There is a certain kind of tension that lives in people who move money digitally, a tension that shows up in small pauses and repeated checks and that quiet moment of waiting where nothing feels fully real until the transaction settles, and Plasma is born from the decision to take that tension seriously instead of dismissing it as a user problem. From its earliest conception, Plasma is shaped around the idea that money is not abstract, not neutral, and never casual, because money carries stories of survival, responsibility, and hope, especially for people who live in economies where stability is fragile and trust in institutions has already been broken too many times. Plasma does not begin as a technological flex or a speculative playground, but as an emotional response to the reality that stablecoins have quietly become the most meaningful financial tool in crypto, not because they are exciting, but because they are dependable, and dependability is what people reach for when everything else feels uncertain.

The project grows out of a hard truth that many systems avoid, which is that most blockchains were never built for the emotional weight of money that actually matters. They were designed for experimentation, for optional participation, for users who could afford mistakes and delays, yet the world adopted stablecoins anyway because necessity does not wait for perfect infrastructure. Plasma emerges at that exact intersection where real human need collides with technical limitation, and instead of asking people to adapt, it adapts itself. It starts with the understanding that for millions of users, stablecoins are savings, wages, remittances, and lifelines, and that any network moving them must behave less like a laboratory and more like public infrastructure, calm under pressure and predictable even when the world outside is not.

