Most blockchains behave like the weather. Some days things are calm, other days fees explode, and everyone is expected to just deal with it. Vanar takes a very different stance. It treats transaction pricing as an engineered system. Not vibes, not auctions, not hope. A control loop that is designed, monitored, and adjusted on purpose.

That sounds dull, but from where I sit, it is one of the hardest problems in crypto. I have seen apps break, subscriptions fail, and basic user actions become unusable simply because fees went wild. At that point, cheap fees as a slogan do not matter. What matters is whether the system can hold costs steady without lying to users.

This is where Vanar starts to feel less like a typical Layer one and more like an operating system for onchain spending.

Why predictability is not a slogan but a protocol responsibility

Most networks promise low fees when nothing is happening. The trouble shows up when demand spikes or the gas token price moves. Even a fast and cheap chain becomes expensive when the token pumps or when users start bidding against each other.

Vanar approaches this differently. Instead of letting the market decide fees through auctions, it targets a fixed fee expressed in fiat terms and adjusts protocol parameters based on the market price of VANRY. According to its documentation, the chain aims to charge a predictable fiat amount per transaction by updating fees at the protocol level.

To me, this changes the framing completely. It moves from saying fees should be low to actually trying to make them low by design.

Fees as a feedback loop, not a static setting

Stable pricing needs feedback. Vanar does not treat fees as a number you set once and forget. The protocol checks the price of VANRY regularly and adjusts transaction costs on a frequent schedule tied to block production.

I think of it like a thermostat. The system observes an input signal, the token price, and adjusts an output parameter, the fee setting, to keep the result stable. That is what a real control plane looks like.

This is why the fee story here feels more serious than marketing. They explain how it works, not just how it is supposed to feel.

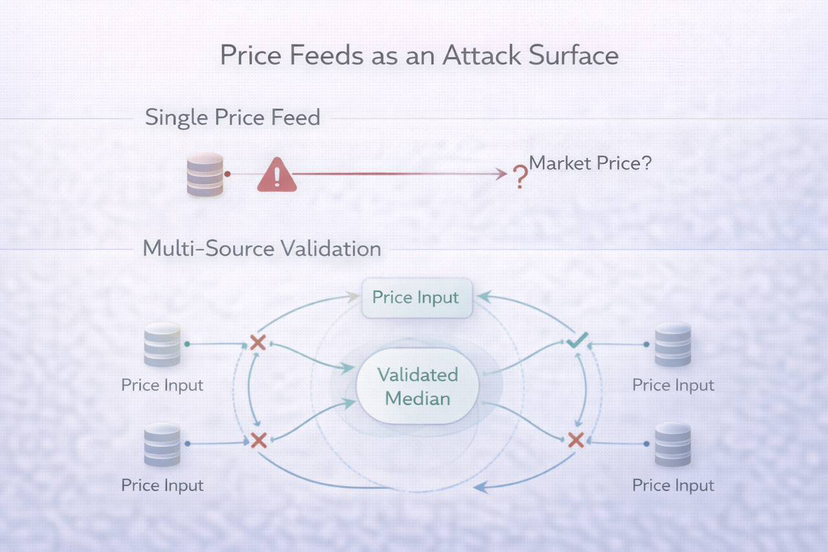

Price feeds are an attack surface and Vanar admits that

A fixed fee model only works if the price input is reliable. If the price feed can be manipulated, the entire system breaks. Attackers would love to trick the chain into thinking the token is cheaper or more expensive than it really is.

Vanar openly addresses this. The documentation describes validating price data across multiple sources, including centralized exchanges, decentralized exchanges, and public data providers. The idea is redundancy and cross checking rather than trusting a single feed.

That detail matters. It shows an understanding that price itself is something attackers will target and that resilience requires multiple viewpoints.

When fees live in the protocol, not the interface

Another subtle but important design choice is where fee data lives. Vanar records the base transaction fee directly in protocol data, specifically in block headers.

Why do I care about that? Because it turns cost from something the UI tells you into something the network itself asserts. Builders can read it deterministically. Auditors can reconstruct historical fee rules. Indexers can see exactly what the chain believed the correct fee was at any moment.

That reduces ambiguity, and ambiguity is poison for serious systems.

Machines need cost certainty more than humans do

People can tolerate uncertainty. We pause, we think, we click later. Machines do not. An agent that executes many small actions needs cost predictability the same way a company budgets cloud infrastructure.

From my point of view, this is the deeper reason fixed fees matter. They make the chain usable for automated systems that operate continuously. Random fee spikes are not inconvenient there, they are fatal.

So despite all the buzzwords, the Vanar fee control plane feels like an investment in a future of frequent, small, machine driven transactions.

Token continuity is also about trust

Economics is not just math. It is confidence. Vanar handled its token transition from TVK to VANRY as a continuity story rather than a reset. VANRY existed as an ERC twenty before mainnet migration, and the swap was framed as evolution, not replacement.

I think this matters more than people realize. Token changes often fracture communities because they feel like value resets. Minimizing that fear helps preserve trust even if markets do not immediately reward it.

Governance as steering, not noise

A control plane needs oversight. Vanar has discussed governance upgrades that allow token holders to influence fee calibration rules and incentive parameters through smart contracts.

That ties directly back to pricing. Builders want stability. Validators want sustainable rewards. Users want low costs. Those tradeoffs cannot be avoided, only managed. Governance becomes the steering wheel that guides the system through changing conditions.

Controlled pricing has risks and Vanar treats them as engineering problems

No fixed fee system is magic. It replaces chaotic auctions with the risk of miscalibration. If updates lag reality or governance decisions drift, the model can fail in different ways.

What I respect here is that Vanar frames these risks as technical and operational challenges, not ideological debates. Regular updates, multi source pricing, and governance are all parts of managing that risk.

Why this is bigger than cheap transactions

The way I see it, Vanar is trying to make blockchain costs behave like a service. Predictable enough to budget. Verifiable enough to audit. Stable enough for machines, businesses, and normal users to rely on.

If it works, the win is not just low fees. It is the ability to treat onchain execution like dependable backend infrastructure. And that is when blockchains stop feeling experimental and start feeling usable.