When we talk about blockchains, we often hear about speed, decentralization, smart contracts, and innovation, but very rarely do we hear a project begin with a simple human question that feels deeply practical. What if a blockchain was built only for moving stablecoins as smoothly as real money moves in the traditional world. What if the entire system was designed from the ground up not for experiments or complex applications but for everyday payments, remittances, savings, and trade. This is where Plasma begins, and once you understand this starting point, everything about its design starts to make emotional and practical sense. Plasma is not trying to become everything for everyone. It is trying to become the place where digital dollars feel natural, fast, and stress free for people who already depend on stablecoins in their daily lives.

Around the world, millions of people already use stablecoins as a form of financial survival. They use them to protect their savings from inflation, to send money across borders without delays, to pay for goods, to receive salaries, and to trade without relying fully on unstable local banking systems. For these people, stablecoins are not a technical experiment. Stablecoins are a lifeline. Yet the blockchains they run on were never designed only for this purpose. Users still face confusing gas fees, unpredictable transaction times, wallet complexity, and the anxiety of waiting for confirmations. Every small friction becomes a real emotional burden because money is not just numbers. Money represents security, trust, and peace of mind. Plasma looks directly at this reality and asks how a blockchain would look if this person was the main focus from the beginning.

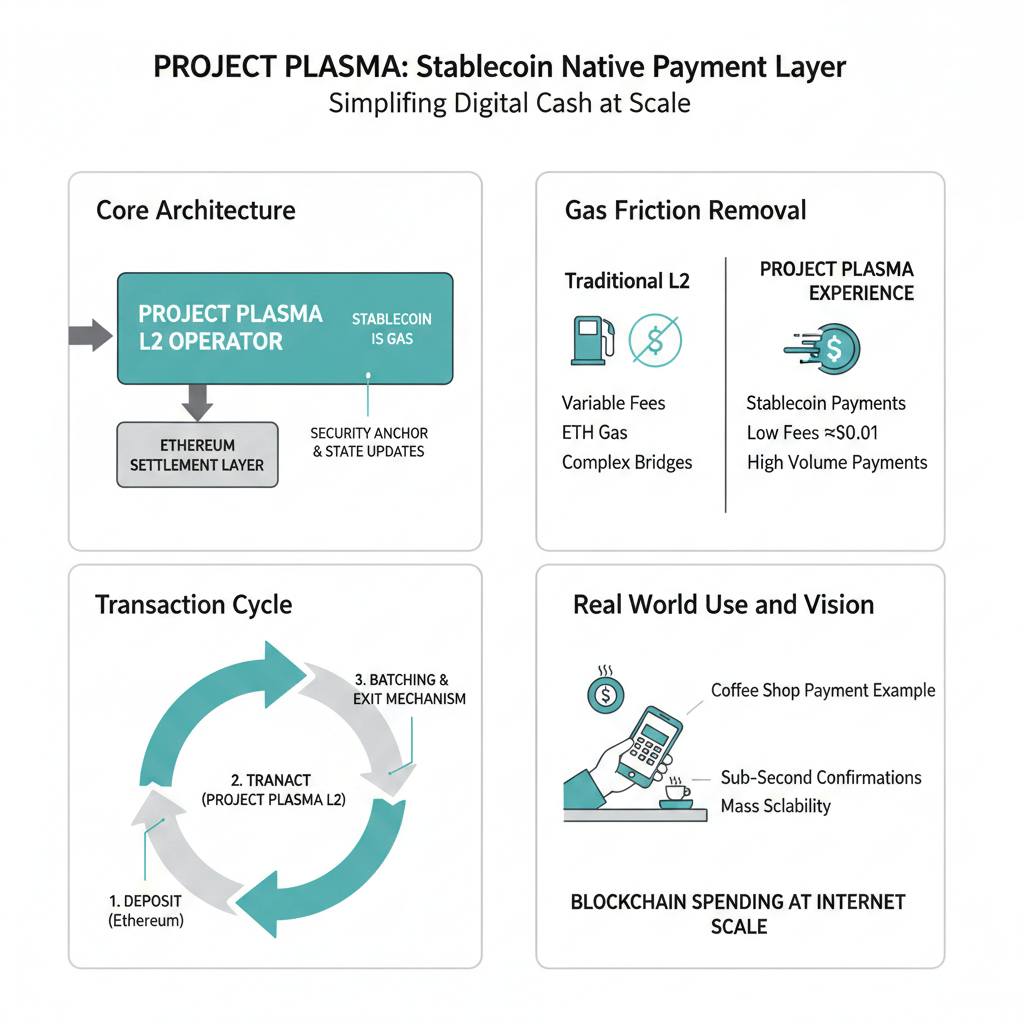

When someone sends stablecoins on Plasma, the experience is shaped to feel simple and immediate. The chain is fully compatible with the EVM through a Reth based implementation, which means wallets, tools, and smart contracts work in ways developers already understand, and this removes the need to reinvent the ecosystem from scratch. But the real difference shows up after the transaction is sent. Plasma uses a consensus mechanism called PlasmaBFT which is designed for extremely fast agreement between validators. Transactions reach finality in less than a second. The receiver does not need to wait and wonder if the payment will be reversed or delayed. The transfer simply feels complete almost instantly.

For specific stablecoin transfers such as USDT, Plasma supports a gas model where users do not experience traditional gas fees at all. The cost is handled through protocol level mechanisms so that users can send stablecoins without thinking about fees. This changes the entire emotional experience. Instead of calculating costs and worrying about network congestion, people can focus on sending money the way they expect to. This design is deeply human because it understands that even very small fees can discourage frequent use and make stablecoins feel complicated instead of practical.

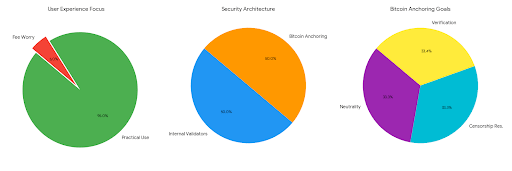

Behind the scenes, Plasma anchors its state to Bitcoin by writing cryptographic commitments that connect its history to one of the most secure and trusted blockchains in existence. This is not done for marketing reasons but for long term neutrality and censorship resistance. If something ever challenges the integrity of Plasma, there is an external reference point that can be used to verify its history. This adds a layer of trust that goes beyond the internal validator set and shows a strong commitment to security and fairness.

