In reflecting on the day to day operations within cryptocurrency ecosystems, I have often found myself pausing over the quiet mismatches between what networks promise and how they perform during routine spikes in activity. Take stablecoin transfers, for instance these have become the unassuming backbone of digital finance, handling everything from cross border remittances to simple peer to peer settlements. Yet, in networks designed primarily for broad computational versatility, these transfers frequently encounter delays that feel disproportionate to their simplicity. It's not a dramatic failure, but a subtle erosion: users expecting near instant confirmations instead face waits that stretch into tens of seconds or minutes, especially when the system contends with competing demands like complex smart contract executions.

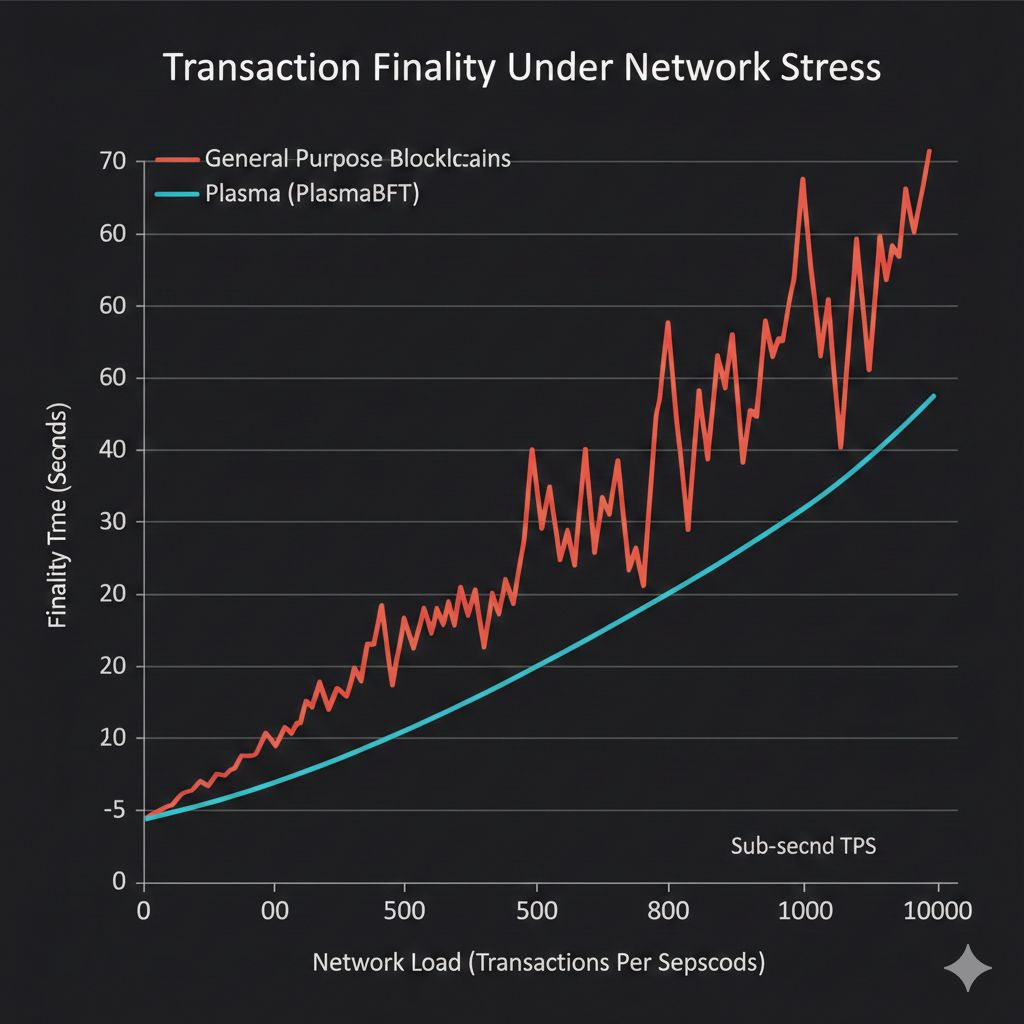

This friction points to a deeper structural issue in many blockchain architectures. At their core, these systems were engineered with an emphasis on decentralization and security for a wide array of applications, which inadvertently introduces inefficiencies for high frequency, low complexity operations. Consider the incentives at play: validators in proof of work or even some proof of stake setups prioritize blocks packed with high fee transactions to maximize rewards, often sidelining simpler payments. Under stress say, during market volatility when stablecoin movements surge the network's coordination mechanisms struggle to maintain consistent finality. This isn't just about speed; it's a fragility in scalability where the time to achieve irreversible transaction settlement balloons, creating trust gaps for users who need reliability in real-time scenarios. Industry behavior exacerbates this, as developers gravitate toward layering solutions on top of existing chains rather than rethinking the base layer, leading to patchwork fixes that mask but don't resolve underlying coordination failures.

Over time, this hidden problem compounds. As adoption grows, particularly in regions reliant on stablecoins for everyday economics, the ecosystem risks persistent bottlenecks. Systems that can't guarantee quick finality under load foster hesitation in integration with traditional finance rails, where sub second confirmations are standard. It's a system level reasoning: without architectural adjustments, the persistence of these delays could limit blockchain's role to niche speculation rather than foundational infrastructure, undermining long term reliability for global scale usage.

