Most crypto discussions obsess over smart contracts, applications, and liquidity metrics. Yet real markets rarely fail because a contract was poorly written. They fail because information moves unevenly. Messages arrive late. Blocks propagate inconsistently. Different participants see the same reality at different times.

That kind of instability might be tolerable for casual token transfers. It is unacceptable for anything that wants to resemble finance.

This is where Dusk Network becomes more interesting than its usual label as a privacy chain. A major part of its seriousness lives below the application layer. Dusk is investing in predictable message delivery and controlled network behavior. That choice is quiet, unmarketable, and extremely important.

Why Message Delivery Is a Financial Primitive

In capital markets, timing is risk. If two participants receive the same information at different moments, someone gains an edge. If the network stalls during congestion, finality may still exist on paper, but execution becomes uncertain in practice.

This is why traditional exchanges spend enormous sums on networking. They are not chasing novelty. They are reducing variance. Uneven propagation creates uneven markets, and uneven markets erode trust.

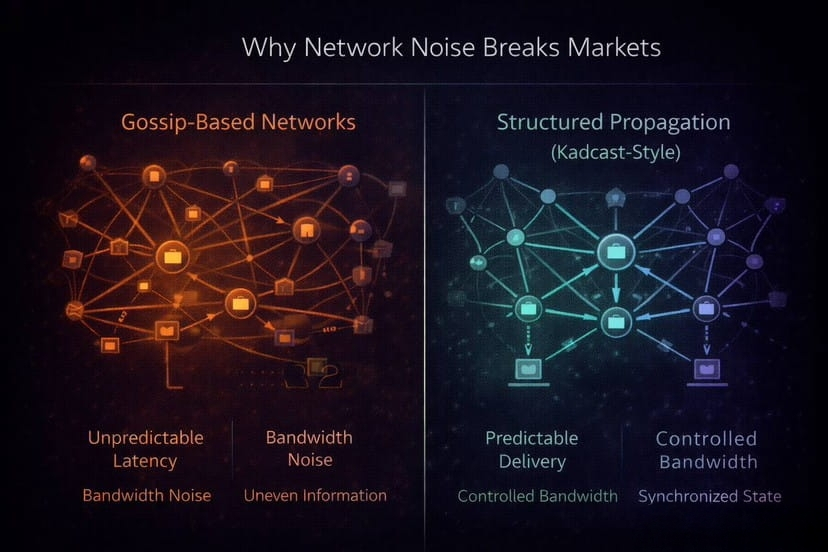

Most blockchains still rely on gossip style broadcasting. Nodes forward messages to random peers and hope they spread fast enough. Gossip is resilient, but it is also noisy. Latency varies wildly depending on peer paths, and bandwidth usage can explode under load. Dusk’s team has been explicit that this approach is not good enough for predictable markets.

Kadcast and the Case for Structured Propagation

Instead of leaning entirely on gossip, Dusk uses Kadcast, a structured overlay protocol designed to route messages more deliberately. In Dusk’s own architectural material, Kadcast is described as a way to reduce bandwidth usage while making message propagation more predictable.

This is not a cosmetic choice. It reflects a philosophy. The network is not treated as an accident of peer discovery, but as an engineered system. Messages are guided, not shouted.

For a chain that wants to support regulated workflows and confidential settlement, this matters more than raw throughput numbers. Predictability is a feature.

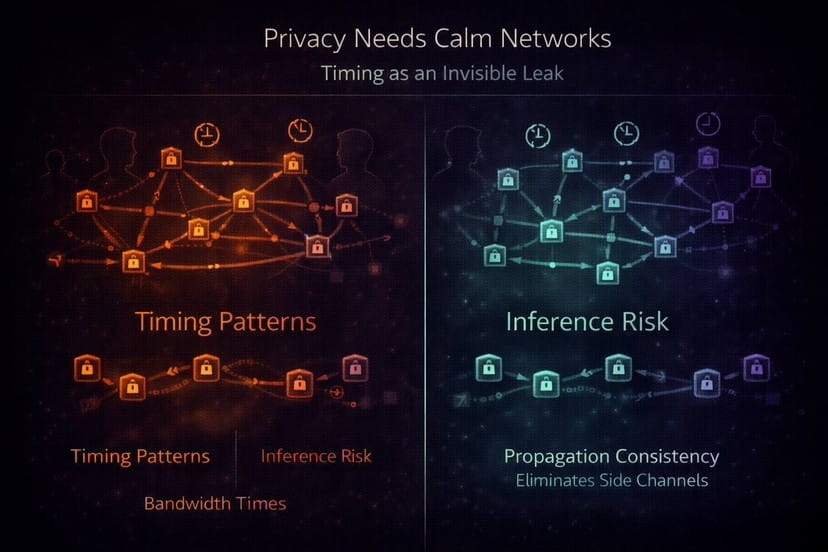

Why Networking Discipline Supports Privacy

Privacy in markets is not only about hiding balances or transaction contents. It is also about minimizing side channels. If propagation is unstable, timing patterns can leak information even when payloads are private. Who consistently sees transactions first, where congestion forms, and how quickly reactions occur all become signals.

