Privacy in blockchain is often treated as a single technical problem with a single technical solution. If you can hide transaction details using zero-knowledge proofs, the assumption is that privacy is solved. Over the years, this thinking has shaped an entire category of “ZK-only” systems where privacy is defined almost entirely by cryptography. While these systems are powerful, they also reveal a limitation in how the industry understands privacy itself.

@Dusk approaches privacy from a different starting point. Instead of asking how to hide everything, it asks when, why, and for whom information should be hidden or revealed. That distinction may sound philosophical at first, but in practice it leads to a very different privacy model.

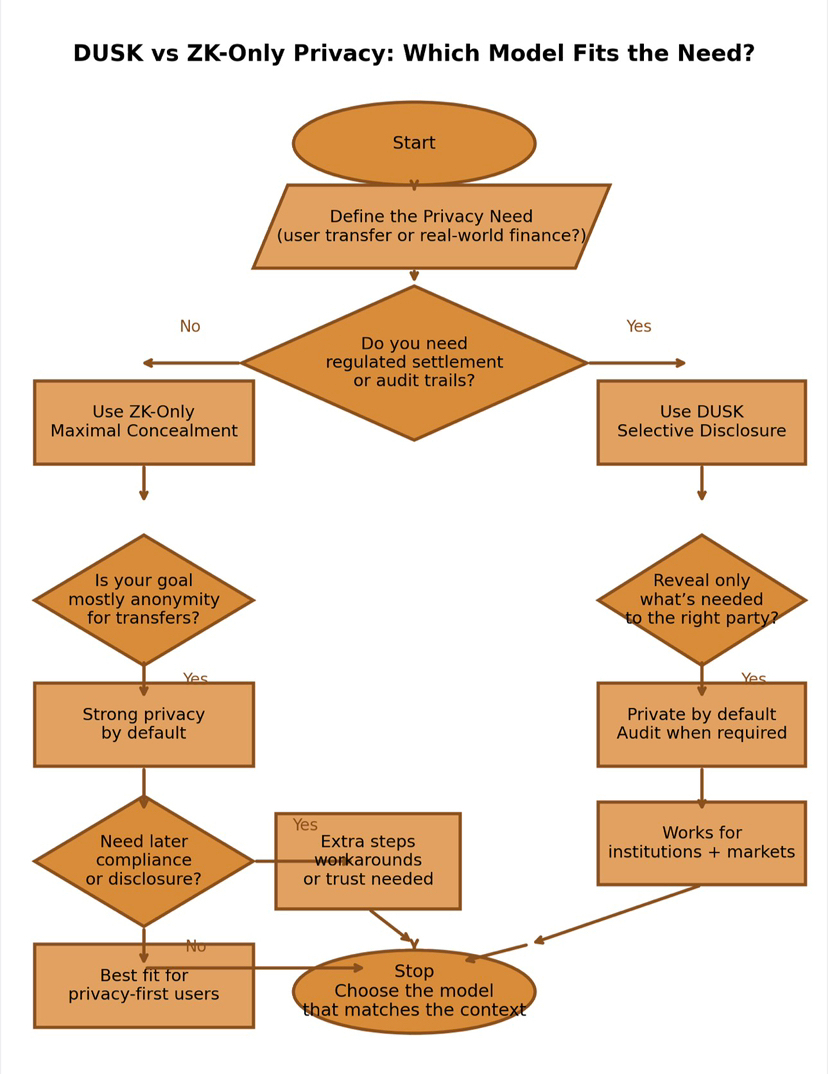

ZK-only systems are built around the idea of maximal concealment. Transactions are proven valid without revealing amounts, senders, or recipients. From a purely cryptographic perspective, this is elegant. It minimizes data leakage and reduces the surface area for surveillance. For individual users seeking anonymity, this approach can be effective. However, the moment blockchain use cases move beyond simple transfers into regulated finance, institutional settlement, or real-world asset issuance, the cracks begin to show.