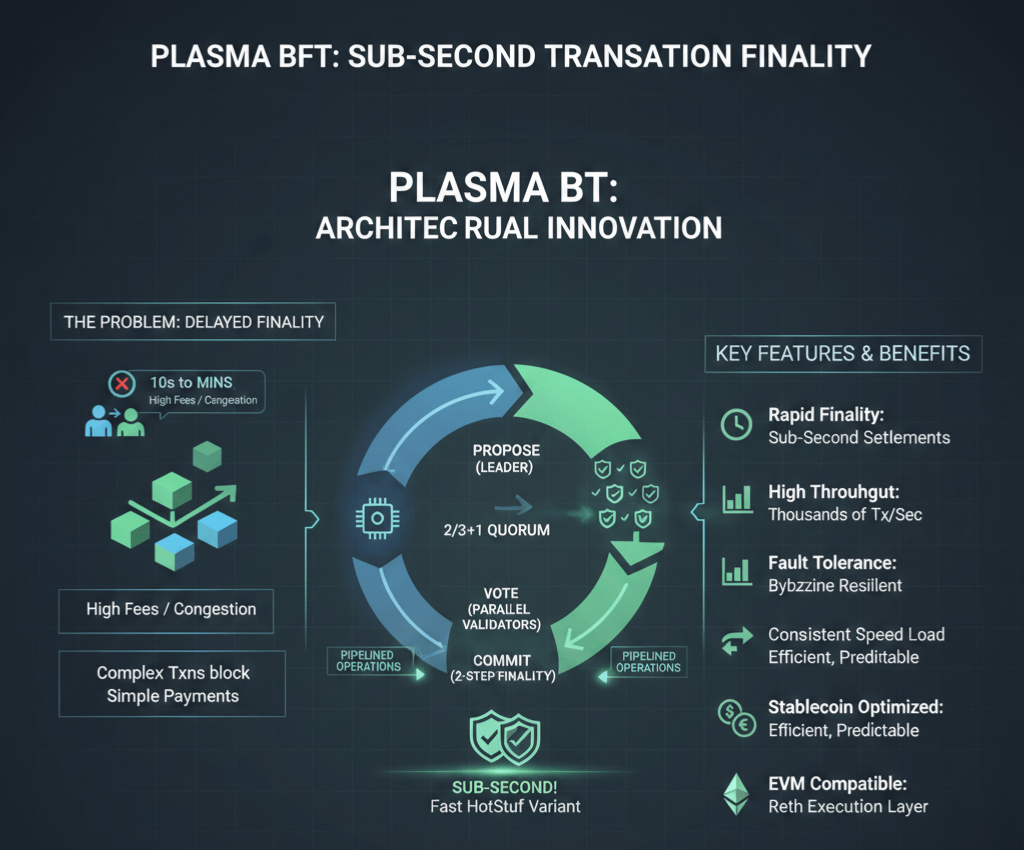

This is where the design of Plasma begins to offer a thoughtful alternative, not through additive features but by reorienting the infrastructure itself toward payment centric efficiency. At the architectural level, Plasma integrates a consensus mechanism called PlasmaBFT, which reimagines how blocks are proposed, validated, and finalized to prioritize rapid settlement. Drawing from the Fast HotStuff protocol a variant of Byzantine Fault Tolerant consensus PlasmaBFT streamlines the process by pipelining operations, allowing multiple stages of block production to overlap rather than proceed sequentially. In essence, it decouples the heavy lifting of transaction execution from the swift agreement on block order, ensuring that finality isn't bottlenecked by exhaustive communication rounds among validators.

Delving deeper, PlasmaBFT achieves this through a optimized commit path that often requires only two consecutive quorum certificates to confirm a block's irreversibility. A quorum certificate here represents a threshold of validator agreement, typically two thirds plus one in a network tolerant of up to one third faulty nodes. By avoiding a third confirmation phase in normal conditions, the mechanism reduces latency significantly, enabling transaction finality in sub-second intervals even as throughput scales to thousands of transactions per second. This isn't a superficial tweak; it's a fundamental shift in how the system handles asynchrony and potential faults, using a leader based rotation to propose blocks while validators vote in parallel, minimizing the rounds needed for consensus. On Plasma, this pairs with a modified execution layer based on Reth, which handles EVM compatible logic efficiently, but the real innovation lies in consensus ensuring that stablecoin focused workloads don't compete unnecessarily for resources.

The significance of this design choice becomes clearer when considering long term dynamics under scale and stress. In a network like Plasma, built expressly for stablecoin flows, sub second finality means that even during peak usage such as a sudden influx of remittances or merchant settlements the system maintains predictable settlement times. This reliability fosters better incentives: users and developers can build applications assuming near instant irrevocability, reducing the need for off chain workarounds