🇸🇻 El Salvador vs 🇺🇸 Saylor: A Bitcoin Story No One Talks About

El Salvador started buying Bitcoin in 2021.

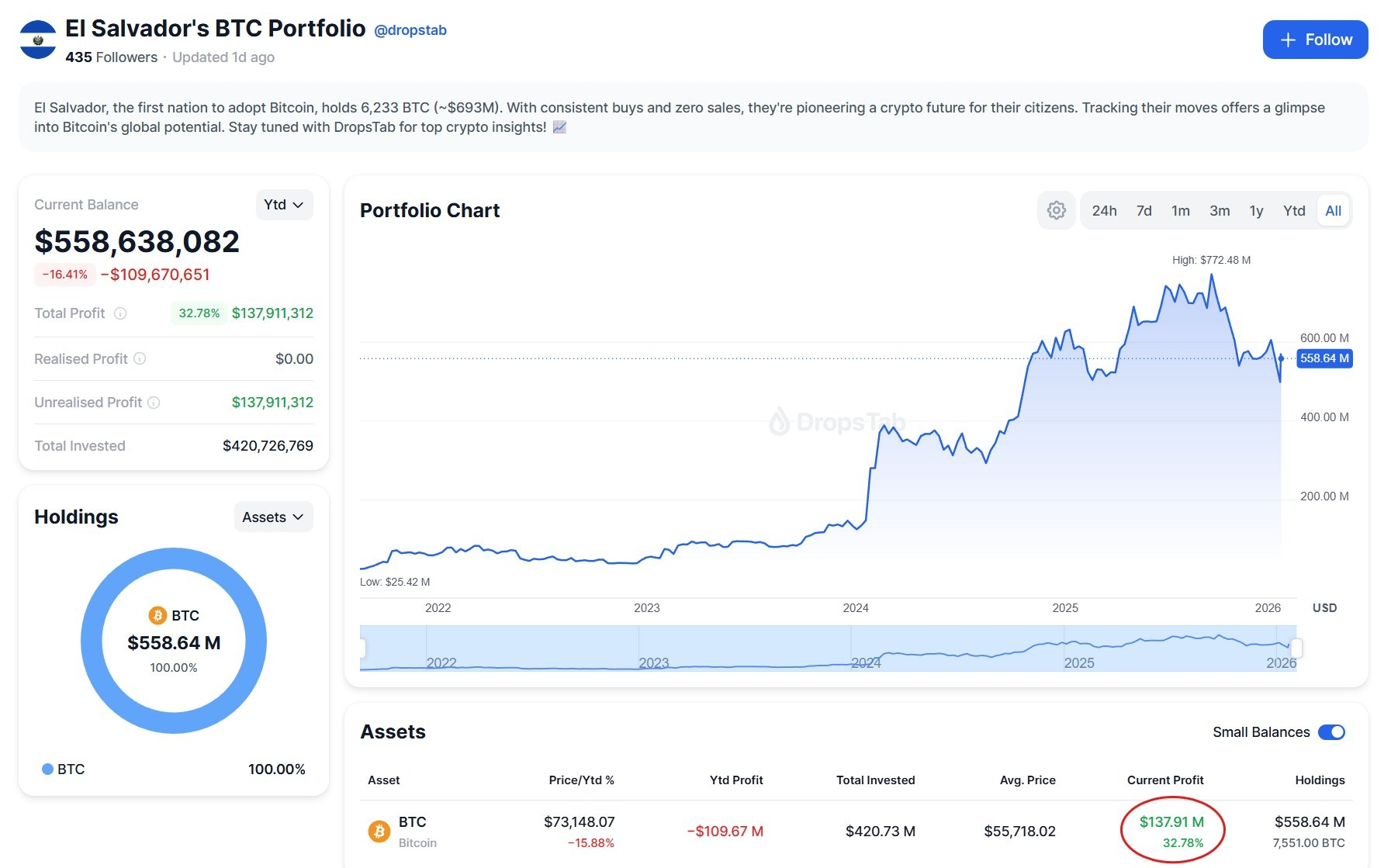

They’ve invested around $400M — about 140× less than Saylor’s $56B.

They currently hold 7,551 BTC, nearly 95× less than Saylor’s 713,502 BTC.

Yet even after the recent market crash, El Salvador is still sitting on about $137M in profit.

Meanwhile, Saylor — who had a 6-year head start and over 100× more capital — is currently down around $2B.

How is this even possible?

Simple: timing, average entry, and strategy.

El Salvador accumulated gradually through bear markets and volatility, lowering its average cost.

Saylor, on the other hand, deployed massive capital at different market phases, including near local tops.

Same asset.

Completely different outcomes.

It’s not just about how much you buy…

It’s when and how you buy it.

Sometimes, the smaller player with better timing wins the game.