Dusk Network has never behaved like a project trying to win a week. It behaves like something built to survive months where nobody is watching. That matters more to me than most people admit, especially after enough cycles trading through mania, boredom, and outright stress. I spend my days watching how price reacts when narratives thin out, how liquidity dries up without warning, and how incentives quietly reshape behavior long before charts confirm it. Dusk sits in an odd place in that landscape, not because it is misunderstood in the loud way, but because it is ignored in the quiet way.

What first caught my attention was not a breakout or a surge in volume. It was how little happened when other things were moving violently. During stress events, when correlations spike and everyone rushes to flatten risk, Dusk tends to lose attention before it loses structure. Price softens, spreads widen, but it rarely shows the kind of panic air pockets you see in assets held together purely by reward narratives. That tells me something about who is actually holding and why. Weak hands leave early, usually during silence, not during chaos.

Silence is where Dusk reveals most of its character. In low volume periods, when the market is distracted elsewhere, the order book does not feel artificially propped up. There are gaps, but they feel honest. No obvious defense levels screaming that someone is desperate to protect a story. Liquidity sits where it should for a network whose value proposition does not rely on constant excitement. When bids disappear, they disappear cleanly. When they return, they return slowly, usually aligned with broader shifts rather than isolated hype.

Hype, when it does show up, behaves differently here. I have noticed that upside moves tend to compress quickly. You get a push, then an almost immediate pause. Not distribution in the dramatic sense, but a refusal to chase. Traders who are used to exponential follow through get bored fast. That boredom is important. It filters the audience. What remains are participants who are comfortable with slower feedback loops and less emotional reinforcement. Over time, that changes the texture of the market.

Token mechanics play a larger role in this than most commentary acknowledges. Dusk’s issuance does not scream scarcity theater, nor does it flood the market to manufacture activity. New supply enters with a purpose tied to validation and ongoing operation. That creates a subtle behavioral effect. Rewards are meaningful, but not so excessive that they turn every participant into a forced seller racing to cover costs. You can see it in how sell pressure appears. It is steady, not spiky. Predictable enough that markets absorb it without drama.

When rewards dominate a market, price action becomes fragile. Everyone knows unlocks are coming. Everyone knows emissions will hit. The only question is who blinks first. Dusk avoids some of that reflexive tension. The result is not explosive upside, but also not constant bleed. Instead you get long stretches of sideways action that frustrate momentum traders and reward patience. That patience is not ideological. It is economic. Holding only makes sense if you believe usage, not narrative, will eventually justify it.

Incentives align best when they stop needing explanation. On Dusk, participation feels less like a game and more like maintenance. Validators are not chasing spectacle. They are responding to rules that are enforced without negotiation. That discipline shows up in price behavior during moments where other chains stumble. When there is a missed window or a delayed confirmation, nothing dramatic happens. There is no rollback, no narrative rescue. The system moves on. Markets tend to respect that kind of finality even if they do not celebrate it.

I have seen traders misinterpret this as weakness. They expect flexibility where rigidity is intentional. They expect the network to bend to human timing, not the other way around. When it does not, they assume something is wrong. From a market perspective, that misunderstanding creates inefficiency. Assets get discounted not because of failure, but because of discomfort. Over time, those discounts either persist or resolve depending on whether real usage fills the gap.

Privacy changes the incentive landscape in ways that are easy to underestimate. When transaction details are not exposed, certain extractive behaviors become harder. Front running loses relevance. Surveillance driven strategies lose their edge. That does not remove speculation, but it shifts it. Traders rely more on structure, less on exploiting visibility. You can feel this in volume patterns. Moves are cleaner. Less churn around obvious levels. Fewer fake breakouts driven by information asymmetry.

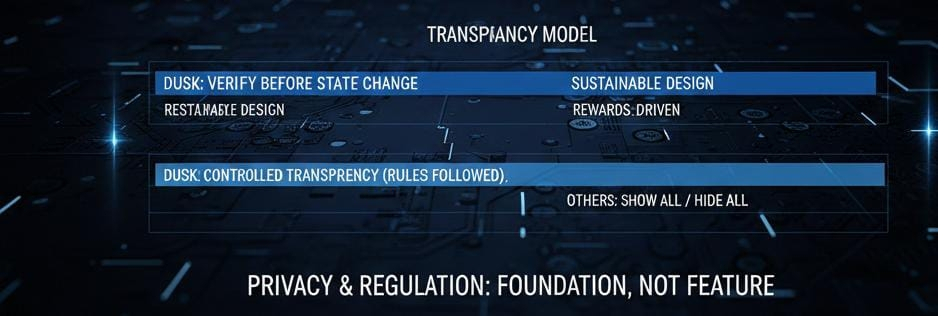

This also affects who uses the network at all. When compliance logic is enforced before state changes, not after, it limits frivolous activity. That sounds restrictive until you watch how much noise disappears as a result. Fewer meaningless transactions. Less artificial volume. Fees come from actions that matter, not from farming incentives. From a trading standpoint, that reduces one of the biggest distortions in crypto markets: volume that exists only to extract rewards.

Where value leaks is mostly in expectation mismatch. People come looking for explosive narratives and find a system optimized for correctness. They leave disappointed. Liquidity follows attention, so price reflects that departure. But the leak is not structural. It is psychological. The market often confuses speed with health. Dusk moves slowly because it enforces constraints most projects postpone. That slowness reads as stagnation until conditions change.

During broader market stress, when regulation becomes more than a headline and institutions pull back to reassess risk, Dusk’s design starts to matter in quieter ways. You see relative stability not because buyers rush in, but because sellers hesitate. There is less urgency to exit something that is not obviously broken. The floor holds not through defense, but through indifference. That is a strange kind of strength, and an uncomfortable one to trade around.

I rarely see euphoric volume on Dusk. When it spikes, it is usually tied to specific realizations rather than vague excitement. Even then, the follow through is measured. This frustrates those trained on reflexive pumps. For me, it signals a market that is not easily manipulated. That does not guarantee upside. It does reduce tail risk.

The biggest misunderstanding I see is the assumption that Dusk is waiting for its moment. As if there is a future switch that flips and suddenly everything accelerates. I do not read it that way. It feels more like a system already operating at its intended pace, indifferent to whether that pace aligns with speculative appetite. That indifference is rare. Most projects contort themselves to fit whatever narrative is liquid. Dusk does not. Markets punish that in the short term.

From a daily trading perspective, this means opportunities are fewer but cleaner. You are not trading announcements. You are trading behavior. Support and resistance matter less than context. Breakdowns that look scary often stabilize quietly. Rallies that look promising often stall without warning. You learn to size accordingly. Overexposure gets punished. Patience gets tolerated.

Where Dusk sits right now is not at the center of attention and not at the edge of irrelevance. It lives in that narrow band where fundamentals continue regardless of price, and price reflects that lack of urgency. It is not a verdict on success or failure. It is a snapshot of a market that has not decided what to do with discipline in an environment addicted to noise. I trade it with that understanding, aware that most of the time nothing dramatic will happen, and that when something finally does, it will probably be quieter than people expect.