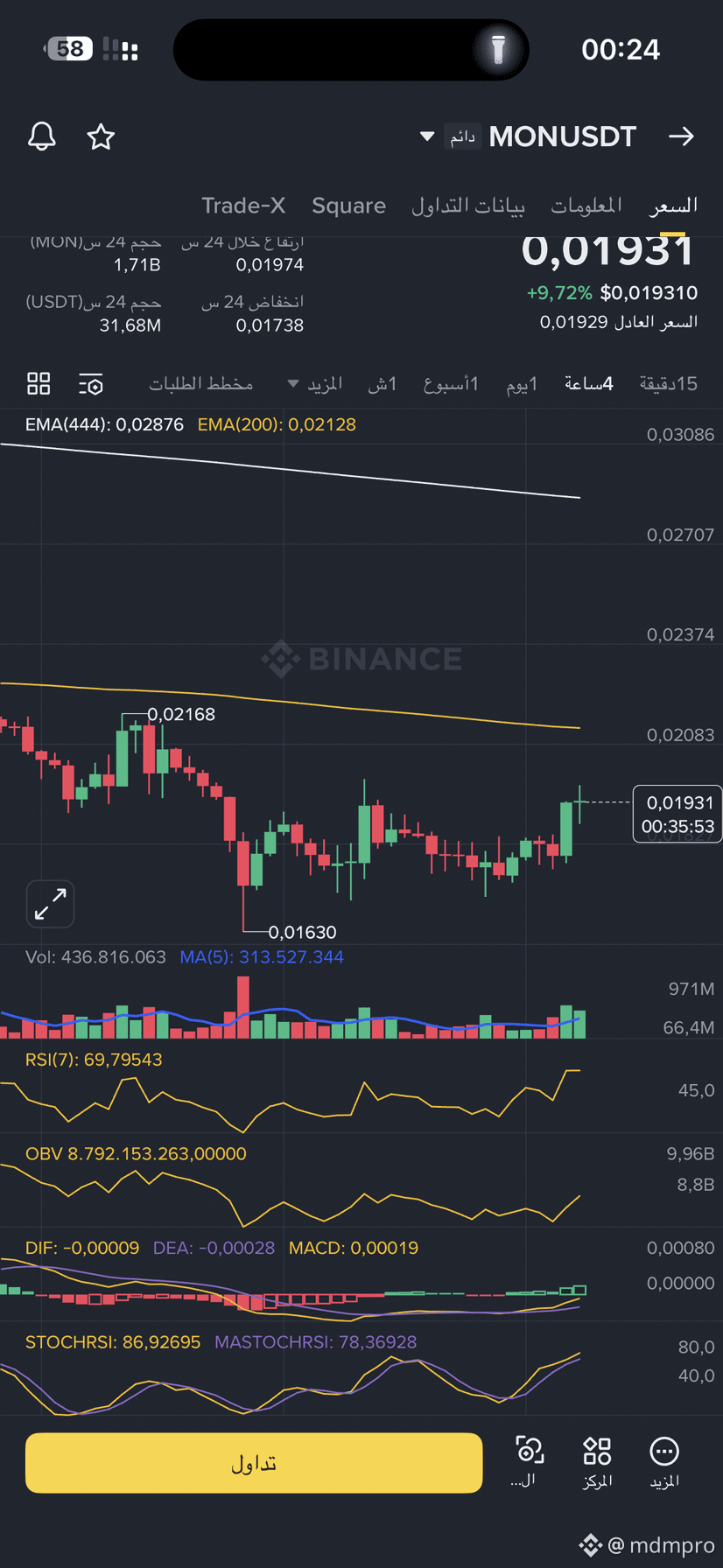

📉 Market Structure

• The overall trend is still bearish on the mid-term.

• Price is trading below EMA 200 (0.02128)

➡️ The current move is a technical rebound, not a confirmed trend reversal yet.

⸻

💰 Current Price

• 0.01931 USDT

• Strong bounce from the key support at 0.01630

• +9.7% intraday recovery

⸻

🧱 Key Levels

Support Zones

• 0.01820 – 0.01780 (minor support)

• 0.01630 (major structural support)

Resistance Zones

• 0.02080 – 0.02170 🔥 (EMA 200 resistance)

• 0.02370

• Strong resistance above at 0.028 – 0.029

⸻

📊 Indicators Analysis

RSI (7) ≈ 69.8

• Near overbought territory

• Strong momentum, but short-term pullback is possible

Stochastic RSI

• 86 / 78

• Overbought zone

➡️ Market may cool down before continuation

MACD

• Fresh bullish crossover

• Histogram turning positive

➡️ Bullish momentum is building, but still moderate

OBV (On-Balance Volume)

• Clearly rising

➡️ Confirms real buying pressure

Volume

• Above average

➡️ The rebound is volume-supported, not a fake move

⸻

🧠 Market Interpretation

• The rebound is legitimate, supported by volume and momentum.

• However, price is approaching a strong sell zone (EMA 200).

• A clean breakout above EMA 200 is required for trend reversal confirmation.

⸻

🎯 Scenarios

✅ Bullish Scenario

• Hold above 0.0190

• Break and close above 0.0217

• Targets:

• 0.0237

• 0.0260

• 0.0280 (requires strong volume)

❌ Bearish Scenario

• Rejection from 0.0208 – 0.0217

• Pullback toward:

• 0.0182

• Then 0.0163

⸻

⚠️ Trading Strategy

If you are already in:

• Consider partial profit-taking near 0.0208 – 0.0217

• Move stop-loss to 0.0185

• Avoid chasing price into resistance

If you are not in:

• No buying at resistance

• Wait for:

• A healthy pullback, or

• A confirmed breakout with strong volume

⸻

🧩 Final Note

MONUSDT is in a strong rebound phase, but still under# a bearish structure.

The real decision point is EMA 200