A wave of fear, uncertainty, and doubt swept through crypto social media in early February 2026, with Binance once again at the center of speculation. Claims of large-scale Bitcoin sales, collapsing reserves, and echoes of past exchange failures circulated widely on X. Yet when the noise is stripped away, on-chain data paints a far calmer picture.

Independent blockchain analytics suggest that Binance remains operationally stable, with reserve movements well within normal ranges. Despite dramatic comparisons to 2022, the numbers simply do not support the idea of an exchange under pressure.

Market Volatility Sets the Stage for Fear

The timing of the rumors is notable. Bitcoin briefly slipped from $78,300 to $74,600 before bouncing, a move that often fuels blame-seeking during fragile sentiment. Some traders were quick to point fingers at Binance, alleging market manipulation or solvency risks. However, when measured against verifiable blockchain data, those accusations appear disconnected from reality.

Where Did the Binance FUD Come From?

Much of the panic originated from viral posts on X. Among the more extreme claims were allegations of a $1 billion Bitcoin dump, stablecoin outflows totaling $4.5 billion since January 8, and warnings that Binance was replaying “FTX-style” collapse dynamics. One widely shared post even suggested that 1.6 million ETH, roughly 1.6% of total supply, had exited the exchange in a single day.

These claims were addressed directly by Changpeng Zhao, who dismissed them as “imaginative FUD.” Zhao clarified that no $1 billion BTC sale took place. He also explained that Binance’s Secure Asset Fund for Users (SAFU) is executing Bitcoin purchases gradually over a 30-day period, not in a single market event. So far, the fund has deployed $201 million, acquiring 2,630 BTC over two days at prices between $74,000 and $76,000.

An additional red flag for analysts was the pattern of accounts spreading the rumors. Several appeared unusually similar in structure and timing, hinting at coordinated amplification rather than organic concern.

What On-Chain Data Actually Shows

The strongest counterargument to panic comes from CryptoQuant. In a research post titled “FUD vs Reality,” the firm highlighted several metrics that contradict the collapse narrative.

Binance currently holds approximately 659,000 BTC in reserves, nearly unchanged from the roughly 657,000 BTC recorded at the end of 2025. For comparison, when FTX unraveled, reserves plunged by more than 12% in a short span as users rushed to self-custody. No such behavior is visible here.

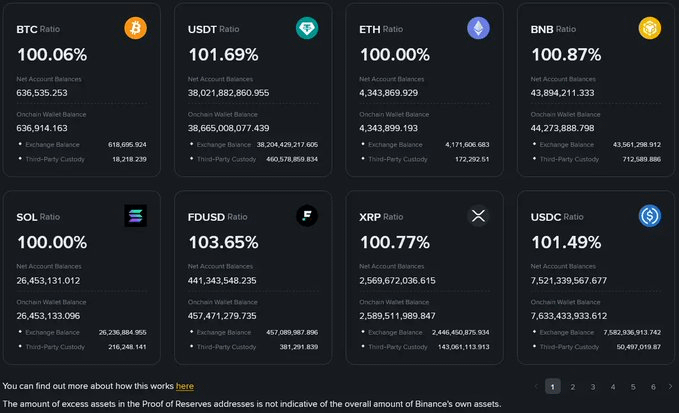

Netflows remain routine, with reserve movement around 0.6%, a level consistent with everyday trading activity. Binance’s January 2026 proof-of-reserves report shows 636,535 BTC in net balances, aligning closely with third-party verification.

Further reinforcing this view, CoinMarketCap ranked Binance first in its January 2026 exchange reserves list, showing $155.6 billion in total holdings. That figure exceeds the combined reserves of several competing platforms.

Market commentators, including Axel Bitblaze, have compared current withdrawal velocity with past crisis events such as FTX and Celsius. Their conclusion is consistent: today’s data shows no comparable stress signals.

What the Reserve Chart Reveals

A longer-term view adds useful context. CryptoQuant’s Bitcoin exchange reserve chart for Binance, covering March 2025 through February 2026, shows reserves declining gradually from about 668,000 BTC to roughly 615,000 BTC. That 8% reduction occurred over nearly a full year, not in sudden bursts.

Such slow, steady outflows are often interpreted as constructive. They typically reflect users moving assets into long-term self-custody rather than fleeing an exchange in panic. In contrast, genuine bank-run scenarios show sharp, abrupt drops in reserves.

Interestingly, this gradual decline coincided with Bitcoin trading in a resilient range between $75,000 and $125,000. Falling exchange reserves alongside stable prices often suggest demand is absorbing available supply rather than overwhelming it.

Could This FUD Mark a Market Bottom?

From a behavioral perspective, extreme negativity has often appeared near local bottoms. Data from Santiment shows that Bitcoin has historically rebounded after peaks in fear-driven sentiment. February, in particular, has delivered an average return of 14.3% across prior cycles, a move that would imply a push toward $101,000 if history rhymes.

Beyond seasonality, broader signals remain supportive. ETF inflows continue, gold accumulation trends point toward a gradual return of risk appetite, and SAFU’s scheduled Bitcoin purchases could introduce steady buying pressure over the coming weeks.

For some analysts, the coordinated nature of the FUD combined with solid on-chain fundamentals makes the recent dip look more like a sentiment-driven shakeout than a structural warning.

The Bottom Line

Social media thrives on dramatic narratives, especially during moments of volatility. Blockchain data, by contrast, is far less emotional. In Binance’s case, reserves remain stable, netflows look normal, and proof-of-reserves data aligns with independent analytics.

Whether confidence returns quickly depends on what market participants choose to trust. The posts may be loud, but the proof, for now, suggests business as usual at the world’s largest crypto exchange.