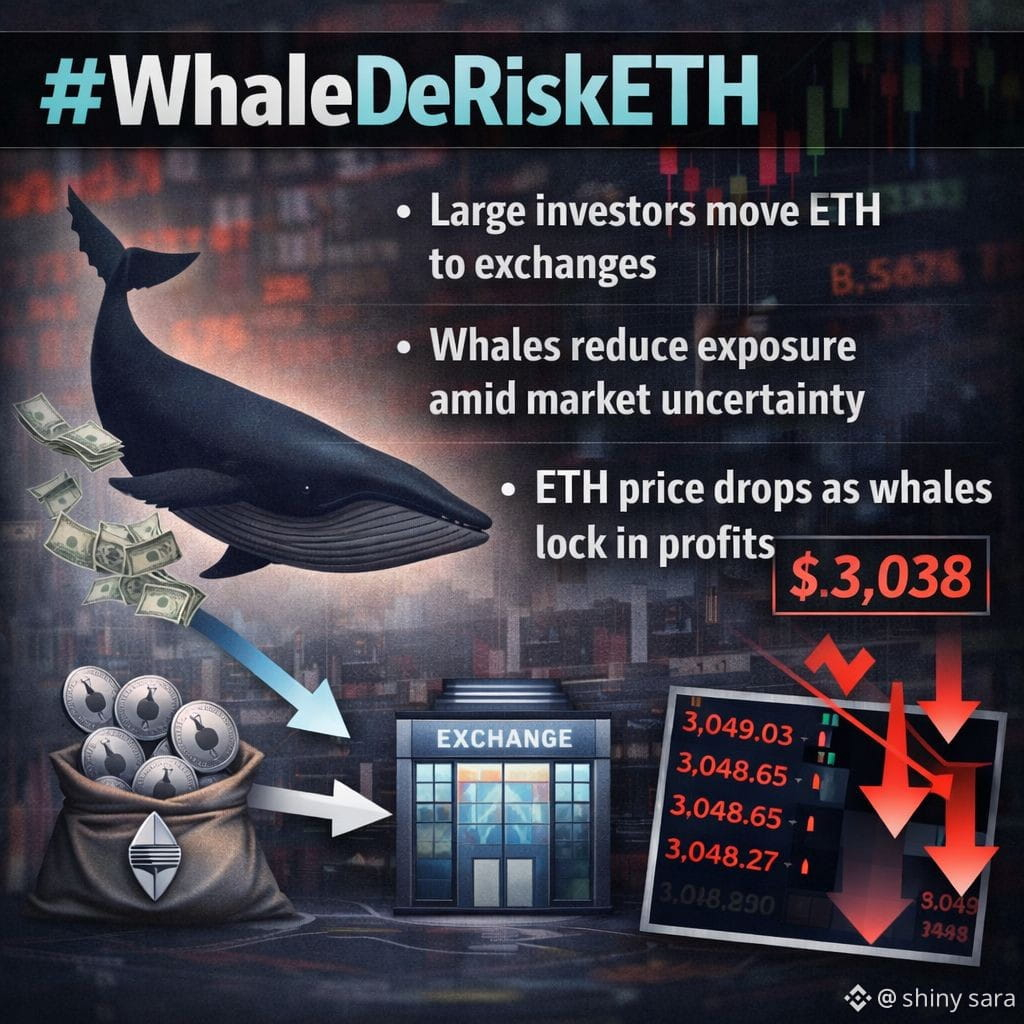

#WhaleDeRiskETH reflects a growing trend where large Ethereum holders, commonly known as whales, are reducing their exposure amid uncertain market conditions.

On chain data has shown notable ETH movements from long term wallets to exchanges, sparking speculation that some major investors are locking in profits or hedging against potential volatility.

These shifts don’t always mean a bearish outlook, but they often signal caution among experienced market participants.

Several factors are driving this behavior. Macroeconomic uncertainty, shifting interest rate expectations, and broader crypto market consolidation have encouraged whales to manage risk more actively.

Additionally, rising competition from alternative blockchains and ongoing debates around Ethereum’s scalability and transaction costs have influenced investor sentiment.

Some whales are reallocating funds into stablecoins, Layer 2 ecosystems, or diversified portfolios to balance risk.

For traders, whale de risking can increase short term volatility, as large sell orders or liquidity changes affect price action quickly.

However, it may also create opportunities for smaller investors if corrections bring ETH to attractive accumulation zones.

Ultimately, while whale movements attract attention, long term Ethereum fundamentals remain tied to network adoption, developer activity, and broader crypto market trends rather than short-term positioning alone.