Every design choice in Plasma reveals a clear priority. EVM compatibility allows fast integration with existing tools and applications. BFT style consensus allows very fast finality which is critical for payments. Gasless stablecoin transfers remove a major barrier for users. Bitcoin anchoring provides long term security. These choices are connected to real problems faced by real people trying to use stablecoins as everyday money.

When evaluating whether Plasma is succeeding, the important signals are not market excitement or short term trends but operational metrics that show real usage. Transactions per second and finality time show whether the chain can handle high demand. The volume of stablecoin transfers shows whether people trust it with value. The number of active wallets and merchant tools shows whether it is being used in daily life. Fee behavior shows whether the system is sustainable for both users and validators. The regular anchoring to Bitcoin shows whether long term security is being maintained consistently.

The XPL token plays an important role in keeping this system running. It secures the network through staking and validator rewards and also supports ecosystem growth by funding tools, integrations, and infrastructure. A payments focused chain needs reliable nodes, wallet support, explorers, bridges, and merchant systems. Allocating resources toward ecosystem development helps create a foundation that allows the network to be useful in practice and not just in theory.

There are also real risks that must be acknowledged. Stablecoins are under regulatory attention across the world, and changes in policy could affect how institutions and users interact with the network. Technical risks exist in bridges and external anchoring which must be carefully audited and maintained. Economic risks appear in how gas subsidies are balanced so validators are fairly rewarded while users enjoy low friction. There is also the risk that fast consensus requirements could reduce the number of validators if not managed properly. These challenges require transparency, strong governance, and constant monitoring.

If Plasma achieves its vision, the future could look very different for stablecoin users. People might send money across borders as easily as sending a message. Merchants could accept digital dollars without worrying about fees or delays. Remittances could become faster and cheaper. Institutions could settle payments instantly with clear records and auditability. Users might not even realize they are interacting with a blockchain because the experience would feel smooth and natural like modern digital banking.

Building infrastructure for money is one of the most complex challenges in technology because it touches trust, speed, cost, regulation, and human emotion at the same time. Plasma feels like a careful attempt to solve all these parts together by focusing on one clear goal which is making stablecoins truly practical for everyday life. If it continues to prioritize usability, security, and honest incentives for validators and users, this type of stablecoin focused Layer 1 could quietly change how millions of people move value around the world. The real success would not be loud headlines or speculation but countless small payments happening smoothly every day, bringing more confidence and simplicity to people who rely on digital dollars for their lives.