Trading volume today is doing more than just ticking numbers on a chart it’s quietly revealing where attention, fear, and conviction are flowing across the market.

At its core, trading volume measures how much of an asset changes hands within a given period. But in real trading conditions, volume is less about math and more about behavior. It tells us whether a move is being driven by real participation or just thin liquidity and noise.

Why Today’s Volume Matters More Than Price Alone

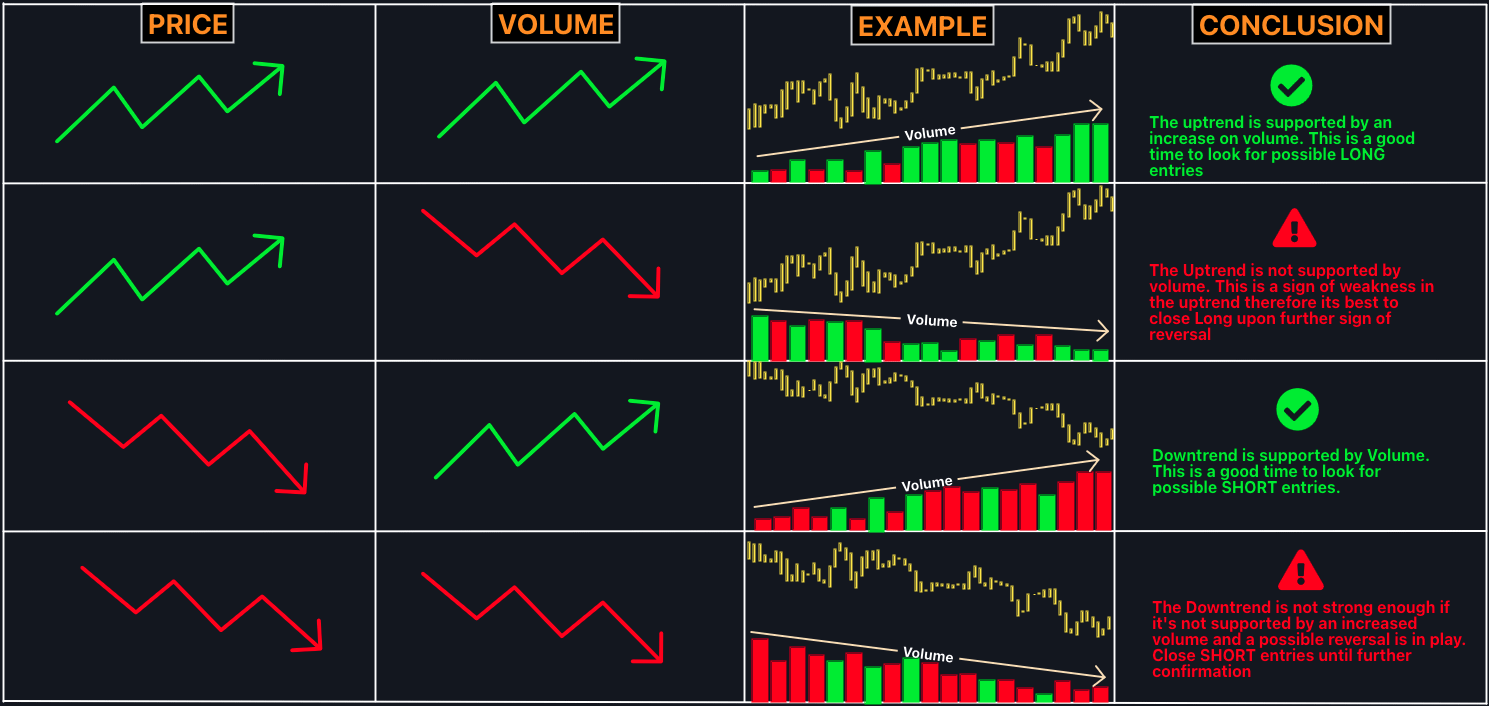

Price can move on very little volume, especially in uncertain or low-liquidity environments. But when volume expands, it means traders are actually committing capital. That’s when moves start to matter.

High volume with price expansion often signals strong conviction.

High volume with price rejection can hint at distribution or aggressive profit-taking.

Low volume moves are usually fragile and easier to reverse.

Today’s market volume reflects a cautious but active environment. Traders aren’t blindly chasing they’re positioning, reacting to levels, and rotating between assets rather than committing all-in

Volume as a Liquidity Check

Liquidity is what allows traders to enter and exit without excessive slippage. When volume is healthy, spreads tighten and execution improves. When volume dries up, even small orders can move price sharply.

That’s why many experienced traders won’t touch assets with declining or inconsistent volume. Today’s volume trends help identify where liquidity is concentrating and where risk is quietly increasing.

What Volume Says About Market Sentiment Today

Volume doesn’t tell you direction it tells you interest.

Right now, volume patterns suggest:

Hesitation near key resistance levels

Increased activity around support zones

Short-term traders dominating over long-term conviction buyers

This usually happens when the market is waiting for confirmation — whether from macro news, technical breakouts, or a shift in sentiment.

How Traders Use Today’s Volume in Real Time

Day traders use volume to confirm breakouts and avoid fake moves. If price breaks a level without volume, it’s often a trap.

Swing traders watch volume trends over several sessions to judge whether a trend has strength or is losing momentum.

Larger players track volume to assess whether the market can absorb size without violent price swings.

Volume is often the difference between a clean trade and an expensive mistake

Final Takeaway

Today’s trading volume is a reminder that markets don’t move on price alone they move on participation. Volume shows where traders are confident, where they’re nervous, and where battles between buyers and sellers are unfolding in real time.

If you’re watching the market today, don’t just ask where price is going.

Ask who is actually showing up to trade.

That’s where the real signal lives.