Most traders look at a sudden drop and think “the bull run is over.”

Experienced investors look at the same move and think “liquidity sweep.”

Big trends don’t move straight up.

Before every major breakout, the market needs to clean the board.

That’s exactly what Bitcoin is doing now.

🧹 A Necessary Reset

When price rallies for months, leverage piles up.

Too many traders get comfortable.

Stops cluster. Liquidation zones build.

Then comes the flush.

Price dips sharply, fear spikes, and overleveraged positions are forced out.

This creates a healthier structure and gives strong hands better entries.

Not weakness.

Preparation.

📈 Why This Is Bullish Long-Term

✔️ Long-term trend still intact

✔️ Strong demand near key support

✔️ Whales historically accumulate during fear

✔️ Previous cycles show similar shakeouts before massive rallies

Markets don’t reward impatience.

They reward conviction.

🧠 The Bigger Picture

This move isn’t the end of the bull cycle.

It’s the reset button that often appears right before acceleration.

Think of it as:

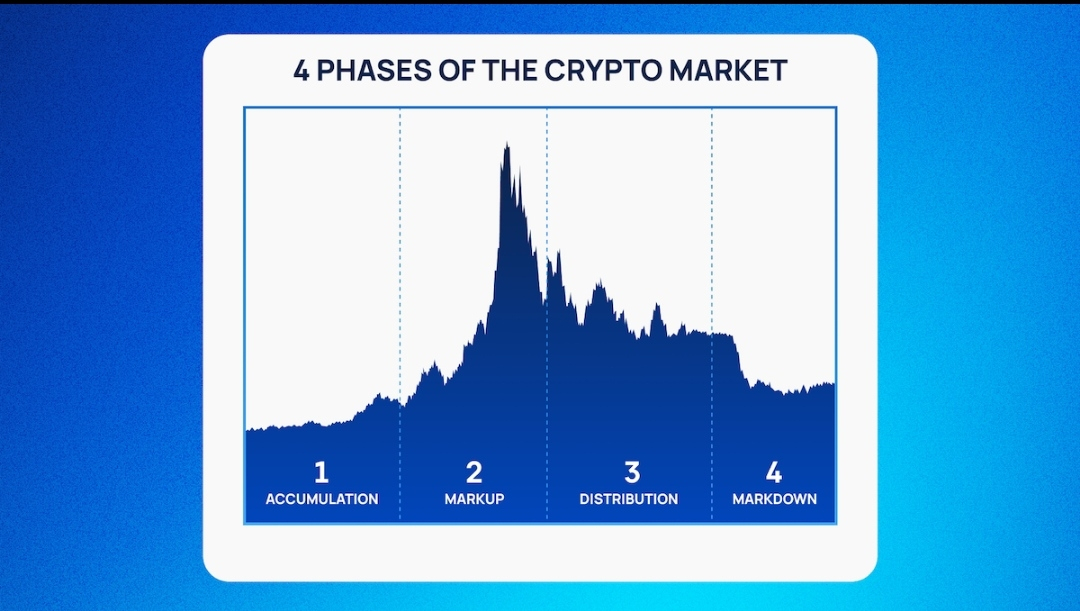

Fear phase ➝ Accumulation ➝ Expansion

We’re transitioning from fear to accumulation.

🔮 What It Could Mean Next

If support holds, Bitcoin can build a base and aim for higher highs.

If support breaks, deeper discounts appear — which still favor long-term bulls.

Either way, volatility creates opportunity.

💡 Final Thought

This is not a collapse.

This is a shakeout before expansion.

The question isn’t “Is Bitcoin dead?”

The real question is:

Are you positioning for the next move…

or reacting to the last one?

#BTC #crypto #Bullrun #trading #Altseason $BTC