that introduce their own trust dependencies. Over years of operation, as transaction volumes compound, this architectural focus on low latency consensus could enhance persistence by distributing load more evenly across validators, avoiding the centralization pressures that plague slower systems where delays incentivize pooling resources. In real world usage, where network partitions or malicious actors might emerge, PlasmaBFT's Byzantine tolerance rooted in its quorum requirements ensures that finality holds without sacrificing speed, potentially making Plasma a more robust foundation for integrating with legacy financial systems that demand deterministic outcomes.

Of course, no architectural approach is without trade-offs, and it's worth examining potential risks thoughtfully. One concern is the reliance on a relatively synchronous network assumption in BFT protocols; in highly adversarial or geographically dispersed environments, message delays could occasionally force fallback to additional confirmation rounds, tempering the sub-second ideal. Additionally, while PlasmaBFT promotes decentralization through proof-of-stake staking, there's a risk that economic incentives might concentrate validation power among fewer entities, echoing issues seen in other chains. These aren't negligible history shows how consensus mechanisms can falter if participation wanes or if attacks exploit timing vulnerabilities. However, Plasma addresses these by embedding economic safeguards, such as slashing for faulty behavior and rewards tied to consistent uptime, which encourage broad validator distribution. Moreover, the pipelined nature allows for graceful degradation: even in suboptimal conditions, finality remains faster than many alternatives, preserving usability. By anchoring certain security aspects to Bitcoin's chain for added resilience, Plasma further mitigates risks, creating a hybrid model that balances speed with layered protections.

Reflecting on these elements, what stands out is how PlasmaBFT's emphasis on streamlined, fault tolerant consensus could quietly reshape the infrastructure for stablecoin economies. In an ecosystem often dominated by narratives around speculative yields or expansive metaverses, this direction toward efficient, reliable settlement may prove more enduring, enabling the kind of persistent systems that underpin real economic activity without fanfare.