I’ll start with the uncomfortable truth most traders gloss over: Dusk is not priced, positioned, or even designed for the same capital that chases high-throughput L1s, meme narratives, or short-lived DeFi yield. When you look at Dusk through that lens, it looks slow, quiet, and under-discussed. When you look at it through the lens of where regulated capital actually breaks, it starts to look deliberately asymmetric.

The first non-obvious signal is where activity doesn’t show up. You don’t see Dusk liquidity being mercenary in the usual sense. TVL doesn’t spike on emissions announcements, and wallets interacting with the network aren’t rotating in and out chasing APRs. That’s usually read as weakness. In reality, it tells you the chain isn’t optimized to reward fast capital. That’s intentional. Dusk’s architecture makes capital sticky by increasing the cost of exit, not through lockups, but through compliance-aware workflows that don’t port cleanly to other chains.

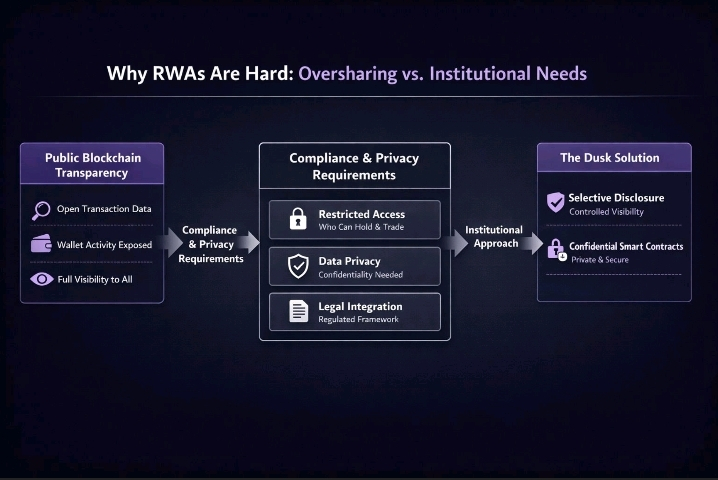

Most L1s optimize for throughput because throughput flatters metrics. Dusk optimizes for transaction semantics. Its privacy model isn’t about hiding balances for retail users it’s about enabling selective disclosure under audit. That distinction matters because it changes how transactions cluster. On-chain, you see fewer micro-interactions and more batched, institution-shaped flows. That reduces fee churn but increases predictability, which is exactly what regulated issuers care about and what traders often underestimate as a source of long-term fee stability.

The modularity in Dusk isn’t about developer flexibility in the abstract. It’s about isolating regulatory surface area. By separating execution, privacy, and compliance logic, Dusk can evolve one layer without invalidating the others. In practice, that means an asset issuer doesn’t face smart contract migration risk every time regulation shifts. From a market perspective, that lowers protocol migration pressure, which is one of the silent killers of L1 token value over time.

Token behavior reflects this. DUSK doesn’t rely on reflexive DeFi demand to support price. That sounds bearish until you realize reflexivity is what collapses first in risk-off cycles. Dusk’s token demand is tied to network participation that cannot be replicated via liquidity incentives alone. Validators and application operators have a reason to hold and stake beyond yield: losing network position has real business consequences. That’s a fundamentally different incentive stack than “stake until emissions decay.”

Another underappreciated angle is how Dusk handles transparency asymmetry. Most chains force everyone into the same disclosure model. Dusk allows graduated visibility. That changes counterparty behavior. Institutions are more willing to transact when they can prove compliance without broadcasting strategy. That doesn’t show up as volume explosions, but it shows up as lower variance in activity across market regimes a trait that becomes valuable when volatility spikes and speculative volume evaporates.

From a capital rotation standpoint, Dusk sits in an odd but increasingly relevant pocket. We’re in a market where risk appetite is selective, not expansive. Capital isn’t looking for the next everything-chain; it’s looking for systems that won’t implode under scrutiny. You can see this in how RWA narratives have shifted from “tokenize everything” to “tokenize what regulators won’t kill.” Dusk quietly fits the latter, not the former.

One subtle on-chain behavior worth noting is wallet concentration stability. You don’t see the typical pattern of early whales aggressively distributing into retail spikes. That’s partly liquidity, but it’s also alignment. Many of the larger holders are structurally tied to network operation or application deployment. Their incentive is network credibility, not short-term price action. That dampens upside in euphoric phases, but it also dampens downside cascades something traders only appreciate after getting chopped up in high-beta ecosystems.

Under stress, Dusk behaves more like infrastructure than speculation. There’s less leverage built on top of it, fewer liquidation chains, and almost no dependency on recursive DeFi structures. That means when the broader market deleverages, Dusk doesn’t get dragged into forced selling the same way yield-heavy ecosystems do. It’s boring in bull mania. It’s resilient when funding rates flip and liquidity disappears.

The real bet with Dusk isn’t “will retail discover it.” It’s whether on-chain finance eventually has to converge with real compliance constraints instead of pretending they’re optional. Every cycle, that convergence moves a little closer. You can see it in custody standards, stablecoin regulation, and permissioned DeFi experiments that quietly fail because they can’t balance privacy with auditability. Dusk’s edge is that it was designed around that tension from day one, not retrofitted after regulators showed up.