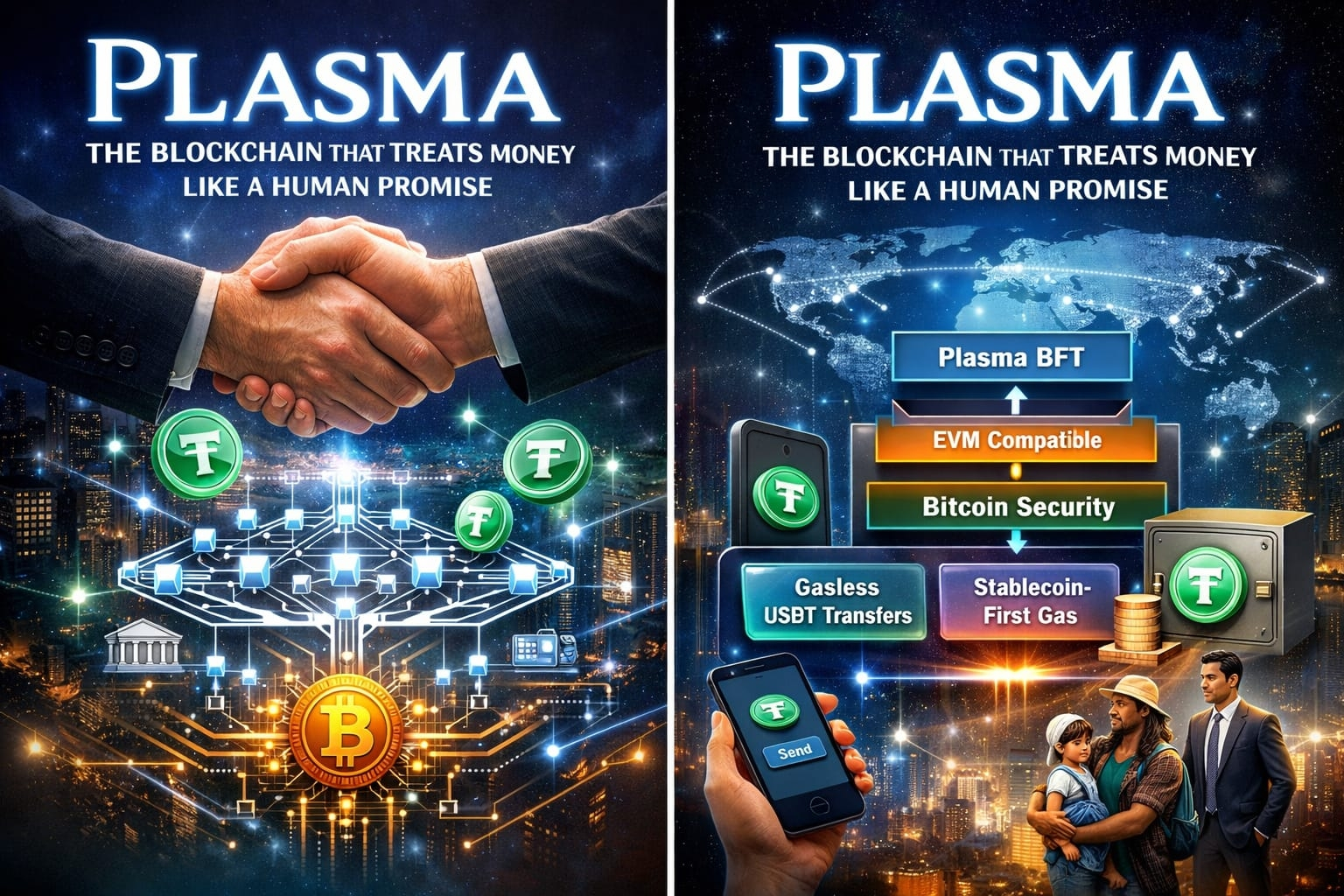

At a technical level, Plasma makes choices that reflect restraint rather than ambition for attention. Full EVM compatibility through Reth is not about trend alignment but about psychological safety for developers and institutions who already understand these tools and trust them with real value. Familiarity reduces error, and fewer errors mean fewer moments where someone’s livelihood hangs in the balance. Sub-second finality through PlasmaBFT is not framed as a performance benchmark but as an emotional one, because the difference between waiting seconds and waiting instantly is the difference between anxiety and relief. When value settles quickly, people feel it in their bodies, not their dashboards, and Plasma is built with an awareness that speed, in finance, is about peace of mind more than raw throughput.

Where Plasma truly separates itself is in how deliberately it centers stablecoins as the reason the chain exists rather than an asset class it happens to support. Gasless stablecoin transfers and stablecoin-first gas are not clever features but acts of respect toward users who should never be forced into volatility just to participate. Paying fees in the same unit you send feels natural, fair, and grounding, and over time that alignment changes how people relate to the system because it stops feeling like a maze and starts feeling like a utility. Plasma understands that friction is not just technical but emotional, and every unnecessary step erodes trust, especially for people who already feel excluded by financial systems.

Security on Plasma is approached with humility rather than bravado, which is why its Bitcoin-anchored design matters far beyond technical diagrams. By tying its security assumptions to Bitcoin, Plasma is not claiming superiority but acknowledging that trust is cumulative and must be inherited from systems that have survived real-world pressure. In a global environment where financial rails are increasingly shaped by political influence, regulation, and centralized choke points, this anchoring is a protective gesture, a way of saying that no single actor should control the flow of value. For users who have experienced censorship, frozen accounts, or sudden loss of access, this design choice resonates at a deeply personal level, because it speaks to freedom without demanding faith.

Operationally, Plasma measures success through repetition and reliability rather than moments of excitement. Uptime, consistent finality, predictable fees, and validator discipline are treated as sacred responsibilities, not background tasks. Its economic design resists the urge to turn participation into speculation, instead rewarding behavior that keeps the network stable and boring in the best possible way. Boring, in this context, means that the system works when people are tired, stressed, or under pressure, which is exactly when money systems are tested most. Plasma is built for those moments, not for screenshots.

Within the broader ecosystem, Plasma does not try to be everything, and that restraint gives it a quiet confidence. It positions itself as a settlement layer where stable value can move cleanly while wallets, payment platforms, and financial applications build on top without fear of sudden shifts in cost or behavior. This makes integration feel less like a gamble and more like a continuation of what already works, and that feeling lowers the emotional barrier to adoption. By choosing specialization over dominance, Plasma signals that it is playing a long game where relevance is earned through service rather than noise.

The real proof of Plasma’s purpose lives far from announcements or roadmaps and instead shows up in everyday repetition. It lives in salaries arriving when they are supposed to, in families sending support across borders without losing value to unpredictable fees, in merchants closing their books without bracing for congestion, and in institutions settling liquidity without operational stress. These moments rarely attract attention, but they define trust, and trust compounds quietly over time. When infrastructure works well, it disappears, and Plasma is intentionally designed to fade into the background of people’s lives while making those lives more stable.

None of this comes without risk, and Plasma does not pretend otherwise. A stablecoin-first chain exists within regulatory realities and issuer dependencies that are still evolving, and anchoring to Bitcoin introduces complexity that demands careful execution. Focus also means saying no to paths that might generate faster attention but weaker foundations. Plasma accepts these constraints because it understands that credibility is built through patience and honesty, not speed alone.

If Plasma succeeds, its impact may not feel dramatic, but it will feel human. It will feel like less fear when sending money, fewer questions about whether something will work, and more confidence in systems that quietly do their job. It points toward a future where blockchains stop asking people to trust them blindly and instead earn trust through calm consistency, and in a world that has grown exhausted by financial uncertainty, that kind of reliability is not just technical progress, but emotional relief.