Dusk frames its model as privacy by design and transparency when required. That philosophy only holds if the underlying network behaves calmly. A noisy network undermines privacy guarantees. A controlled network reinforces them.

Seen through this lens, Kadcast is not just a performance optimization. It is network hygiene.

Infrastructure Thinking Instead of Feature Chasing

Many crypto projects treat networking as an afterthought. Dusk treats it like product. Its documentation talks about bandwidth, propagation, and latency with the same seriousness others reserve for tokenomics.

That focus signals a different target audience. Institutions do not want chains that are theoretically elegant but operationally chaotic. They want systems that behave the same way every day, even under stress.

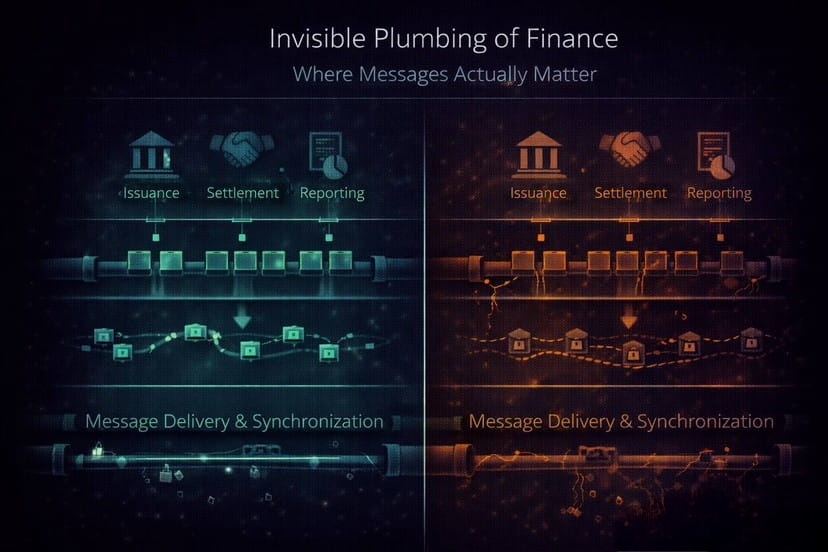

In practice, any chain aiming for real financial use needs three things. A stable settlement layer. Execution environments that can evolve without rewriting truth. And network plumbing that does not melt down when usage spikes. Dusk addresses all three explicitly.

Designed for Backends, Not Just Wallets

The infrastructure mindset shows up again in how Dusk expects developers and operators to interact with the network. The platform does not assume everything lives inside a smart contract.

Developers can deploy on DuskEVM using familiar tooling. They can write Rust or WASM contracts directly on the settlement layer. Or they can integrate at the backend level using APIs, events, and data feeds. This matters because real finance is built on servers, reconciliation systems, monitoring dashboards, and audits, not just wallets.

Even the way Dusk documents explorers and observability reflects this. Visibility depends on transaction type and disclosure rules, but the tools exist to understand what happened, when, and under what conditions. That is operational reality, not demo culture.

A Useful Mental Model: Dusk Optimizes for Calm

If i had to describe Dusk in one word, it would be calm.

Calm means predictable propagation. Calm means reduced bandwidth chaos. Calm means fewer surprises for operators and builders. Calm means the chain feels like infrastructure rather than an experiment.

Crypto often mistakes noise for progress. In distributed systems, noise is usually a warning sign.

What This Unlocks Over Time

If Dusk succeeds, it will not be because privacy became fashionable again. It will be because the chain becomes reliable enough that builders stop thinking about the chain entirely. They think about products, workflows, and markets.

The highest compliment infrastructure can receive is invisibility. The messages arrive. The settlement behaves. The system just works.

Dusk’s networking choices, combined with its integration paths and tooling, point toward that future. It is not loud. It is deliberate.

Final Thought

Blockchains are distributed systems before they are application platforms. Distributed systems live or die by their network behavior.

By investing in predictable propagation and treating network plumbing as a first class concern, Dusk signals that it is building for the constraints real markets live under. That discipline may never trend on social media, but it is exactly what long lived financial infrastructure requires.

In the end, the most important part of a market is not what you see. It is what quietly works underneath.