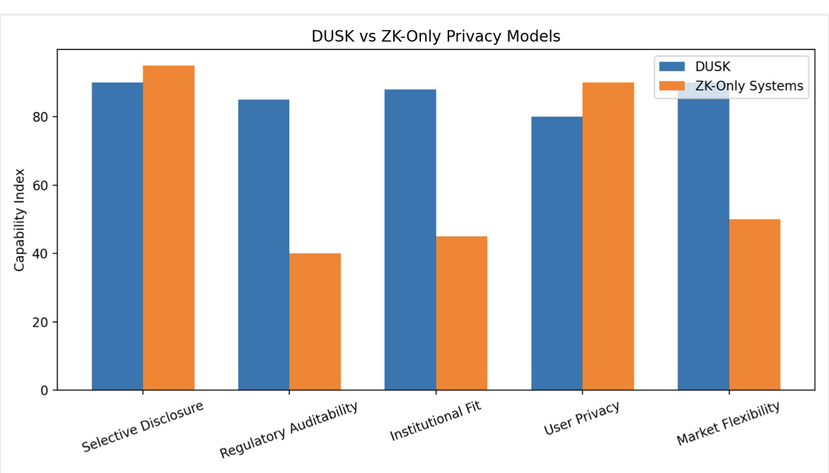

The core issue is that privacy is not binary in real economic systems. Financial markets do not operate in a world where everything is always hidden. They operate with selective visibility. Traders protect strategies, but regulators need audit trails. Companies protect sensitive data, but counterparties need assurance. ZK-only systems struggle here because their privacy model is rigid. Once something is hidden, revealing it later often requires complex workarounds, trusted intermediaries, or breaking the privacy guarantees entirely.

DUSK’s model is built around selective disclosure. Instead of making privacy absolute, it makes it programmable. Participants can prove facts about transactions or identities without exposing full details, and crucially, they can reveal information to specific parties when required. This shifts privacy from a static property to a dynamic one.

Technically, DUSK still uses zero-knowledge proofs, but they are embedded inside a broader system design. Privacy is enforced at the protocol level, not just at the transaction level. Identity, compliance, and settlement are all treated as first-class components. This allows DUSK to support private transactions while still enabling regulated use cases like tokenized securities, compliant exchanges, and institutional settlement.

One practical difference becomes clear when you look at auditability. In ZK-only systems, auditing is often an external process. Regulators or auditors must rely on offchain data or trusted disclosures from participants. The blockchain itself remains opaque. DUSK, by contrast, allows proofs to be generated that confirm compliance without revealing sensitive information publicly. Auditability becomes a native function rather than an afterthought.

Another difference lies in market structure. ZK-only systems tend to push all participants into the same privacy posture. Everyone is equally hidden, regardless of role. This is not how real markets work. Market makers, issuers, custodians, and regulators all have different visibility requirements. DUSK’s privacy model reflects this reality by allowing differentiated access. Privacy becomes contextual rather than uniform.

There is also a performance and usability dimension. ZK-only systems often require heavy cryptographic operations for every transaction. This can limit throughput, increase latency, or complicate user experience. DUSK balances cryptographic privacy with system-level design choices that keep the network usable for high-value, high-frequency financial activity. Privacy does not come at the cost of settlement guarantees.

Perhaps the most important distinction is philosophical. ZK-only systems are built around the assumption that blockchains should avoid interaction with real-world institutions. DUSK assumes the opposite. It assumes that blockchains will increasingly intersect with regulated finance, legal frameworks, and existing market infrastructure. Its privacy model is designed to survive that intersection rather than resist it.

This does not mean ZK-only systems are wrong. They are well suited for certain use cases where anonymity is the primary goal and external integration is minimal. However, they represent only one end of the privacy spectrum. DUSK occupies a different space, one that treats privacy as a system property shaped by economic and legal context, not just by cryptographic capability.

My take is that the future of onchain privacy will not be dominated by a single model. Absolute privacy and selective disclosure will coexist, serving different needs. What makes DUSK notable is that it does not force a choice between privacy and legitimacy. By designing privacy as something that can be proven, constrained, and revealed when necessary, DUSK aligns more closely with how real financial systems actually function. In that sense, it feels less like an alternative to existing markets and more like an evolution of them.