Most blockchains still behave like products competing for attention. Faster TPS, cheaper gas, louder narratives. Vanar takes a different approach. It treats blockchain as infrastructure — something users shouldn’t have to notice, understand, or even think about.

That design choice changes everything.

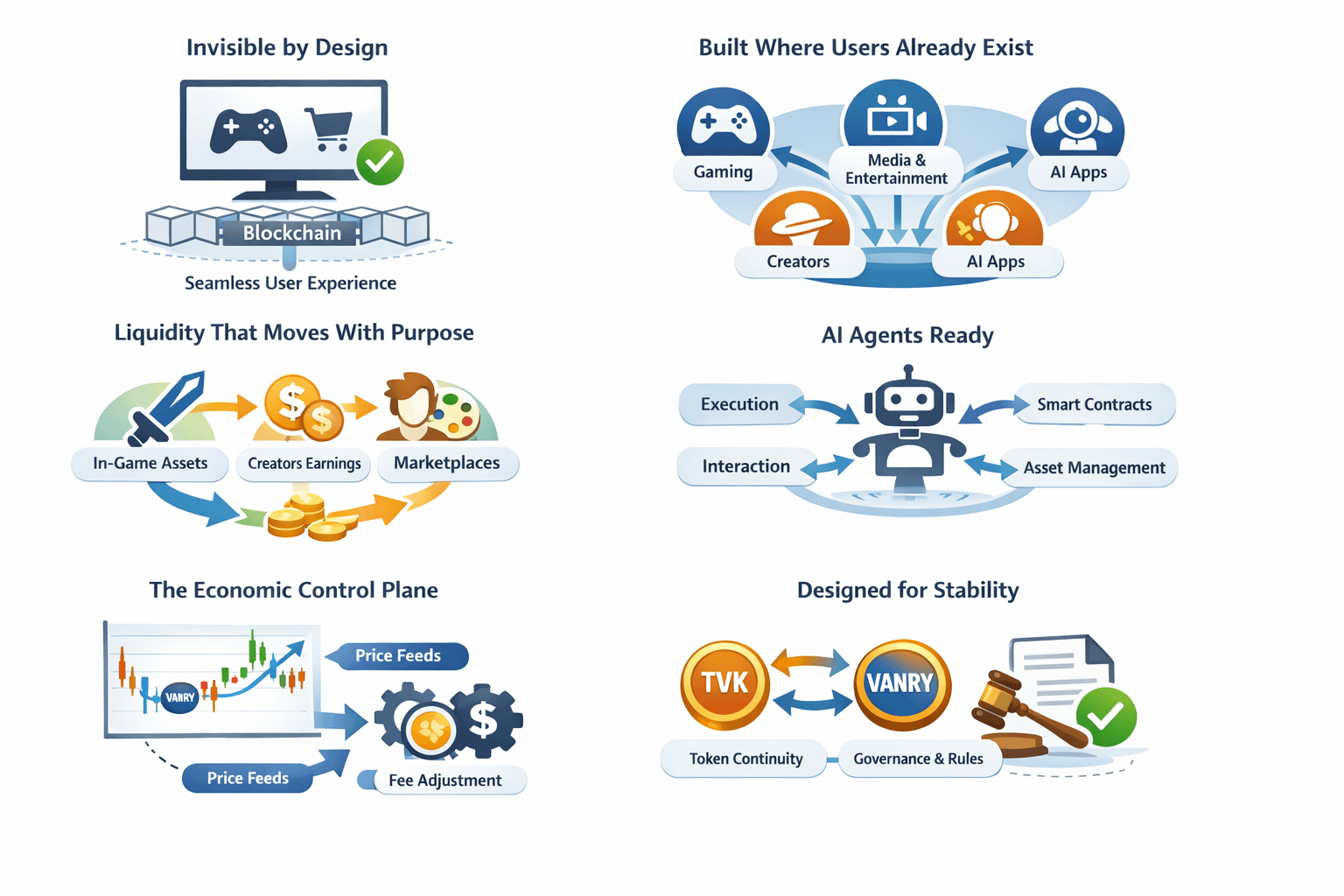

Invisible by Design

The best technology fades into the background. Users don’t think about TCP/IP when they browse the internet, and they shouldn’t need to think about chains, gas or wallets to enjoy Web3 applications.

Vanar Chain is built around this idea. Users click, play, and pay. The chain stays out of the way. Complexity is pushed downward into infrastructure, while experience stays front and center.

This is how Web3 starts to feel normal

Built Where Users Already Exist

Vanar doesn’t treat adoption as a marketing challenge. It treats it as an alignment problem.

Instead of launching empty ecosystems and hoping users arrive later, Vanar builds directly inside environments where digital activity already happens:

Games and virtual worlds

Entertainment and media platforms

Creator ecosystems

AI driven applications

These users aren’t chasing yield. They’re there for experiences. That distinction matters because experience-driven users behave differently: they stay longer, transact naturally, and generate organic activity instead of temporary volume.

Liquidity That Moves With Purpose

On many chains, liquidity is fragile because it exists only due to incentives. Once rewards disappear, so does activity.

On Vanar, liquidity is embedded directly into application flows:

In game assets circulate through economies

Creators earn and reinvest inside platforms

Marketplaces generate constant transactional demand

This creates circulation instead of stagnation. Capital moves because it has a reason to move.

AI Agents Change the Requirements

The most forward looking aspect of Vanar is how it prepares for AI agents.

AI agents are not speculative users. They operate continuously. They execute logic, manage assets, and interact with contracts at machine speed. This creates a workload that most blockchains were never designed to handle.

Vanar anticipates this shift by focusing on:

Predictable execution

Low and stable fees

Reliable state transitions

When costs spike unpredictably, automation breaks. Vanar treats this as an engineering problem, not a marketing slogan.

The Economic Control Plane

Vanar’s real innovation sits in its fee model.

Instead of auction-based gas pricing, Vanar targets fixed fiat-denominated transaction fees, adjusted at the protocol level. Fees update through a feedback loop that tracks the price of VANRY using multiple data sources.

This matters because:

Microtransactions remain viable

Subscriptions don’t break during congestion

AI agents can budget costs like cloud infrastructure

Fees are not promises. They are protocol truths, recorded on-chain and verifiable by builders, auditors, and machines.

Designed for Stability, Not Hype

Vanar also takes a conservative approach to token continuity. The transition from TVK to VANRY was framed as evolution, not replacement. That matters because sudden resets destroy trust and fracture communities.

Governance is treated as a steering mechanism, not theater. Fee parameters, incentives, and calibration rules are meant to be adjusted deliberately, balancing users, builders, and validators over time.

Final Take

Vanar represents a quiet shift in how blockchains should be evaluated.

The right question is no longer “how many features does this chain have?”

It’s “does this chain fit where digital behavior is already going?”

Users live inside applications.

Liquidity follows utility.

AI agents are becoming operators, not experiments.

Vanar assumes this future is already here and builds accordingly.