@Plasma enters the market at a moment when liquidity has stopped being generous. Capital is no longer impressed by novelty alone. It wants systems that behave predictably when pressure shows up and quietly hold together when attention fades. I watch this shift daily across charts and flows, and it changes how projects are evaluated. The question is no longer what something could become, but how it acts right now when real money interacts with it. Plasma is being tested in exactly that environment.

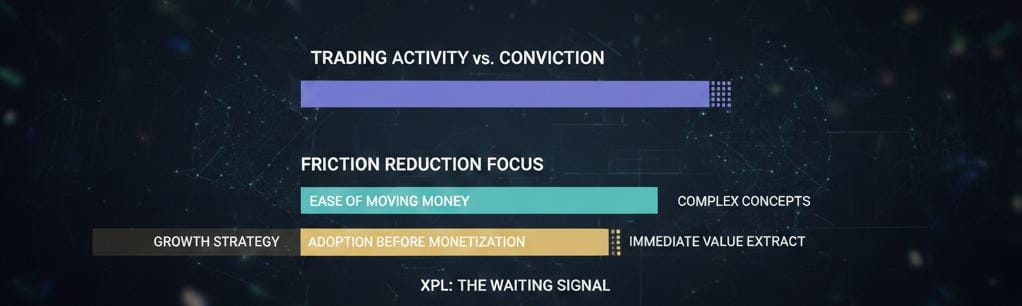

What stands out immediately is the contrast between activity and conviction. XPL trades often. Tokens move. Volume appears and disappears in cycles. Yet price struggles to earn patience. That tells me the market sees something interesting but not something settled. Traders are comfortable engaging short term, but few are willing to anchor capital and wait. This is not rejection. It is restraint. The market is keeping Plasma on probation.

In stress conditions this becomes clearer. When the broader market tightens and correlations rise, XPL does not collapse dramatically, but it also does not get defended aggressively. You see liquidity thin out instead of panic selling. Bids step back rather than get wiped. That behavior usually means holders are not overleveraged and expectations are already low. The asset is not crowded, which reduces forced exits, but it also lacks the kind of conviction that creates reflexive rebounds.

Silence is where Plasma reveals more than hype ever could. In low attention periods the chart flattens, but trading does not die. There is a steady churn that suggests the idea remains under observation. People are testing exposure, exiting, re entering, and watching how the system responds. This kind of action often appears before trust forms. The market is asking the same question repeatedly and waiting for behavior to answer it.

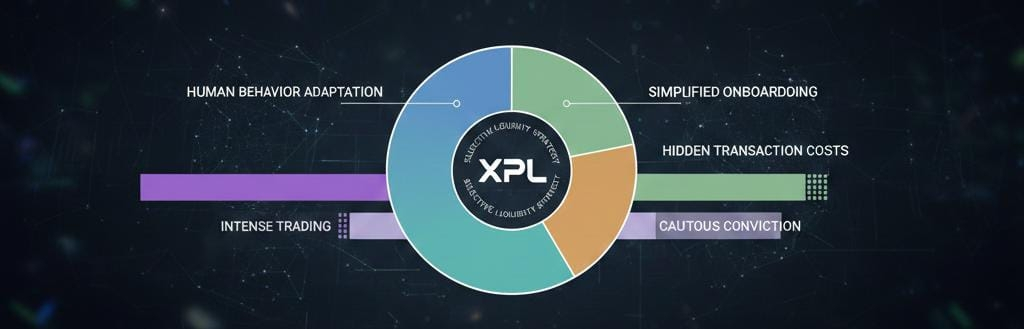

The central tension around XPL shows up in its token mechanics. Removing visible transaction costs changes how users behave, but it also changes how investors think. When fees are hidden or absorbed, usage can grow faster, but value capture becomes harder to trace. Traders sense this even if they cannot articulate it cleanly. You can see it in how rallies stall early. Price moves attract interest, but buyers hesitate to chase because the ownership loop does not yet feel closed.

During hype phases the same pattern repeats. Momentum brings attention, volume spikes, and then the move compresses. Sellers appear earlier than expected. Not aggressively, but consistently. That is usually the sign of participants treating the token as optional rather than essential. They are willing to trade the narrative but not marry it. Until ownership feels structurally necessary, that behavior persists.

What Plasma does well is reduce friction in a way the market immediately understands. You do not need a whitepaper to feel it. The idea of moving value without paying extra just to unlock movement resonates instinctively. That is why volume shows up so easily. Traders recognize the demand side logic. Where skepticism enters is on the supply side. How does usage translate into sustained demand for the token itself. That uncertainty caps valuation more effectively than any external criticism.

Incentives partially align but not fully. Validators and operators have reasons to participate, but long term holders are still waiting to see if their role is essential or incidental. When incentives are incomplete, value leaks slowly rather than violently. Price drifts. Interest cycles. Nothing breaks, but nothing resolves. This is exactly where XPL sits.

One common misunderstanding is assuming the market is ignoring Plasma. It is not. It is watching closely and refusing to extrapolate. That is a very different posture. The market has learned that smooth user experience does not automatically produce durable token demand. Many systems achieved adoption without rewarding ownership. Traders remember that. Caution here is not cynicism. It is experience.

From a trading perspective, this creates a specific kind of opportunity and risk. Downside is limited by low leverage and modest expectations. Upside is limited by unresolved value capture. You trade ranges, not dreams. You size smaller. You react rather than anticipate. Anyone looking for explosive continuation usually leaves disappointed. Anyone comfortable with ambiguity stays engaged.

The broader context matters. Capital is slowly rotating toward systems that resemble infrastructure rather than experiments. Stable value movement is one of the few areas with organic demand beyond crypto native behavior. Plasma positions itself close to that flow, which is why it continues to attract attention despite unresolved questions. It is touching something real, and real demand keeps it relevant even without narrative excess.

Execution pressure is constant here. If incentives tighten too early, usage suffers. If they stay loose too long, ownership weakens. The market is pricing that balance attempt in real time. Declining price alongside active trading is not a contradiction. It is a reflection of uncertainty being expressed through behavior rather than words.

Where Plasma belongs right now is in that narr8ow zone between curiosity and commitment. Not dismissed, not embraced. Actively tested. The market is letting it operate under observation, measuring whether simplicity can hold power once novelty wears off. That is not a verdict. It is simply where the project stands today, in a selective liquidity environment that rewards proof quietly and withholds patience until it is earned.#Plasma @Plasma $XPL