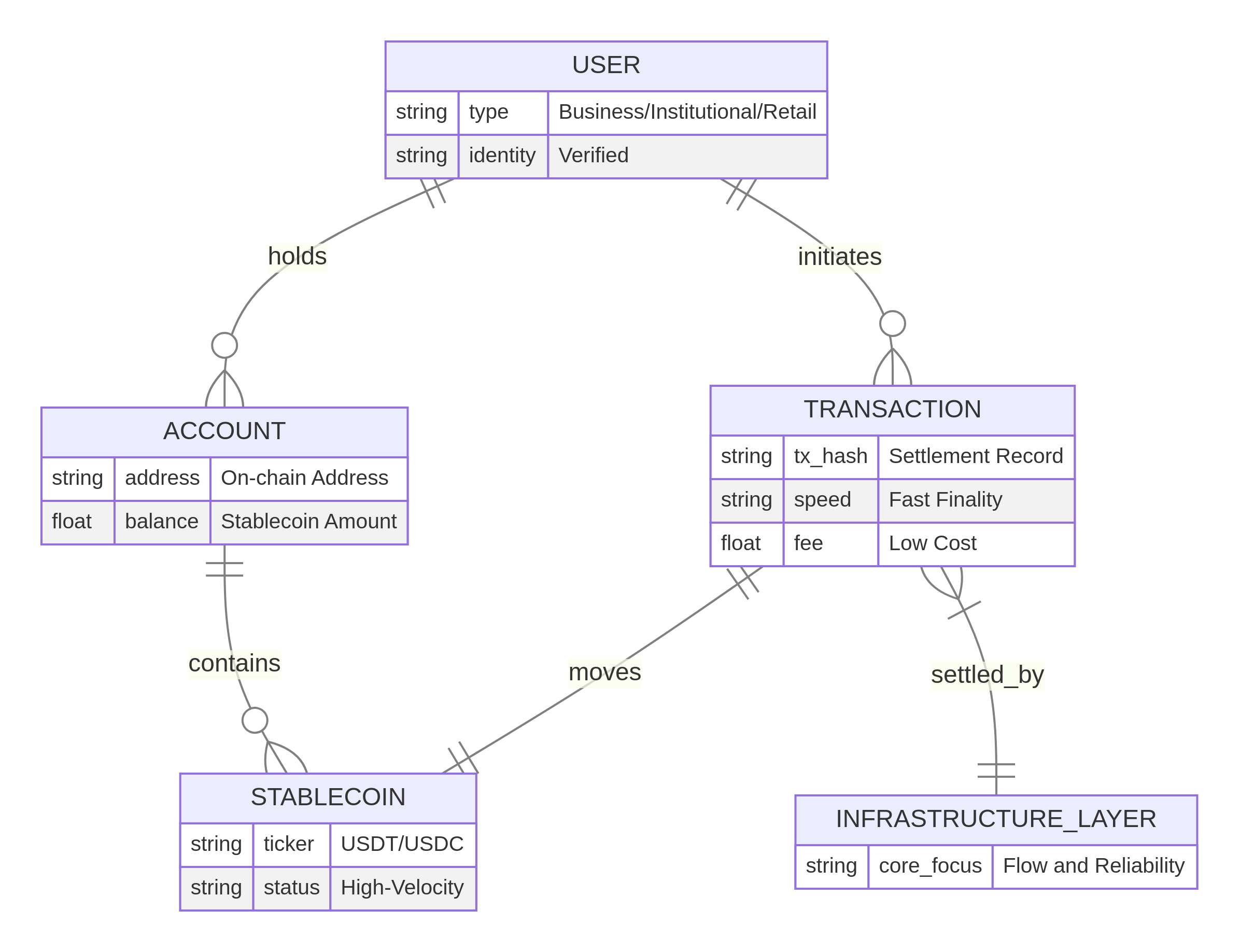

Plasma believes that stablecoins should act as infrastructure, not applications. That sounds like a small thing, but it’s an important difference. Infrastructure is uninteresting when it works. You don’t even think about it. You only notice it when it breaks. Most chains are made for composability and experimentation. Plasma is made for flow.

This is reflected in its design. It prioritizes fast finality and assumes stablecoins will be used. There are fewer steps between “send” and “settled.” This isn’t about including more features. It’s about getting rid of reasons for friction. Every extra confirmation, bridge, or gas calculation gives users a reason to pause, and hesitation can kill adoption.

What makes Plasma’s initial signs worth watching is not the balance sizes, but the behavior they suggest. Stablecoins don’t move to new systems unless there’s a reason. Speculators might chase yield anywhere, but businesses don’t. If stablecoins stay on a chain, it's usually because moving them again is cheap and reliable.

Even so, skepticism is still needed. Early liquidity can hide weak usage. A chain can seem healthy while money stays put. Real adoption shows up as repeated behavior, such as transfers happening at all times and balances moving between accounts. Fees should also stay low even when things are busy. These signs are harder to fake.

Another risk is how concentrated the money is. If a small number of big holders make up most of the TVL, things can change fast. Infrastructure only proves itself when it supports many different flows, not just a few coordinated ones. Plasma’s challenge is changing early capital presence into widespread, everyday use.

This is where stablecoins leave no room for error. They don’t accept “good enough.” If settlement feels uncertain, users notice right away. If transfers stop, confidence disappears. Unlike speculative tokens, stablecoins don’t get the benefit of the doubt. They either work, or people avoid them.

In the long run, Plasma’s positioning makes sense. As crypto grows, fewer users will care about chains as brands. They’ll care about results. Did the payment go through? Did the balance update? Did it cost too much? Stablecoins are central to these questions.

My view is simple. Plasma’s early liquidity is a sign, not a final answer. It shows that capital is at least willing to try the system. The next step is tougher: turning stored value into constant flow, and making settlement so reliable that nobody has to think twice about using it again.

If Plasma can do that, the “billions in TVL” headline will be less important than the quiet reality underneath it, and that’s what real infrastructure looks like.