How Vitalik Is Quietly Breathing Life Back Into a Forgotten Scaling Path

Bitcoin could not outrun macro reality this time. After the Federal Reserve doubled down on a hawkish stance, BTC slid back to levels last seen before the February rally tied to Trump related optimism. Even high profile holders were left with paper losses. More than four hundred thousand over leveraged traders were wiped out in a single swing. The idea of Bitcoin as untouchable digital gold cracked the moment liquidity tightened.

If all i look at is the red candles, the story feels finished. But beneath the surface, something else has been happening. While the giants fight gravity, one of the oldest ideas in Ethereum scaling has quietly returned to relevance. Plasma, once considered a failed experiment, is resurfacing with a new technical backbone and a very different purpose.

This comeback is not driven by hype or leverage. It is driven by payments, stablecoins, and a shift in how value actually moves when speculation slows down.

Old Ideas Do Not Die, They Get Rewritten

Plasma first appeared in 2017, introduced by Vitalik Buterin and Joseph Poon. At the time, it was ambitious but impractical. Exits were complex, data availability was fragile, and the user experience was far from usable. When Rollups emerged later, Plasma was slowly pushed into the background and eventually treated like a museum exhibit from Ethereum’s early days.

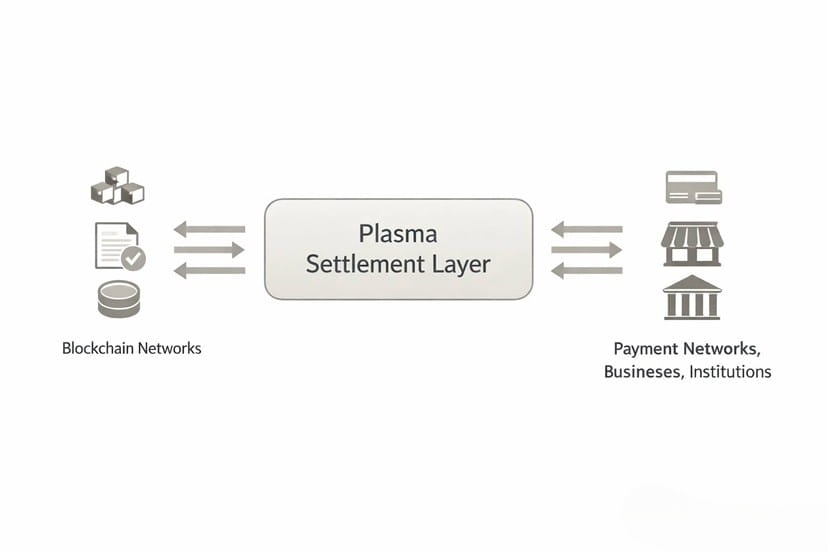

What changed is not the concept, but the tooling. Zero knowledge proofs reshaped what Plasma can be. New implementations no longer require every transaction detail to be posted on Ethereum. Instead, activity happens off chain, while cryptographic proofs act as certificates of correctness on the base layer.

For me, this is the key shift. Plasma stopped competing with Rollups on throughput and started competing on cost and simplicity. Where Rollups still pay rent for data posted on chain, ZK enhanced Plasma avoids that overhead entirely. The result is something Rollups struggle to offer in bad market conditions: transfers that effectively cost nothing.

Why Zero Fee Transfers Matter in a Downturn

In bull markets, nobody notices friction. In winter, every dollar matters. Gas fees that feel small during hype cycles become deal breakers when volumes drop and users turn cautious. This is exactly where Plasma finds its opening.

By keeping transaction details off chain and only submitting compact proofs, Plasma implementations can support stablecoin transfers without requiring users to hold native gas tokens. For anyone trying to move dollars rather than speculate, this is not a novelty. It is survival.

This is why i see Plasma less as a scaling trick and more as a financial rail. It is optimized for repetition, settlement, and boring reliability. That makes it poorly suited for memes, but surprisingly well suited for real usage.

Stablecoins Are the Real Subway System

Recent signals make this even clearer. The Plasma ecosystem wallet Plasma One has reportedly passed seventy five thousand registrations and started rolling out debit cards across Southeast Asia and the Middle East. That detail matters more than most charts. It shows where demand is actually coming from.

When markets are unstable, people do not ask how fast a chain is. They ask whether they can spend stable value without friction. Debit cards, local payments, and fee free transfers answer that question directly.

On the infrastructure side, Plasma’s integration with NEAR Intents pushed this further. Cross chain swaps across more than a hundred assets now happen at the protocol level. From a user perspective, it feels simple. From a systems perspective, it is a big step toward abstracting chains away entirely.

If i hold a depreciating asset, i can rotate into USDT without worrying about bridges or gas spikes. That experience is closer to how money actually moves in the real world.

Vitalik’s Quiet Signal

Earlier this year, Vitalik Buterin wrote that 2026 should be about reclaiming digital sovereignty. Reading that now, it feels less philosophical and more practical. Plasma’s revival aligns with that idea. It reduces reliance on congested base layers, lowers costs for ordinary users, and focuses on utility rather than yield.

This version of Plasma is no longer a research toy. It behaves more like a settlement subway for stablecoins, built for frequent stops rather than high speed thrills.

Reality Check Comes First

None of this saves over leveraged traders. No scaling solution can fight macro pressure or stop liquidity from evaporating. Technology is not a rescue plan for bad risk management.

What it can do is draw a clear line between speculation and utility. When conversations shift from price targets to whether i can pay for something without fees, the industry moves closer to reality.

The recent liquidation wave cleared out projects that existed only as narratives. What remains are systems focused on saving time, saving money, and removing friction. Plasma fits that profile better than most.

I do not know if Plasma will dominate the future. But in a market that finally values boring infrastructure over dreams, it makes sense that an old idea refined by zero knowledge proofs is finding oxygen again.

After the dust settles, the ability to move value cheaply, quietly, and predictably may matter far more than the color of the last candle.